Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Housing bubble starting to pop?

Options

Comments

-

More news from stateside about the ongoing collapse over there, here are some of the highlights...When the real-estate industry made it easy to borrow a lot of money, it also made it easy for people to get into financial trouble. Which is exactly what's happening, as foreclosures are surging across the country.

There are calls for loan restrictions, more disclosure and more education. Lenders are talking about "foreclosure prevention" -- ways to give homeowners more time to make payments or rework their debts. Hot lines have been set up to counsel strapped consumers.

The problem has been evident in Texas for a while. Foreclosures have been rising at double-digit rates for four years, and unlike other parts of the country, home values haven't appreciated enough to bail out borrowers.

About 3,300 homes in the Metroplex are posted for the October foreclosure auction, the most since the real-estate bust of the late 1980s, says George Roddy of Foreclosure Listing Service in Addison. He says we may be approaching a peak, but he had the same thought a year ago, only to see the postings keep rising.

Nationwide, 26 percent of the home loans were interest-only in 2005, up from 6 percent three years earlier.

In California, these loans accounted for 44 percent of originations.

Some analysts look at those numbers and predict a wave of defaults, as scores of adjustable mortgages reset to higher rates. This year, $375 billion in hybrid adjustable-rate mortgages will reset, according to the PolicyLab Consulting Group.

Next year, $1 trillion in loans are scheduled to reset.0 -

What? this thing is real? ... i thought it was a joke!! ..ircoha wrote:http://www.dublincoastaldevelopment.com/index.html

Just imagine the size of the brown envelopes for this project:)

But if this actually happened, it would be a goer, a no chav gear zone .... there would still be fights, but a lot fewer people would end up stabbedIt would work if they turned it into the ultimate gated development I would easily pay the going rate for a 2 bed apartment if I could avoid the various **** bags roaming Dublin at the moment. 0

0 -

Faceman,faceman wrote:Yet another "bear" who is bitter? This thread has really turned into something it shouldnt have.

Sure i might as well join in...

I made €65k after taxes etc on one of my properties which i sold this year. I bought it 2 years ago. How much you "bears" make this year?

If you u bought a house two years ago, then that was proably around the time the European Union went from 15 to 25 countries. Straight away people were talking about the increased demand for houses brought by immigrants, and sure enough ,they were correct.

In addiiton, FF, in an attmept to increase their ratings IMHO, reduced stamp duty, another stimulent to demand.

Therefore you made your money on your house because you got in at or before these factors WERE PRICED IN. Growth in house prices had slowed prior to that because all other factors had been priced in!

However whether this was good luck or good guidance, there is no doubt that your growth can be attributed to these factors. The fact that these factors are unlikely to repeat themselves means that you need new factors to boost demand in order to counteract the higher interest rates.

Seeing as how you see yourself as an astute investor, what positive factors do you think have yet to be priced in. All I can see are negative factors and I'm usually an optimist.

One remotely positive factor might be that the Governemnt in a bid to save face over not achieving their target of builidng 10,000 social and affordable houses, engage on a crusade to purchase as many houses and sell them as social housing might increase the demand for existing houses.

I'm sure there are many others, I would like to know, and so would the owner of the house up the road whose house went on sale in August for over EUR 2.3 million, before reducing to EUR 2.1million in early September reaching sale agreed in mid -Sept and then the deal falling through in late-Sept, and the house going on the market for a lower price YET AGAIN.0 -

SimpleSam06 wrote:You'll no doubt be thrilled to give us all a few facts and links to back up your point of view, here. I mean, anything, really. You can be the first bull in the thread to do so. It will make you special!

More so, I mean.

More so, I mean.

Are you advocating arson here, or just trolling?

On the contrary i would love nothing more than for house prices to come down.

I was just making the point that the same people are going on and on so much that its like they are obsessed with a crash.

After a quick gander through the thread i see that SimpleSam06, D'Peoples Voice, Pa ElGrande and sponge bob have about 50% of the posts in this thread between them. :eek:

There should be a tool to show how many times a particular person has posted in each thread.0 -

D'Peoples Voice wrote:One remotely positive factor might be that the Governemnt in a bid to save face over not achieving their target of builidng 10,000 social and affordable houses, engage on a crusade to purchase as many houses and sell them as social housing might increase the demand for existing houses.

The cynic in me says this will be another builder buddies/government (read builders buddies = Berty and friends) crapola poorly finished stock that they cannot shift anymore at vast profits.

The sooner the Aherne name is removed from governance the better imho, they've sold working Ireland down a deep deep dark hole with their own greed..for shame

I blame the current bubble squarely and totally on our corrupt government/builders buddies and cannot wait to vote them out(they could have done more..eg actually acted on the Bacon report for starters!!, but the tents at the Galway races saw that one swept under the carpet).

Whats worse is because I don't want to live in a traffic jammed poorly constructed one bed shítehole in Lucan I'll be branded as a begrudger...bah.

I'm renting and plan on staying renting, even the so called affordable housing coming onstream (just around election time - anecdotal evidance for this also) may become negative equity in the next few years imho...plus you get the added bonus of clawback !!

Unless yer getting 2-3 bed..don't even think of buying an apartment near Dublin in the next while imho. funny enough..whats the one thing you cannot get 100% mortgages on..yep ..one beds...

In fairness to faceman, he's been a persistant bull and hasn't resorted in name calling unlike some others here..shame on you that have.

Faceman ..so you sold a property bought recently for a tidy profit eh?..wise decision I'd say

Have a weather station?, why not join the Ireland Weather Network - http://irelandweather.eu/

0 -

Advertisement

-

Longfield wrote:The cynic in me says this will be another builder buddies/government (read builders buddies = Berty and friends) crapola poorly finished stock that they cannot shift anymore at vast profits.

The sooner the Aherne name is removed from governance the better imho, they've sold working Ireland down a deep deep dark hole with their own greed..for shame

Funny that, the cynic in me is contemplating what would happen if we voted the current shower back in, and let them deal with the mess that they have made with property in this country.

I would rather have them left in the mud with a huge problem that they have to sort out rather than them "contesting" the election but really aiming for second place so to speak and then have the "glory" of seeing (for example) FG/Lab get stung with a property downturn and be able to say "told you so, it was only going up when we were in charge".

Not beyond the realms of possibility.

L.0 -

I agree with you 100%. Affordable housing is a smoke-screen for greater ills. And besides, what honest and hard-working person wants to live in a managed apartment complex outside of the city? They deserve better (and no, it's not an unrealistic expectation for a person to be able to own their own home in a developed and civilised coutry like Ireland). Scangers and lay-abouts get better housing than the kind of generic egg-boxes that are being built in the name of affordable housing.Longfield wrote:The cynic in me says this will be another builder buddies/government (read builders buddies = Berty and friends) crapola poorly finished stock that they cannot shift anymore at vast profits.

The sooner the Aherne name is removed from governance the better imho, they've sold working Ireland down a deep deep dark hole with their own greed..for shame

We don't want to overdo the galway races rant - for fear of being accused of just that, being a ranter. But the point is obvious and a valid one at that. I'm going to wag my blame finger here too - I blame government corruption. AFAIC this country has not been governed for the last 10 years - it has been on autopilot with the vested interests and lobby groups running the show in the name of "incentive schemes" and "public-private partnership". (Don't get me started on the unions and public sector pay).Longfield wrote:I blame the current bubble squarely and totally on our corrupt government/builders buddies and cannot wait to vote them out(they could have done more..eg actually acted on the Bacon report for starters!!, but the tents at the Galway races saw that one swept under the carpet).

I do sometimes feel sorry for the miserable, bleary-eyed commuters, but then again they were stupidly fooled into a false dream: a lot of the blame lies in their own court - we do live in a democracy after all and you can't legislate for stupidity. Having said that, it's bloody bad luck to be stuck in a rut a la commuter. Anyone who buys an out of town apartment/townhouse in a managed complex in 2006 is an idiot afaic, and ought to be made learn the hard way.Longfield wrote:Whats worse is because I don't want to live in a traffic jammed poorly constructed one bed shítehole in Lucan I'll be branded as a begrudger...bah.

Me too. The house I rent in Dublin 6 works out at an equivalent yield of less than 1% at today's prices. You'd be mad to buy at that level.Longfield wrote:I'm renting and plan on staying renting, even the so called affordable housing coming onstream (just around election time - anecdotal evidance for this also) may become negative equity in the next few years imho...plus you get the added bonus of clawback !!

I'd go even further than that - don't go near Irish property at all. I think we'll never recover from this boom, unless some economic miracle (like EU cohesion funds or US foreign direct investment) comes our way again - unlikely: we're on our own this time chaps.Longfield wrote:Unless yer getting 2-3 bed..don't even think of buying an apartment near Dublin in the next while imho. funny enough..whats the one thing you cannot get 100% mortgages on..yep ..one beds...

Me too.Longfield wrote:In fairness to faceman, he's been a persistant bull and hasn't resorted in name calling unlike some others here..shame on you that have.

Faceman ..so you sold a property bought recently for a tidy profit eh?..wise decision I'd say 0

0 -

How often do you get to witness a piece of history?shaptakster wrote:I was just making the point that the same people are going on and on so much that its like they are obsessed with a crash.

Why am I even bothering to answer this. Add something to the discussion or go away. Please.shaptakster wrote:After a quick gander through the thread i see that SimpleSam06, D'Peoples Voice, Pa ElGrande and sponge bob have about 50% of the posts in this thread between them. :eek:0 -

faceman wrote:Yet another "bear" who is bitter? This thread has really turned into something it shouldnt have.

Sure i might as well join in...

I made €65k after taxes etc on one of my properties which i sold this year. I bought it 2 years ago. How much you "bears" make this year?

bitter? why of course ! Very bitter at how as a country we got rich and wasted it!

I sold up recently made 90k - we got out in time, I am leaving the country, I do love the country and if I come back I hope property has come to a level where people can have a better standard of living.0 -

faceman has more than i doshaptakster wrote:After a quick gander through the thread i see that SimpleSam06, D'Peoples Voice, Pa ElGrande and sponge bob have about 50% of the posts in this thread between them. :eek:

I would not go as far as you just did...about yourselfThere should be a tool to show how many times a particular person has posted in each thread.

Now count the whole thread properly willya .0 -

Advertisement

-

I don't mean to be a Jeremiah, this is not about me wishing for a house price crash, this is about alerting people to the mayhem that's just around the corner in our domestic economy when the credit tap is turned off. Hopefully people reading this will take a rational approach towards purchasing a house, instead of feeling pressured to get on the housing 'ladder' in any location at any cost, to the detriment of their own future prosperity and be able to enjoy a reasonable standard of living as a result.shaptakster wrote:On the contrary i would love nothing more than for house prices to come down.

I was just making the point that the same people are going on and on so much that its like they are obsessed with a crash.

After a quick gander through the thread i see that SimpleSam06, D'Peoples Voice, Pa ElGrande and sponge bob have about 50% of the posts in this thread between them. :eek:

Despite the sooth saying from the estate agents and mortgage lenders the fundamentals of the Irish property market at this point in time are questionable to say the least.- 275,000 empty properties in April 2006.

- Professional people on good wages are priced out.

- Numbers of first time buyers is declining.

- Construction output is at all time record levels.

- Interest rates set to increase further this year.

- A record 1 in 8 of us work in construction, highest ratio in the EU.

- Debt levels continue to increase.

- Manufacturing employment continues to decline.

- Inventory for sale has increased in Autumn 2006

- Fitch estimated that bank credit to the private sector would increase to 190 per cent of GDP this year, one of the highest ratios of 100 countries surveyed.

- Rental yields at current prices are down to 3.75% and even lower.

What I am observing is the relentness nature of the information presented here runs counter to the indoctrination that many people have undergone with regard to the property market. This normally seems to result in an emotional response towards the poster of the information that contradicts a persons beliefs rather than a logical assesment of the infomation or argument put forward by the poster.

I know your goal is to help your daughter and son-in-law find a home and you have put a great deal of effort into researching the market and I wish you good luck with this.Net Zero means we are paying for the destruction of our economy and society in pursuit of an unachievable and pointless policy.

0 -

Pa ElGrande wrote:I don't mean to be a Jeremiah,

Thanks Pa ElGrande, this is an excellent post! Very useful to have all the references in one spot!0 -

http://www.london.gov.uk/news/2002/421-1410a.jsp

3.6% of homes in London were empty in 2002 .

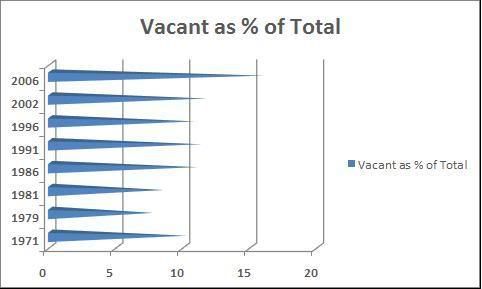

I have no Dublin figure but nationally it was 10-11% or so in 2002 which is typical of Ireland .

Now its 16% . What is it about we Irish that property is best left empty and unused on this scale .......and particularly in recent times where all records have been broken.

The difference between what is NOW empty (16%) and what is NORMALLY empty (10%) is 6% of the national housing stock.

The national housing stock is 1.8m units

6% of that is 108,000

A normal years building averaged over the past 15 years is around 50,000. We have two years worth of supply lying idle over and above the long term empty rate which is enormous anyway .

We have only built that 2 years oversupply within the past 4 years according to my graph.

Despite the recent immigration of east europe * .* we have still not found a use for this gross oversupply.

Who the **** are we fooling here except ourselves ?????????0 -

This would be the headline in today's Evening Herald, according to the lads over on AAM. I can't find a link to it however. This would be domino number two falling, and much sooner than I expected.0

-

-

finnpark wrote:

yep, thats right, th UK boom ended in 2003

http://www.housepricecrash.co.uk/graphs-average-house-price.php

they have managed to keep it steady since then somehow. That being said there is a suspicion of prices declining there now.

Lucky Brits can adjust their own interest rates to mange the property market... pity we can't0 -

whizzbang wrote:yep, thats right, th UK boom ended in 2003

http://www.housepricecrash.co.uk/graphs-average-house-price.php

they have managed to keep it steady since then somehow.

In the UK the national rate of empties is c. 4-5 % with the figure around 5% or more in Wales and Scotland and 3% in SE England

( and some of ye who will not do yeer own research can simply go find some source that tells you otherwise or else accept what I say as gospel right ??!! )

right ??!! )

In Ireland the national rate of empties is 16% .

We have over 3 times more empty properties than they do and this OVERSUPPLY is an OVERHANG on our market .

The UK has not spent the last 4 years overbuilding our national stock as did we and do have a more appropriate interest rate as whizzbang said. Their banks are not as big a pack of muppets either I'll wager .

HTH0 -

Interesting comment from that 2003 BBC article...But even the 70,000 buy-to-let mortgages agreed in 2002 made up only 5% of the total.

Last year in Ireland, BTL's were 40% of the market.0 -

whizzbang wrote:Thanks Pa ElGrande, this is an excellent post! Very useful to have all the references in one spot!

Here here, keep up the good work Pa!0 -

Sponge Bob wrote:In the UK the national rate of empties is c. 4-5 % with the figure around 5% or more in Wales and Scotland and 3% in SE England

erm, is this in relation to my post? I agree with everything you say here!0 -

Advertisement

-

I have to fess up, I bought the Herald this evening when I saw the hoarding on O'Connell Street.

Fears grew today that thre house price boom is over. In Dublin, in particular, more houses are being left unsold and auctions are suffering.

Fears grew today that thre house price boom is over. In Dublin, in particular, more houses are being left unsold and auctions are suffering.

<snip>

Evening Herald business expert Dan White said: "What has happened over the past nine months is entirely consistent with the early stages of a downturn in prices."

He said recent interest rate rises had definitely slowed the market down.

He added: "After more than a decade of being scarce as hens' teeth, the market is suddenly awash with second hand houses. The problem is that this creates a sudden increase in supply which triggers the very crash that sellers had been fearing."

<snip>

Buyers were thin on the ground at auctions around the country, but Dublin was particularly hit. Those who did bid were cautious, with the small number of houses selling making little over their advised minimum values.

<snip>

"People are making an informed choice on the properties they are going for," he said. "The market price is defined by the buyer, they are looking to see what is available and are making their decisions on that basis."

more ...

House price boom shudders to a halt

http://www.evening-herald.ie/ [free registration required]

Its essentially a rerun of the Sindo article, Dan White describes everything but stops short of calling the bubble burst.

Thursdays Irish Times could get interesting, to see how they spin the poor auction results, but I'm not going to give myself backache to find out.Net Zero means we are paying for the destruction of our economy and society in pursuit of an unachievable and pointless policy.

0 -

I missed the Sunday Indo article, but here it is, I'm posting the whole thing as the site requires free reg.NICK WEBB Sunday Indo wrote:THE extraordinary glut of houses coming on the market this month has led to widespread falls in the prices being demanded by estate agents.

In one case a red brick house on McMahon Street in Portobello off Dublin's South Circular Road has seen its asking price slashed by 20 per cent. The house was withdrawn from auction in June, with agent Sherry FitzGerald then quoting a price of €1.25m. Last week the property was advertised at just €1m.

Aylesbury, a luxury home on Glenageary's Adelaide Road, was withdrawn from auction before the summer. Agents Sherry FitzGerald were then quoting a price of €8.5m for the home on an acre. Last week, the property was for sale with a guide price of €7.5m. This represents a drop of 12 per cent. A detached redbrick house in Shrewsbury Park in Ballsbridge has had €450,000, or 11 per cent, shaved off its asking price, now €3.45m. Other properties from Blackrock to Ballinteer on the southside have seen thousands of euros shorn from their asking prices.

While the downward trend is most evident across more expensive houses on the prime southside suburbs of Dublin, the Sunday Independent has uncovered significant falls in asking prices in other areas of the city.

On the northside of the city a property at Brompton Grove in Castleknock is on offer at €650,000 almost 4 per cent lower than its pre-summer price. Hamilton Osborne King is selling a three bedroom home in Castilla Park, Clontarf for €795,000, having some months ago offered the property at €825,000.

Price reductions have also been widespread across the country, especially in Dublin's commuter belt counties. Both Douglas Newman Good and Hassett have chopped asking prices for certain homes in Bray and north Wicklow by between 5 per cent to 10 per cent. Auctioneer John Keane is selling a Rosslare house for €725,000, with the property having been advertised at €750,000 before the summer. Smith Harrington has sliced over 6 per cent off a Navan four bed.

Last week, two estate agents, Rathmines based Herman White and the Phibsboro branch of Mason Estates were openly advertising properties as being "reduced to sell" or "reduced price region". The homes in question were a €1.5m Victorian house on Rathgar Avenue in the heart of Dublin 6 and a €495,000 three bed on Danielli Drive in Artane, Dublin 7.

Speaking to the Sunday Independent , Douglas Newman Good economist Paul Murgatroyd said, "There is a more realistic element coming in for vendors."

However he added that DNG figures will soon reveal that average Dublin property prices actually rose 2.4 per between July and September, although the time taken to sell houses has increased.

Since the auction season began again two weeks ago, an unprecedented number of houses have been put up for sale.

edit: Cleaned up code0 -

it's about to happen0 -

The two pillars of the housing bubble, interest rates and market sentiment, are both starting to fall away. What with reversing trends in economies, China running the risk of overheating, and the general German terror of inflation, I can see rates going as high as 6%, the Fed be damned, which would double the interest portion of mortgage repayments for anyone that has them.Pa ElGrande wrote:Thursdays Irish Times could get interesting

An article like that in a widely read national paper is going to seriously damage market sentiment; those thinking of buying are going to pull out, and those in danger will be trying to sell, which floods the market with even more properties, creating a snowball effect. This is going to get messy. So much for the nouveau riche who really weren't and the amateur investor who thinks he's a professional.0 -

I don't thing anyone should get smug, a crash would be very bad for the economy

The only person who could afford to be smug is faceman, your the only person who made good arguments against selling investment properties and all the while you were getting out yourself, I like your style!faceman wrote:I made €65k after taxes etc on one of my properties which i sold this year. I bought it 2 years ago. How much you "bears" make this year?0 -

SimpleSam06 wrote:The two pillars of the housing bubble, interest rates and market sentiment, are both starting to fall away. What with reversing trends in economies, China running the risk of overheating, and the general German terror of inflation, I can see rates going as high as 6%, the Fed be damned, which would double the interest portion of mortgage repayments for anyone that has them...

QUOTE]

Must admit, I don't see interest rates going quite so high. The ECB seems to lumber its way through decisionmaking and as it is purely driven by the concerns of the French and German economies, I wouldn't be surprised to see interest rates peak by the end of the year and drop back a little in the first quarter of 2007. Too late to mitigate the damage to sentiment though...0 -

You said the uk had managed a 'soft landing' scenario "somehow" My opinion is that the "somehow" in the UK is primarily supply related.whizzbang wrote:erm, is this in relation to my post

We will not have a soft landing for the reason that we do not have that "somehow" here along with the lack of an interest rate mechanism and the third problem which is that the Financial regulators completely failed to stop the banks from priming the markets with oodles and oodles of cash...until the banks panic that is ...together with the speculators who hold this huge supply of empties funded by these stupid banks between 2002 and 2006

All Textbook muppetry as the economic history books will show by the end of the decade.

This textbook muppetry in our property market and in ludicrous locations like Bulgaria and the Cape Verde islands is what makes we Irish "different" and "special" to a large degree .

You start writing it whizzbang and I will throw in a chapter or two for my % and proof it for you of couse . Make sure its in the shops for christmas 2007 sez this sponge smelling the green

People who enjoy a top financial yarn should read this extremely amusing book about another bubble 25 years ago in which a lethal combination of a commodity bubble and a dip**** expert who made predictions about the commodity 'upside' which were ludicrous and stupid borrowers and very very very stupid bankers all went very close to crashing the US banking system ...and did crash the 13th largest bank at the time.0 -

This post has been deleted.0

-

Please clarify what you mean by drop back a littleHailee Fat Mushroom wrote:I wouldn't be surprised to see interest rates peak by the end of the year and drop back a little in the first quarter of 2007.-

hold off on any further increases

-

reduce interest rates

As I said to Faceman, I see no evidence in the futures markets pricing of any U-turn in the ECB policy for the next 18 months. There are no decreases priced in, only increases. One at the start of October, another at the start of December, another at the start of March and finally again in June. The ECB will then hold off for a long while.

Not sure if you aware, but Germany, Italy and France are still running budget deficits, hence in the absence of a recession, the ECB should be running a deflationary policy. That is why, everytime it meets, it speaks of removing the accomodating factor built into it's present rates, the rates are only accomodating or inflationary because the euro area WAS in recession.

I know the UK increased interest rates at a quick pace, then had to reduce them again for a few months before increasing them again but that is why the ECB is increasing them at a slower pace so it won't have to reduce them.0 -

Advertisement

-

Another vaguely possible positive factor for the market might be that many of the 'investors' who are selling their houses now may have children who are looking to buy.D'Peoples Voice wrote:Faceman,

Seeing as how you see yourself as an astute investor, what positive factors do you think have yet to be priced in. All I can see are negative factors and I'm usually an optimist.

In which case, seeing as rabobank et al deposit rates will rise to at most 5.5% by next year, these investors may wish to instead loan the profits they made from property to their children, at a rate which would be higher than the current rental yield but lower than the mortgage rate offered by banks. Hence we might have new buyers willing to take up the slack provided by all the sellers.

Of course why people who wished to get out of the market would wish to give someone a loan to get back into the market, borders on insanity, there is a slight difference. As investors they owed houses that had would have had a rental yield below the deposit rate offered by Rabobank et al, but through this loan agreement they receive an interest rate greater than the deposit rate and for little risk, assuming their children wish to remain in the house indefinitely. After all we have no reliable figures of how many people are priced out of the market, all we can do is infer form the population statistics collected by the CSO!0

Advertisement