Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Housing bubble starting to pop?

Options

Comments

-

Only 4% of Ireland is built on as towns/cities, this is half or less of many other countries in europe. The geographical area of Dublin could sustain two or three times the current population comfortably if higher density was adopted,higher density doesnt mean skyscapers everywhere by the way. If you drive along any main road into dublin city centre through likes of drumcondra ranelagh rathmines etc etc all building are around two stories when they should be around four at least as is case in most major cities(see equivalent locations in london), this would almost double density in the area with little negative impactjesus_thats_gre wrote:Out of curiousity, what is the population density of Ireland compared to other European countries that do not seems to be suffering chronic shortages of land? What is the population density of Dublin compared to other citys also?

I am nearly sure I read somewhere that Dublin is far larger than most citys with similar populations.0 -

Sponge Bob wrote:Looks like there IS no september season in Dublin either. Galway inventory building up like mad but cartel holding (just about) and not reducing their asking prices ...at least not until next week

However there is a Meltdown in Lucan according to what DNG seems to have told a customer as Nervous Sellers start to panic.

http://www.askaboutmoney.com/showthread.php?t=36605

http://www.askaboutmoney.com/showthread.php?t=36335

http://www.askaboutmoney.com/showthread.php?t=35498

The €350k semi in Lucan will be reality by end October and that will kill Adamstown stone dead and pretty much the whole commuter belt further out.. €300k in Maynooth and €200k in Mullingar.

Very interesting threads SB For my own personal opinion I always thought Adamstown was waaaayy overpriced so I for one wont be surprised if it falls in value at any stage in the future. Its a new "town" (my arse) in the middle of nowhere, dont think it will ever be one of Dublin's desirable addresses due to its apartment/duplex style. Undoubtedley a rental city. Check it out for yourself www.adamstown.ie

For my own personal opinion I always thought Adamstown was waaaayy overpriced so I for one wont be surprised if it falls in value at any stage in the future. Its a new "town" (my arse) in the middle of nowhere, dont think it will ever be one of Dublin's desirable addresses due to its apartment/duplex style. Undoubtedley a rental city. Check it out for yourself www.adamstown.ie

Lucan was an interesting one. To put some context into the comments from sellers there on askaboutmoney. Theres a strong whiff of estate agents not knowing their arse from their elbow in that area :eek: It would appear they dont know how to price the property which is A)Confusing the seller and B)Affecting the marketplace as people dont now know if the market is bollixed or not as the prices of houses are apparently dropping there. If the estate agent gets it wildly wrong....theres one case there of a lad trying to sell for 450ish and one agent was telling him to put it on the market for 480 and then 'drop it back' if no bites...WTF

And also for people who dont know the area, there is an absolute mountain of estates there in a very condensed space and it could well be a case of a mini-economy where there is indeed over supply for that particular area. This has yet to be borne out in other areas of the city.

Also from reading those threads and ppl's experiences with EA's...why arent people selling property themselves !

eg: http://www.privateseller.ie/

EA's are only feckin keyholders anyway and know fcuk all about your gaff so if people are willing to out some sort of effort in they will probably sell their teacht just as quick and save a few quid in the process 0

0 -

The price range is either side of a stamp duty band at c 380k, as there is a big stamp duty difference between say 380k and 390k the FTB will always tend to drag the price below that threshold if its close at all.

Still, if you can get a 3 bed house for €370k or €380k what does that do to the 1 bed box in Adamstown (with a hefty annual maintenance charge) for €280k , and no parking at that price either.

Lucan , unexpectedly for me , seems to be the canary in the coalmine of the Irish property market . It is now september , a high selling season and nothing is even being VIEWED never mind shifting or getting offers according to that lot.0 -

ronbyrne2005 wrote:Only 4% of Ireland is built on as towns/cities, this is half or less of many other countries in europe. The geographical area of Dublin could sustain two or three times the current population comfortably if higher density was adopted,higher density doesnt mean skyscapers everywhere by the way. If you drive along any main road into dublin city centre through likes of drumcondra ranelagh rathmines etc etc all building are around two stories when they should be around four at least as is case in most major cities(see equivalent locations in london), this would almost double density in the area with little negative impact

Try and put a planning application in at double the height in these areas and the NIMBYs will come down on you like a ton of bricks. The result is that the newer developments on the outskirtd are at a higher density , while those living in the the central inner suburbs are enjoying low density and the best infrastructure. Helps to explain the mad price difference between the inner and outer suburbs0 -

But densities are actually going higher in the city, old buildings/factories/offices/houses are getting demolished and rebuilt at higher densities .The council has approved higher densities in city and over time densities will increase in same way they have in most major world cities.bico wrote:Try and put a planning application in at double the height in these areas and the NIMBYs will come down on you like a ton of bricks. The result is that the newer developments on the outskirtd are at a higher density , while those living in the the central inner suburbs are enjoying low density and the best infrastructure. Helps to explain the mad price difference between the inner and outer suburbs0 -

Advertisement

-

Sponge Bob wrote:The price range is either side of a stamp duty band at c 380k, as there is a big stamp duty difference between say 380k and 390k the FTB will always tend to drag the price below that threshold if its close at all.

Still, if you can get a 3 bed house for €370k or €380k what does that do to the 1 bed box in Adamstown (with a hefty annual maintenance charge) for €280k , and no parking at that price either.

Lucan , unexpectedly for me , seems to be the canary in the coalmine of the Irish property market . It is now september , a high selling season and nothing is even being VIEWED never mind shifting or getting offers according to that lot.

Thats always gonna happen when something is pitched near the stamp duty band, regardless of what the value of the property is, human nature

Agreed on Adamstown, rip off ! Cant believe there was clowns QUEUEING for these only a few months ago :eek: Certainly not value for money.

Dont even get me started on "maintenance" fees 0

0 -

Moderators, Category Moderators, Arts Moderators, Entertainment Moderators, Social & Fun Moderators Posts: 16,603 CMod ✭✭✭✭

Join Date:Posts: 15348

Join Date:Posts: 15348

Link from today's Indo.

http://www.unison.ie/irish_independent/stories.php3?ca=303&si=1687849&issue_id=14640

Bare in mind its the same paper that splashed this as a headline:

http://www.unison.ie/irish_independent/stories.php3?ca=9&si=1688017&issue_id=14640

We all know what the IMF predications have been over the past 5 years and we're still waiting.... The Indo didnt happen to mention that.

Did they clear up their misquote from the article the other day where they said over 200,000 people had posted to a thread on AAM??? Fools.

Lots have ppl have pointed out property that has come down in value but as many have pointed out it was overvalued in the first place.

I think its fair to say its dangerous to generalise when it comes to property though.

Overall if the property market which has had double digits growth up to now drops to growth rates of of less than 4%, does that constitute a crash? Discuss.

Oh yeah i cant remember who brought up the topic of bankruptcy in ireland but to confirm, there were 14 bankruptcys in ireland in 2005. I cud tell you why there wasnt more but that would be a secret! ;-) (Well its not really if you want to know i will tell u!)

And as for yer man above who said that interest rates would go up for the next 3 years and that we are all are forgetting that...

http://www.businessworld.ie/livenews.htm?a=1516072

Today i had a scare and my life almost came to an end. I look back on this thread at utter disgust. Greed, those wishing economic doom, aggressive posts, and downright silly posts. life is too short people.0 -

interesting only 14!faceman wrote:Oh yeah i cant remember who brought up the topic of bankruptcy in ireland but to confirm, there were 14 bankruptcys in ireland in 2005. I cud tell you why there wasnt more but that would be a secret! ;-) (Well its not really if you want to know i will tell u!)

do tell! 0

0 -

Yes we're all just little people and have to suck up the decisions of the big boys. Sorry, but that hasn't been true since the removal of the monarchy.K_user wrote:My point has simply been that we can’t stop that growth, we have to live with it.

Yes, one has been photoshopped to adjust for brightness, contrast, and higher hue, the other hasn't. The only other differences you could sort out with a lawnmower. Oh and speaking of which, the grimy looking photo one has a bigger garden.K_user wrote:Spot the difference?

Which is in direct opposition to what you said earlier. Direct. "First of all house prices are not toppling in Australia. I just had a long chat with an Australian and he laughed at the idea."K_user wrote:By-the-by, Australia is currently a buyers market, prices are either at a standstill or going down. The last time they did that was in ’87. But that didn’t last back then and it won’t last now. It’s the same here.

Heheheh.K_user wrote:The market here is Ireland may stagnate. People may loose their homes, or investment properties. But house prices will never rock bottom out.

The upshot of which is that you own more of your home starting out than otherwise. You keep changing your story, mixing generalities with truisms with bad advice and flat-out lies. Whats your interest in the housing market, for a bit of full disclosure? Not that it matters, as far as I'm concerned you have lost all credibilty here...K_user wrote:Sure that might be the best time to buy but banks, having been bitten, tend to be more careful with giving money out. That makes getting a mortgage more difficult and therefore harder to “capitalise” on the lower prices. Just something to think about…0 -

Jaysus. Just how exposed are you?faceman wrote:Today i had a scare and my life almost came to an end.0 -

Advertisement

-

faceman wrote:Today i had a scare and my life almost came to an end. I look back on this thread at utter disgust. Greed, those wishing economic doom, aggressive posts, and downright silly posts. life is too short people.

Greed? Hah. Get a grip. Do you not see the danger of continually rising prices?

And if you do, can you see any logically way that prices will level off?

If prices stop rising, the canny investors will bail. Add on interest rate hikes, job losses etcetc and see where it leads us - the only instances of people here acting 'aggressive' or stamping down their point is to underline the shambles of a situation we're in as a country (and of course respond in disappointment to another ridiculous post by you).

Questions.

What do you see happening to prices?

If prices level off, what do you see the short-term 'flipper' and other poorly funded go-geter do with the property?

What are interest rates doing to streched investors and FTB's? Are they feeling the stretch? (if they are, what are new purchasers[who have to buy at even greater inflated prices?)

If supply falls to match lower demand what will happen to our economy? Are we somewhat reliant on the construction sector?

Sorry, this is just another silly post.0 -

True, The IMF has been warning about this for a while, its like saying if you drive a Range Rover at 120KM/h into a 90 degree turn you are likely to crash. Its obvious to an external observer what's likely to happen, but when the car occupants are high on cheap credit they feel protected by the vehicles size, despite the impending reinforcement of the laws of physics.faceman wrote:We all know what the IMF predications have been over the past 5 years and we're still waiting.... The Indo didnt happen to mention that.

Whats more, they were also noticed quoting directly from the AAM thread without attributing their sources in an earlier article.faceman wrote:Did they clear up their misquote from the article the other day where they said over 200,000 people had posted to a thread on AAM??? Fools.

Agreed.faceman wrote:Lots have ppl have pointed out property that has come down in value but as many have pointed out it was overvalued in the first place.

I think its fair to say its dangerous to generalise when it comes to property though.

This is an element of the scenario painted by the economists for a soft landing to happen, however this reduction alone would trigger a decrease in construction output, leading to a decrease in the level of bank lending, leading to a rise in unemployment among displaced construction workers and bank staff and the same time the deflation of the money supply in the economy will lead to a decrease in retail activity and more unemployment, so starting a downward cycle that will not stop until the excess of the boom has been normalised. As the same time government revenue will decrease and a budget deficit open up, leading to cutbacks in public services and increased taxation.faceman wrote:Overall if the property market which has had double digits growth up to now drops to growth rates of of less than 4%, does that constitute a crash? Discuss.

The knckon effects on house price inflation have already been discussed.

That was me, the banks have an increasing number of non performing loans on their books, which they are not publicising. However the signs of debt stress are starting to become visible, especially among people on lower income or who have lost employment. How they are handling these situations: they evict the mortgage holder for 24 hours and take ownership of the property, they freeze the mortgage (while gathering interest) and rent the property back to the person at friendly rate, until the person can get back on his/her feet and start paying the new higher rate.faceman wrote:Oh yeah i cant remember who brought up the topic of bankruptcy in ireland but to confirm, there were 14 bankruptcys in ireland in 2005. I cud tell you why there wasnt more but that would be a secret! ;-) (Well its not really if you want to know i will tell u!)

Credit Unions' bad debts causing some concern

http://www.rte.ie/business/2006/0914/mibusiness.html

More people in North Cork falling victim to poverty trap

http://www.unison.ie/corkman/stories.php3?ca=34&si=1688320&issue_id=14644 [free registration required]A rising trend in interest rates will hurt Irish borrowers further . Roughly 40 per cent of borrowers reckon their financial position would deteriorate substantially if interest rates rose by 1 per cent. As many as 80,000 borowers would be hit by another half per cent rise in interest rates. O these we reckon some 50,000 borrowers who already expressing significant concerns about both household and non-household debt will feel a considerable pinch.

‘In too Deep?’ IIB Bank/ESRI launch study on Irish personal borrowing.

http://www.esri.ie/pdf/IIB%20ESRI%20Debt%20Survey%202006%20June%20PR.pdffaceman wrote:And as for yer man above who said that interest rates would go up for the next 3 years and that we are all are forgetting that...

http://www.businessworld.ie/livenews.htm?a=1516072

We do know the ECB's primary brief is to maintain low inflation by using interest rate policy to affect price stabilty, until that is achieved interest rates will keep rising. We are getting the boiled frog treatment, which is creating a false sense of security among those who should be re-evaluating their position.

* One other factor that has not been taken into acount is a decline in the value of the dollar. Something that Pat McArdle referred to . . . ."Again, it is not specific, but the dollar’s precarious position must be one of the more obvious ones. A dollar collapse would have a detrimental impact on growth throughout Europe and would exacerbate our already-poor competitiveness situation. Yet we rarely read about this in the media and nobody factors it into their central forecast scenario."

Comment: House-price doomsayers are still getting it all wrong

http://archives.tcm.ie/businesspost/2006/08/13/story16355.asp

or the bursting of credit derivatives

Liars' loans

http://www.dailyreckoning.co.uk/article/150920063.htmlfaceman wrote:Today i had a scare and my life almost came to an end. I look back on this thread at utter disgust. Greed, those wishing economic doom, aggressive posts, and downright silly posts. life is too short people.

You had a good day today, you live to see another day. Hopefully you were not hurt or anything serious. This is just thread where we express our opinions behind the safety of a computer screen, given today's focus on the housing market in Irish society, its bound to attract a highly charged emotional response from people who feel their beliefs are being undermined by contrary opinions to theirs. This thread would have died long ago if there was consensus.Net Zero means we are paying for the destruction of our economy and society in pursuit of an unachievable and pointless policy.

0 -

I guess the way it will be from now on is that not everyone will be able to afford to buy a house. Some people will have to rent forever. Oh wait that how its always been.

My daughter and son in law are coming back to Ireland and looking at buying a 2 bed semi in Lucan.

We've been tracking the prices there since last year and they are still going up at an alarming rate.

I've yet to see house prices falling anywhere, and i've been watching nearly 10 years. I've seen some outrageous asking prices fall alright, but thats just asking prices. Nothing to do with real house prices at all.

I guess they wont go down if at all for a while yet either.

Its just a normal market where demand is high. If demand ever decreases then something might happen. But there is no sign of that on the horizon at all.

For every story predicting doom and gloom theres an opposite rosey story.

Property is worth what people are willing to pay for it - and there are plenty willing to pay todays prices.0 -

True, but that is only one way of looking at worth.shaptakster wrote:Property is worth what people are willing to pay for it - and there are plenty willing to pay todays prices.0 -

Moderators, Category Moderators, Arts Moderators, Entertainment Moderators, Social & Fun Moderators Posts: 16,603 CMod ✭✭✭✭

Join Date:Posts: 15348

Join Date:Posts: 15348

Pa ElGrande wrote:That was me, the banks have an increasing number of non performing loans on their books, which they are not publicising. However the signs of debt stress are starting to become visible, especially among people on lower income or who have lost employment. How they are handling these situations: they evict the mortgage holder for 24 hours and take ownership of the property, they freeze the mortgage (while gathering interest) and rent the property back to the person at friendly rate, until the person can get back on his/her feet and start paying the new higher rate.

Im not so sure where you got this info from. As im very familiar with debt issues in ireland, courts, bad debts and other legal issues i havent come across this happening before.

However the real reason that there were only 14 bankruptcies in ireland last year was due to how difficult it is in ireland to declare someone bankrupt. However i would encourage anyone who's interested to read the gazettes regarding registered judgements in ireland. makes for very interesting reading.Pa ElGrande wrote:Credit Unions' bad debts causing some concern

http://www.rte.ie/business/2006/0914/mibusiness.html

Im afraid that the reason that alot of credit unions are having high instances of bad debt is actually very little to do with bad customers and more to do with business practice. I cant really go into it in detail as im covering myself against legal issues! but i can say the banks are not having the same problem.

but i can say the banks are not having the same problem.

havent time to repond to all ur points dude, but will come back again!0 -

- 32.6% of new mortgages and home equity loans in 2005 were interest only, up from 0.6% in 2000

- 43% of first-time home buyers in 2005 put no money down.

- 15.2% of 2005 home buyers owe at least 10% more than their home is worth.

- 10% of all home owners have no equity in their homes

- $2.7 trillion in loans will adjust to higher rates in 2006 and 2007.

- 70% of borrowers who took out pay-option ARMS in the past year have loan balances larger than their initial loan.

- Homeowners face higher payments as mortgages are reset. Generally, monthly payments rise between $200 and $500 depending on the size of the mortgage.

- According to Reality Trac, August foreclosures were up 23% over July and 53% over a year ago.

- The number of homes for sale is at record highs, and inventories are 59% higher than a year earlier.

- New home sales are down 22% and existing home sales down 11%.

- The NASB housing market index has recorded an all-time decline.

- The housing affordability index is at a 15-year low.

- The house price-to-income (rents) ratio is off the charts. According to HSBC, in 18 states accounting for over 40% of national home values, the price-to-income ratio is 3.6 standard deviations above the mean.

- The OFHEO index of house prices deflated by the consumption price deflator has soared to a record high of 350 from 250 in 2001. From 1976 to 1996 it never was above 220.

- According to the NAR the year-to year prices of existing homes are now flat. A short time ago they were rising at a yearly rate of 16%.

- Nationally, home prices have not declined on a year-to-year basis since 1933. Recently, however, prices have been dropping in the North East, West and Mid-West.

- Sales incentives are now estimated at 3% to 7% of selling prices.

USA: The Hard Landing For Housing is Already Here

http://www.comstockfunds.com/index.cfm?act=Newsletter.cfm&category=Market%20Commentary&newsletterid=1263&menugroup=Home

Shanghai, Sydney, Florida, one by one they are popping, who's next?Net Zero means we are paying for the destruction of our economy and society in pursuit of an unachievable and pointless policy.

0 -

Is there anyone left who really does think property price will level out to a nice safe CPI-type increase? Surely this would be like attempting a controlled landing with no hydraulics... Only one or two factors within governmental control, the rest completely guided by external pressures.

Taking immigration for an example... Will this continue at the current rate? Will it drop off? Or even reverse? Anecdotal evidence would suggest that the ethnic Russians who have come in from the Baltic states have nothing to go back to so they'll stay, but what about the Poles? Suppose Germany lifts the employment embargo? Hopping over the border would surely seem far more attractive than making the trek all the way over here... And if the idea that the Poles are filling low-paid jobs that the rest of us wouldn't touch is true, surely to goodness they'd take the same type of work in their neighbouring country rather than one so relatively far flung with such high prices and inflation? Nature abhors a vacuum... Sooner or later the manufacturing and service industry multinationals will realise that it's more expensive paying Poles at Irish rates than leaving them where they are and paying them Polish rates then relocations will accelerate. Even supposing the decision is made to accept Bulgarian and Romanian workers without control, what will these people be doing? Removals for the Polish !? Needless to say, were I a buy-to-let landlord, I wouldn't be counting on this wave reaching the shore.

Then there's the medium term issue of cheaper employment enticing manufacturing eastwards and a glut of highly qualified and cheap labour sourced from China and India to sway the hitech employers... Is there anything coming out of the Dail suggesting that this has been planned for? What exactly will Ireland be *producing* in 10 years time? Of course, if apartments could be exported, we'd be laughing...

Consequently not only do I expect that the faltering bubble will finally burst, but that the last few years will be viewed in the future as the aberration they really were, a gold rush fuelled by low interest rates and high greed matched with moral ambiguity. Hopefully meaning a messy end to the absentee BTL landlords who, dress it up how you will, are guilty of nothing less than trading in ordinary home buyers' misery.0 -

I've long wondered when Irish property would reach valuations similar to Japan during its peak bubble years, when we could sell up the entire country and buy the United States. It looks like we don't have far to go.

If we could sell Ireland at the per/acre cost of parts of Dublin, we could raise enough cash to buy the United States and more! For details check out http://irishpropertybubble.blogspot.com/2006/09/lets-sell-up-entire-country.html0 -

Hailee Fat Mushroom wrote:Even supposing the decision is made to accept Bulgarian and Romanian workers without control, what will these people be doing?

What ever we may think this is totally outside our control,if the UK decides to keep them out(which is looking very likely) then so will we because of our common travel area arangements.The UK decided to let eastern european workers in on accession so we had to follow suit,however they totally misjudged the no's that would arrive and this is now a huge issue in the UK.0 -

I'm a little confused. What do you mean by this?coolhandluke wrote:then so will we because of our common travel area arangements.0 -

Advertisement

-

well, we have to follow uk, otherwise all the guys could just use ireland as a backdoor into uk, bypassing their decision

coolhandluke: i havent looked into this, why is looking very likely?

very interesting interview about the usa house price bubble: http://www.europac.net/media/Schiff-Bloomberg-9-8-06_lg.wmv

a bit scary, he says usa is heading for years of recession :eek:

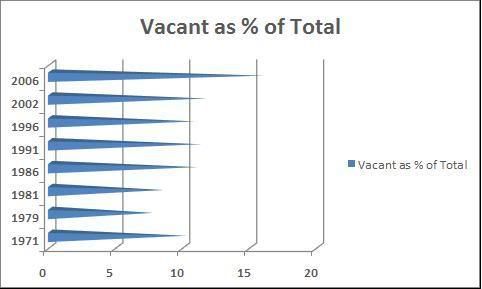

this graph is good:

and my prediction graph

these sites are good for this topic:

http://www.housepricecrash.co.uk/

http://globalhousepricecrash.com/0 -

bounty wrote:very interesting interview about the usa house price bubble: http://www.europac.net/media/Schiff-Bloomberg-9-8-06_lg.wmv

a bit scary, he says usa is heading for years of recession :eek:Greenspan and the privately-owned Fed played a major role in putting us in this mess by rubber-stamping the new system of precarious loans (no down payments, interest-only loans, ARMs) and perpetuating their “cheap money” policies. Greenspan admitted this a few months ago when he said that current housing increases were “unsustainable” and would have corrected long ago if not for the “the dramatic increase in the prevalence of interest-only loans . . . and more exotic forms of adjustable rate mortgages that enable marginally-qualified, highly leveraged borrowers to purchase homes at inflated prices.”

Greenspan’s circuitous comments are tantamount to an admission of guilt. The fallout from the Fed’s policies are bound to be widespread and devastating. The country has been buoyed along on $10 trillion of borrowed money which has created the unfortunate sense of prosperity, which is not reflected in the general economy. The increase in housing prices has not come from wages (which have actually decreased under Bush) or from demand (inventory is now at a 10-year high). It has merely been the availability of low interest loans and the promise of getting rich quick. As the market cools, millions of Americans will either face foreclosure or be shackled to a mortgage that is higher than the dwindling value of their homes. It is a grim picture of 21st century debt-slavery.

more...

Day of reckoning; America’s economic meltdown

By Mike Whitney

http://onlinejournal.com/artman/publish/article_1183.shtml

Its really surprising how fast the housing boom is unravelling in the USA, even more surprising is that the financial regulators and bankers now admit they do not understand the level of exposure they have in credit derivatives. Worse there is little regulation in this area, that has been growing substantially since 2001.Securitisation

Dublin has built up a reputation as a centre of excellence for securitisation and many of the world's top banks, investment banks and law firms now use the jurisdiction on a regular basis. It is seen as an attractive location because securitisation transactions are increasingly driven by investors, who tend to favour an onshore EU jurisdiction.

http://www.ifsconline.ie/about2.html

This is a much more more entertaining debate - http://www.europac.net/Schiff-CNBC-8-28-06_lg.aspNet Zero means we are paying for the destruction of our economy and society in pursuit of an unachievable and pointless policy.

0 -

Exactly, which is why we urgently need a properly requlated market with long increased security of tenure for tenants. I am actually surpised that the buy-to let owners are not pushing for this since it would make for a more stable long term return on their investment.shaptakster wrote:I guess the way it will be from now on is that not everyone will be able to afford to buy a house. Some people will have to rent forever. Oh wait that how its always been.

I don't know their personal circumstances or long term goals, but if they intend to settle and have children will a cramped 2 bed semi in Lucan allow them an acceptable quality of life? Certainly if I was going to pay top € for a place, I would be asking myself that question.shaptakster wrote:My daughter and son in law are coming back to Ireland and looking at buying a 2 bed semi in Lucan.

What we are seeing is abnormal growth (averaging 14.6%) per annum in the past ten years, logically this rate of growth cannot continue, part of this is accountable since property in the early 90's was dramatically undervalued due to the economic recession of the '80's, however in my opinion after 2001 it should have levelled and risen in roughly in line with CPI, thats not what happened, interest rates dropped to record lows, lending criteria was relaxed, income taxation lowered and low prices of goods and we persuaded ourselves these conditions will last forever, our incomes grew and we pushed the amount we could borrow to the absolute limit, this growth has also attracted the specuvestor, who with their higher incomes can outbid the first time buyer easily, thus driving prices higher still and focing couples out beyond the suburbs where there are limited services and long commute times to work.shaptakster wrote:We've been tracking the prices there since last year and they are still going up at an alarming rate.

I've yet to see house prices falling anywhere, and i've been watching nearly 10 years. I've seen some outrageous asking prices fall alright, but thats just asking prices. Nothing to do with real house prices at all.

I guess they wont go down if at all for a while yet either.

Its just a normal market where demand is high. If demand ever decreases then something might happen. But there is no sign of that on the horizon at all.

That rosey story is of a generation who bought their houses on a single income, under very strict lending criteria, high interest rates and had the cost of the servicing that debt eroded by high wage inflation, reduced taxation and low interest rates. They bought their houses at a time when houses were for nesting not investing. They have good pensions, medical insurance cover and property whose price has hyper-inflated since they bought it. Good for them I say and i hope to be as fortunate as them when I get to retirement.shaptakster wrote:For every story predicting doom and gloom theres an opposite rosey story.

Spare a thought for the young couples who carry this burden today, they are going to have the situation I outlined reversed on them.shaptakster wrote:Property is worth what people are willing to pay for it - and there are plenty willing to pay todays prices.

This price is determined by the amount people are willing to borrow at the expense of their own future financial security.

"In Ireland, the ratio of private credit to GDP has reached 190%, the world's highest. "

http://www.finfacts.com/irelandbusinessnews/publish/article_10007281.shtmlNet Zero means we are paying for the destruction of our economy and society in pursuit of an unachievable and pointless policy.

0 -

Sunday Tribune (News Section)finally calls the slump in Dublin.

http://www.tribune.ie/article.tvt?_scope=Tribune/News/Comment&id=51553&SUBCAT=Tribune/News

(reg needed) . One quote onlya Rude Awakening awaits many sellers

That comment came from Austin Hughes , a well known talker upper of the market. Lots of the usual suspects from various estate agents yabber on about a soft landing . That would be the best they could hope for ....if it wasn't too late already.

I note that everybody is staying well away from this statistic below. The 16% vacancy rate, the highest ever recorded in Ireland . 0

0 -

SB, can you not just copy and poste the article?:)0

-

bounty wrote:very interesting interview about the usa house price bubble: http://www.europac.net/media/Schiff-Bloomberg-9-8-06_lg.wmv

a bit scary, he says usa is heading for years of recession :eek:

Eek indeed!!0 -

Moderators, Category Moderators, Arts Moderators, Entertainment Moderators, Social & Fun Moderators Posts: 16,603 CMod ✭✭✭✭

Join Date:Posts: 15348

Join Date:Posts: 15348

IMHO the oversupply of houses for sale in dublin (lol what does oversupply mean?!) has a sense of panic about it. Those houses will sell, but it will take longer than the record few weeks we have experienced in the past years, or in fact this year alone.

I wudnt be worried but if i was a buyer i wud pounce on opportunity to be in a better negotiating position.0 -

http://www.smh.com.au/news/national/bought-for-262500-in-03-sold-for-95000-last-week/2006/09/16/1158334735688.htmlThe one-bedroom unit in Cabramatta sold at auction last week for $95,000. In November 2003 it cost $262,500.

I wonder when this will start happening here...0 -

pod wrote:http://www.smh.com.au/news/national/bought-for-262500-in-03-sold-for-95000-last-week/2006/09/16/1158334735688.html

I wonder when this will start happening here...

A lot of those houses in Australia that are falling are far from public transport or services, so don't expect those dramatic drops to happen here unless you are buying at the outskirts or beyond of communterland.

When it will happen? That depends on whether you believe armchair economists (see earlier in the thread), or professional economists who earn a living doing this as you can see from their opinions in January 2006 they got it spectacularly wrong in that they underestimated the growth.All economists are agreed that house prices will continue to rise this year. However forecasts for price growth vary from 4% to 12% depending on market sector. On the most optimistic side one economist believes that the strongest growth of over 10% will be seen in the Dublin second hand market for larger homes. Another expects new homes to show national average increases of only 4%.

http://www.unison.ie/irish_independent/index.php3?ca=51&issue_id=13534 [free registration required]

However the rate of growth so far this year has still been higher than expected with an increase in prices nationally in the first seven months of the year of 9.1%, compared to 3.3% for the same period last year (2005).

http://www.finfacts.com/biz10/irelandhouseprices.htm

It's understandable why they got it wrong, we are in a bubble, and trying to rationalise people's behaviour in such an environment is a fools errand. But one thing is certain, as sentiment turns, it does so on a dime and nobody knows how low prices will go or how quickly.Net Zero means we are paying for the destruction of our economy and society in pursuit of an unachievable and pointless policy.

0 -

Advertisement

-

Sizzler wrote:SB, can you not just copy and poste the article?:)

That Tribune Article Today, register for the of it rest willya

http://www.tribune.ie/article.tvt?&_scope=Tribune/News/Home%20News&id=51468&SUBCAT=Tribune/News&SUBCATNAME=NewsAN over-supply of second-hand houses, along with two expected interest-rate increases by December, is fuelling speculation about a cooling of prices in Dublin's property market.IIB Bank chief economist Austin Hughes this weekend warned that a "rude awakening" awaits many sellers putting their property on the market this autumn.

"While there is no sense that prices will drop, some sellers will have to adjust their expectations of price. There is no way that the price inflation of spring will be matched, " Hughes told the Sunday Tribune.

The number of houses offered for sale by Dublin estate agents has increased by 25% compared to figures for the equivalent period last September, according to the managing director of one leading agency. These extra properties, added to the glut of withdrawals at auction over the summer, has resulted in an over-supply of second-hand homes in Dublin.0

Advertisement