Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

An Economic Miracle Cure? The Case For A Negative Income Tax In Ireland

Options

-

13-04-2009 3:01pm#1I posted this over on my blog a few days ago, and I thought that it might be suitable for discussion here in the new 'Irish Economy' forum. Any comments or opinions would be much appreciated.

An Economic Miracle Cure? The Case For A Negative Income Tax In Ireland

Ireland is in the middle of what can only be described as a complete economic meltdown, with a recession to the tune of 8% of GDP, unemployment reaching into double digits, and a catastrophic decay in the public finances. Attempts to deal with these problems have unfortunately been limited to tinkering around the edges with marginal changes in the tax rates and limited cuts in public expenditure. The recent mini-budget has continued with this approach, and there have been very few proposals that have gone much further than creative accountancy when it comes to the budget, and little more than platitudes regarding a reduction in the unemployment rate, let alone anything that seriously addresses the collapse in GDP.

There is, however, a little known miracle cure that could do the trick for the Irish economy. It’s a relatively simple idea that could create 300,000 jobs, save the Government €2 billion, bring down the cost of living, dramatically increase Irish competitiveness and turn the corner towards economic growth. Sounds too good to be true? Perhaps it is, because nobody’s ever actually tried it.

The idea is to bring in something called a Negative Income Tax. This works, as you might expect, sort of like the opposite of a normal income tax. Instead of just taking away some of the earnings of people above a certain income, the government would also simply give extra money to people below a certain income, in effect ‘topping up’ their salaries. The idea has been floating around economic circles for quite some time, and has been proposed in many shapes and sizes, perhaps most famously by Milton Freidman, who took it to a rather extreme form where it would replace all other forms of welfare. It’s never made that jump from theory to practice, though, and there are a number of reasons why.

Before I get to that, though, I’ll give a quick run through existing tax systems for comparison.

The simplest form of income tax is called the flat tax. This is where every person is charged the same percentage of their salary in tax. So, with a 30% flat tax, a person earning €10,000 would pay €3,000 in tax, and someone earning €80,000 would pay €24,000 in tax. Here’s a diagram of how a 30% flat tax would affect people on different salaries:

The blue line shows what someone would take home if there were no tax at all (ie their entire salary), whereas the red line shows what they would actually take home after a 30% flat tax. The shaded pink area is the revenue that the government receives from the tax.

The flat tax is popular partially due to its simplicity, but also in large part because it doesn’t disincentivise work as much as a progressive income tax would. It’s been largely replaced by progressive taxation, however, because it gives no special treatment to those on lower incomes who are likely to be more heavily affected by the tax.

The progressive income tax is probably the most common form of income tax in the developed world. It operates by charging different tax rates depending on how much the citizen earns. For example, tax could be levied at a rate of 20% on all earnings below €40,000, and at a rate of 40% on all earnings above that, such as in the following diagram:

This is generally favoured because it places less of a burden on low-earners, and taxes high-earners more heavily, and is hence considered fairer. Libertarians would argue that in doing this it disincentivises work amongst high-earners (by reducing the amount of take-home pay they get), and hence reduces overall economic activity, but in most places it’s accepted as the fairest way to distribute the tax burden. It can also be organised with any number of tax bands, and sometimes completely exempts those on the lowest incomes.

Of course, even exempting low-earners from tax altogether doesn’t necessarily leave them with enough money to live, and those without any job would be literally out on the street. Hence the combination of a minimum wage, to make sure everyone who works is guaranteed a certain standard of living, and unemployment benefits, to give those who can’t find work a means to get by. These two policies are used the world over to help out those less fortunate in life, and are widely accepted to be the best way to go about it. The only problem is that, as well-meaning as they are, they don’t really make all that much sense.

Take the following example: a country has a minimum wage of €20,000 a year (not taxed) and unemployment benefits of €10,000 a year. A company wants to hire a new employee, but can only afford to pay €15,000, and an unemployed man would take the job (as he’d be €5,000 a year better off), but can’t. In this scenario, everyone is unhappy; the company has no employee, the man has no job and the government has to pay out €10,000 in benefits. It’s clearly not an optimal solution to the situation.

What happens, though, if the government agrees to this; the company pays this man €15,000, and the government ‘tops up’ his salary by €5,000? The man gets €20,000 a year, which is €10,000 better than being on benefits, and high enough to meet the minimum wage. The company can employ the man they want and the government saves €5,000 a year. This is a better solution for all involved, it boosts employment and benefits the economy. This is negative income tax, but no country has ever actually implemented it. Why?

The principal concern with any system of negative income tax is disincentivising work. Why would the man in the example work harder to bring his salary up to €20,000 if the government would just take away their ‘top-up’ and he’s left with exactly the same amount as he had before? Even if they left him with some of the top up, would it be enough to convince him to put the extra work in? And if the government do have to give these ‘top-ups’ to low-paid workers, can they afford it? The answers to the second and third questions can be yes, but as we’ll see there isn’t necessarily an easy solution.

The classical implementation of negative income tax is to give everyone a fixed sum, and then levy a flat tax on all earnings. Here’s an illustration of such a scheme with a €10,000 lump sum and a 33% tax:

Here the green area is the negative tax that the government is paying out to those on lower incomes, or the ‘top-up’ on their salaries. There are quite a few benefits to this over a normal flat tax, in that it is ‘progressive’ in the sense that it favours those on lower incomes, but it retains the lowered disincentive to work that the flat tax promises. It also eliminates the need for a minimum wage (and the market distortions that go with it) by boosting low incomes. There is a big problem, though, and that’s the cost of the scheme to the government.

The break-even point on the example above is €30,000. This is where the €10,000 lump sum is cancelled out by €10,000 of taxes on what they’ve earned. But what if €30,000 is the median wage? This would mean that fully half the workforce would actually be net beneficiaries of the tax system, and the other half would have to cover these payments as well as all other government spending. This simply isn’t sustainable, but the only ways to improve the balance is either to drastically reduce the lump sum payment, which would defeat the purpose of helping low-wage workers, or drastically increase the tax rate, which would increase the disincentives that flat taxes are designed to avoid.

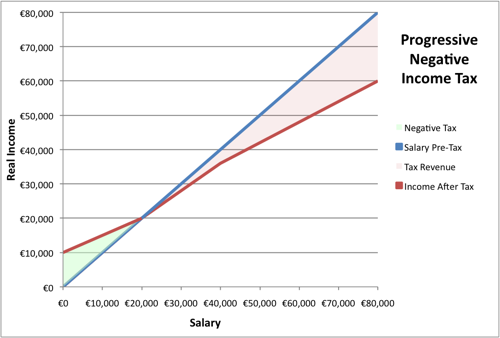

Most of the times that a negative income tax has been discussed it’s been in the context of a scheme like the one above, with all the problems that it entails. There is, however, the option of applying the negative income tax to a progressive tax system like Ireland’s. This means giving negative tax only to those who really need it, low taxation on middle incomes, and higher taxation above that. Consider the following tax scheme:

Here we’ve got a negative tax scheme for those who earn less than €20,000, calculated as €10,000 minus half their earnings. From €20,000 to €40,000, earnings are then taxed at 20%, and at 40% above that. This sort of scheme is what we’re going to have to look at here in Ireland, because we’re in exactly the sort of scenario where it would bring about the biggest benefits, a scenario that no country has ever really been in before. Have a look at the situation we’ve found ourselves in:

- 11% unemployment and rising: As big a problem as this is in itself, every one of these is also claiming unemployment benefits off the state, which feeds into:

- Double-digit budget deficit: This means that a Keynsian-style attempt at economic stimulus to create jobs and boost growth simply isn’t feasible, as the government simply can’t afford it.

- Internationally high wages: Years of economic boom left us with some of the highest wages in the world, which now seriously hamper our competitiveness, and our ability to rebound with export-led growth.

- High minimum wage: As desirable as a decent minimum wage is in times of high employment, it’s now aggravating the unemployment situation and causing problems for both our international competitiveness and our own cost of living. Furthermore, any attempt to reduce it (even in line with deflation) would be politically disastrous.

- High cost of living: In line with our high wages, we also have a very high cost of living by international standards. We’re starting to see deflation, but it’s still a big problem.

- Common currency: For all the benefits a common currency brings (look at Iceland without), being unable to control monetary policy means that the government can’t attempt to devalue their way out of the deficit.

- 8%+ GDP contraction: This is the biggie. With a 3% downturn last year, and a definite continuance of the recession into 2010, we’re already in a full-blown depression by most economists’ measures. If it weren’t for Iceland’s complete collapse, Ireland in 2009 would stand a very good chance of seeing the highest single-year decline in GDP of any developed county since World War 2. It is simply not possible to overstate the scale of the economic decline, and big moves, not just tinkering around the edges, need to be made to address it.

No country has ever experienced the same combination of economic, budgetary and employment crises so suddenly from such a high peak, so any actions that really can save us have never been used before, because they’ve simply never been needed before. A scheme like negative income tax may seem radical, not just because of the fact that it’s never been implemented, but because it requires wholesale change in the way our taxation and welfare systems operate. Radical, however, is exactly what we should be looking for right now, because it’s the only kind of policy that actually stands a chance.

And as radical as negative income tax may be, its potential benefits are just too big to ignore:

- Unemployment down to 3-4%. By removing the minimum wage, businesses would be able to make big increases in the number of low-paid jobs, and there should be a large take-up because the government top-up ensures any employment (even very low-wage) is preferable to the dole.

- €2 billion in government savings. The state currently pays out somewhere around €10,500 a year to each person on unemployment benefits. With unemployment rising higher and higher, the welfare bill is growing massively exactly when the government can least afford to pay it. By shifting people from unemployment benefit to subsidised work, the amount the government has to pay out can be significantly reduced. A back-of-a-paper-envelope estimate puts this saving in the region of €2 billion a year, although it could be even larger compared to future unemployment rates, and doesn’t take into account the savings that could be made in reduced administration of social welfare.

- Reduction of cost base for businesses. High wages are a significant contributor to business costs in Ireland, which in turn affects their ability to compete in world markets. Allowing wage costs to drop below the minimum wage would make businesses more competitive and boost economic growth.

- Reduction in cost of living. High costs in Ireland are significantly affected by the high minimum wage. By bringing wages down at the low end of the market, the cost of living can be reduced considerably. We’re already seeing cost of living decreases, but a quick, sharp drop in prices is necessary to facilitate lower wages across the board, and help restore the country’s competitiveness.

- Mitigating the long-term effects of unemployment. Most of those on the unemployment register today have been out of work for under a year, meaning that given the opportunity, they would have little difficulty fitting back into the workforce. Fast-forward a few years, though, to when the recession has finally subsided, and Ireland could have 10% to 15% of it’s workforce in long-term unemployment. Even if jobs start to be created at that stage, people who have been out of work for 3 or 4 years will find it very difficult to rejoin the workforce and settle into a new job. This will not only be very difficult for all those involved, but severely hamper the economic recovery when it does come around. By keeping as many people in employment as possible, a negative income tax could prevent this eventuality and make sure the work force is in good shape to take advantage of the eventual upturn.

A kick-start to the economic recovery. Each of these factors make a contribution towards economic recovery. The benefits to an increase in employment are obvious, and the money saved by the government can reduce the need for further tax rises or spending cuts. Furthermore, decreases in costs and wages are a vital prerequisite to making ourselves internationally competitive again and attracting inward investment. It’s impossible to put a figure on how this would affect the recession, but the benefits could be decisive.

Of course, as with any scheme, there are possible drawbacks. The most notable of these are the potential disincentives created for low-income workers. Taking the example I gave above, those on negative tax are in a situation where, for each extra euro that their salary increases, their real income only goes up by 50 cent. The argument is that this disincentivises workers from seeking out higher wages, and hence keeps wages artificially low, costing the government more in negative tax. While work disincentives are a strong argument against high taxation on high earners, I don’t believe the same can be said for those in the lowest income categories. The fact is that salaries between €10,000 and €20,000 are not much to live on, and I would fully expect that, even with the reduced returns, such workers would continue to compete for higher earnings.

A further argument could be made against the potential administrative complexity of such a scheme. The UK set up a system of “working tax credits” a number of years ago which gives some individuals and families lump-sum payments depending on their circumstances (although the name is rather misleading, as it’s not actually implemented as part of the tax system). The system has been widely discredited as an administrative disaster, as huge numbers of eligible people aren’t aware that they can make claims, and many of those that do have been over-paid and have to give the money back. Furthermore, the cost of keeping the system up and running is quite considerable.

The important distinction between welfare models like that one and a negative income tax is that the negative income tax isn’t administered as a welfare payment, but within the tax system itself. Currently, when you receive a PAYE slip, your employer will have deducted the appropriate income tax and PRSI and will pay it to the government on your behalf. Similarly, if you are on negative income tax, your employer will top up your paycheck to the appropriate amount, and then claim it back from the government themselves. In fact, the majority of businesses will have many more positive-tax employees than negative-tax ones, meaning that they will simply deduct your payment from their overall tax bill, and the administration required will be little more than accountancy.

It would be foolish to claim that implementation of a negative income tax would be a complete cure to the nation’s economic woes. A wide variety of measures will have to be introduced, some more palatable than others, to put Ireland on the road to its eventual recovery. Exactly what each of those measures are and why they are needed is a long and complex discussion that will have to be left to another day, but for the moment there’s a simple and effective, if radical reform that can make a big difference. What we need to do is move the debate away from just tax hikes and spending cuts, and start talking about whole new ways to do things. In the state the country’s now in, we can hardly afford not to.8

Comments

-

LOL i thought we already gave money to people for doing nothing.0

-

My argument is that rather than give money to people for "doing nothing", we would be better off giving them money to actually work.0

-

I havnt heard of the concept before but I think its nonsense , I think the last 10 years should have proved that the gov. should not be tinkering with incentives to "help" economic activity.

If you think the market isn't clearing you should be looking at the welfare system , the minimum wage and the fact that personal taxes are rising. if you factor out the previous and the sums still dont add up then the wages need to drop or the activity is not productive enough for the economy. I for one dont want to give part of my salary over so that people can work in Dell. I am happy to see costs drop so that more activities are profitable in Ireland.

if you want to lisen to a freemarket approach

Why You've Never Heard of the Great Depression of 1920

Presented by Thomas E. Woods, Jr., at "The Great Depression: What We Can Learn From It Today," the Mises Circle in Colorado; sponsored by Limited Government Forum of Colorado Springs and hosted by the Ludwig von Mises Institute. Recorded Saturday, 4 April 2009.A belief in gender identity involves a level of faith as there is nothing tangible to prove its existence which, as something divorced from the physical body, is similar to the idea of a soul. - Colette Colfer

0 -

just wanted to say this is probably the best idea i heard so far to get us out of this mess

its reassuring to know that while the majority of people are still finger pointing and trying to find a scape goat there are users here who can objectively look at a picture and come up with solutions backed by numbers

now, how does get the government to implement this?

Have you tried contacting the newspapers with this??

btw may i recommend you edit the link to your blog to include the title, that way at least you get better ranking in google 0

0 -

I'm curious about this part. Someone earning €0 gets "topped up" to €10,000?0 -

Advertisement

-

Dotsie~tmp wrote: »

I'm curious about this part. Someone earning €0 gets "topped up" to €10,000?

whats better paying someone €10,000 for doing NOTHING and sitting on welfare

or paying someone €10,000 for WORKING in producing goods/services

which of the above provides greater economic return?0 -

Dotsie~tmp wrote: »I'm curious about this part. Someone earning €0 gets "topped up" to €10,000?

Effectively it's just unemployment benefit if you're not earning anything.0 -

So are you saying you are going to expect people to work in return for their dole? Doing what?0

-

The problem:

Welfare at the moment will get you €12,480 per annum.

Minimum wage will get you: €17,684 per annum.

There's not enough of a difference here to act as much incentive and the marginal gain per extra Euro earned over welfare is much less than 50c and this is just pure Welfare at €240 per week, it doesn't count your medical card, extra payment for kids, spouse or rent allowance etc.0 -

Dotsie~tmp wrote: »So are you saying you are going to expect people to work in return for their dole? Doing what?

hes saying scrap welfare and minimum wage and replace it with negative taxation

So i suppose if someone looses a job they might have a few months before their social insurance runs out to find a job, if this job happens to only earn 5k, the negative taxation will top it up to 15K and so on

this is definitely a great idea and provides incentives to work, and creates jobs as theres no minimum wage nonsense

basically this is a form of welfare but one would have to work for it, and the removal of minimum wage would mean creation of jobs and falling costs of living/exporting which is good for the worker and the economy

.0 -

Advertisement

-

Just point out this to people we effectively have Negative Income Tax in this country for people with children through the Family Income Supplement.

For example. Someone on minimum wage earning €346 a week with a work at home spouse and 2 kids will receive €146.40, bringing their weekly wage up to €492.40.

Details on rates here: http://www.citizensinformation.ie/categories/social-welfare/social-welfare-payments/social-welfare-payments-to-families-and-children/family_income_supplement

This is compared to the Welfare payment for such a family of €391.60 (not counting Rent Supplement).0 -

Does seem elegant.0

-

hes saying scrap welfare and minimum wage and replace it with negative taxation

So i suppose if someone looses a job they might have a few months before their social insurance runs out to find a job, if this job happens to only earn 5k, the negative taxation will top it up to 15K and so on

this is definitely a great idea and provides incentives to work, and creates jobs as theres no minimum wage nonsense

basically this is a form of welfare but one would have to work for it, and the removal of minimum wage would mean creation of jobs and falling costs of living/exporting which is good for the worker and the economy.

I'd just like to clarify that personally I wouldn't advocate a move to "scrap welfare", just rejig it. If someone is actually unable to find work, then they should still receive enough off the state to live on. However, any move by the government to encourage them back into work deserves to be looked at.nesf wrote:The problem:

Welfare at the moment will get you €12,480 per annum.

Minimum wage will get you: €17,684 per annum.

There's not enough of a difference here to act as much incentive and the marginal gain per extra Euro earned over welfare is much less than 50c and this is just pure Welfare at €240 per week, it doesn't count your medical card, extra payment for kids, spouse or rent allowance etc.

Basic Jobseeker's Allowance is currently €204 per week, which equates to €10,608 a year, although your point still stands. The issue is that we've got high unemployment, wages and prices are dropping, and we have a high minimum wage. Aside from being politically infeasible, simply reducing the minimum wage would bring it closer to unemployment benefit and reduce the incentive to actually return to work. On the other hand, any significant reduction in welfare rates is similarly infeasible.

Although the numbers I posted above are rounded off, I still think that they'd serve as a good guide. A €10,000 basic income isn't too far off our current Jobseeker's Allowance, especially once you take deflation into account. €20,000 is somewhat above our minimum wage, and would hence necessitate the subsidy of already-existing jobs to the tune of about €1000 a year, but I feel this is necessary to keep the marginal gain on earnings at 50%. This expense should be more than cancelled out by the money saved as people move from unemployment benefit to work.nesf wrote:Just point out this to people we effectively have Negative Income Tax in this country for people with children through the Family Income Supplement.

For example. Someone on minimum wage earning €346 a week with a work at home spouse and 2 kids will receive €146.40, bringing their weekly wage up to €492.40.

Details on rates here: http://www.citizensinformation.ie/ca...ome_supplement

This is compared to the Welfare payment for such a family of €391.60 (not counting Rent Supplement).

In fact, when you take into account Child Benefit, the Family Income Supplement, Back to School Clothing and Footwear Allowance, One-Parent Family Payment, Back to Education Allowance, Fuel Allowance, Disability Payments, Farm Income Support, etc., etc. there are a lot of ways in which you can be a net beneficiary of the state. But none of these are actually implemented in the form of negative income tax. Once the PAYE system is upgraded to facilitate negative tax payments, almost all social welfare payments could be integrated into in as tax credits. This would not only be vastly more efficient than the current system, but would allow the government to much more easily target payments to those on lower incomes (such as they are now attempting to do with child benefit).0 -

I'd just like to clarify that personally I wouldn't advocate a move to "scrap welfare", just rejig it. If someone is actually unable to find work, then they should still receive enough off the state to live on. However, any move by the government to encourage them back into work deserves to be looked at.

of course, scrapping unemployment insurance would be crazy, if some get made redundant they deserve to receive welfare for few months to a year as happens in alot of countries provided their employer and/or them payed PAYE/PRSI for a while

the solution you outlined as it doesn't completely scrap welfare but provides incentives for new jobs to be created and for people to work instead of sitting at home, its a win win

the only people who would object would be the long term leeches0 -

hes saying scrap welfare and minimum wage and replace it with negative taxation

So i suppose if someone looses a job they might have a few months before their social insurance runs out to find a job, if this job happens to only earn 5k, the negative taxation will top it up to 15K and so on

this is definitely a great idea and provides incentives to work, and creates jobs as theres no minimum wage nonsense

basically this is a form of welfare but one would have to work for it, and the removal of minimum wage would mean creation of jobs and falling costs of living/exporting which is good for the worker and the economy

.of course, scrapping unemployment insurance would be crazy, if some get made redundant they deserve to receive welfare for few months to a year as happens in alot of countries provided their employer and/or them payed PAYE/PRSI for a while

the solution you outlined as it doesn't completely scrap welfare but provides incentives for new jobs to be created and for people to work instead of sitting at home, its a win win

the only people who would object would be the long term leeches

I am starting to like you and your thinking...

The only thing I am against is placing people in impossible positions where they do not have enough to survive on, realistically...but I have nothing against wages being dropped all the way to zero to retain jobs by dint of "negative taxation".

The other beauty of it is that it allows for all "shades" of wage drop between 10,000 and zero.

If you set up a system of tax credits for children/spouses to ensure it remains viable it could actually be fairer for single people too, who cannot claim income supplements, but can still wind up on minimum wages below the breadline.

It is a way of UTILISING skills that are sitting idle on welfare, not because nobody has a use for them, but because nobody can afford to pay for them.

The only problem is safeguarding the system against abuses by employers.0 -

The Communists had/have a similar system, except it was more flat than a sliding scale.

However, you cannot create jobs by lowering the minimum wage, you just end up with people sitting around bone idle.

In the Soviet Union they used to have one person dig a hole and have another one to fill it, just to claim low unemployment.0 -

The Communists had/have a similar system, except it was more flat than a sliding scale.

However, you cannot create jobs by lowering the minimum wage, you just end up with people sitting around bone idle.

In the Soviet Union they used to have one person dig a hole and have another one to fill it, just to claim low unemployment.

FAS did that too...0 -

The Communists had/have a similar system, except it was more flat than a sliding scale.

However, you cannot create jobs by lowering the minimum wage, you just end up with people sitting around bone idle.

In the Soviet Union they used to have one person dig a hole and have another one to fill it, just to claim low unemployment.

comparing centrally planned communist system vs market driven capitalist one?

apples and potatoes your comparing

USSR failed for many reasons (alcoholism, going bankrupt due to cold war, centrally planned beuracratic rot,etc) but they never had such as system as above

btw i know someone who was born and lived in the old USSR and I still remember what she said to me, quote followsHere we were trying to build "socialism" for 70 years while you Irish have it all along, never in our wildest dream did we imagine that one could get paid for doing absolutely nothing like happens here in Ireland

also there is a solution for these inefficiencies have the minimum end of the tail at just the level thats required to survive and cover the needs, basic human greed will ensure that the person will work harder to get more money so they can get things that they want

.0 -

I really enjoyed your well thought out and well constructed post. Some really good ideas that I have not come across before.

2 points.

1)

Reduction in cost of living. High costs in Ireland are significantly affected by the high minimum wage. By bringing wages down at the low end of the market, the cost of living can be reduced considerably. We’re already seeing cost of living decreases, but a quick, sharp drop in prices is necessary to facilitate lower wages across the board, and help restore the country’s competitiveness.

In order to see a sharp decline in cost of living you would have to believe that people would have less disposable income - this would be achieved by companies reducing the amount they are paying workers (which would happen as a result eliminating the minimum wage).

I don't see positive benifits coming from this. Companies would reduce what they pay workers and the goverment would top it up (far more preferable to have the private sector pay the entire wage for obvious reasons) and the money saved would presumably be taken as profits by the companies owners (bad thing as they are either foreign and taking it out of the country which is a disaster, or well off Irish people who have a much higher prepensity to save and therefore less useful for stimulating the economy)

The problem of companies lowering wages in the face of the minimum wage is one of the largest problems I would see with this idea.

Which leads me to...

2)

Consider a slight variation on your plan. Essentially what I am suggesting is limiting your 'negative taxation' to a small number of companies to get the maximum benifit of it without creating a wage deflationery effect accross the entire economy.

We set up a number of 'State' companies. These companies are very specific companies that can not compete with companies in the private sector and are staffed by people who are currently unemployed. People in these companies are paid €300 / week (50% increase on what they would get otherwise).

The cost to the governemtn of these workers is therefore ~€100 / week

I can think of two companies offhand that could be set up and staffed with these workers

Irish Callcentre limited:

This company competes with (for example) Indian companies offering English speaking callcentre operations. At €100 / person / week cost this company could potentially be competitive internationally and could at least cover its costs (prehaps it would even be able to make a contribution to the €200 / week as well)

Irish construction limited:

This company could take constuction workers currently on social welfare and again pay them €300 / week (as above) to complete some of the capital projects on the national development plan (only the ones that have already been canceled - as otherwise this company would be competing with, and distorting, the private sector). This company (in contrast to Irish Callcentre limited) would cost the government money (as the €100 / week plus materials would not be re couped) but would be a significantly cheaper way to engage in the type of economic stimulas package currently going on in the US (also we get our national development plan!).

My flatmate has already pointed out to me that both Irish construction limited, and Irish callcentre limited would immediately fall foul of EU State Aid rules - which pretty much rules them out. However from a pure economic point of view I think they are relatively sound.0 -

USSR failed for many reasons (alcoholism, going bankrupt due to cold war, centrally planned beuracratic rot,etc) but they never had such as system as above

.

ROFL

i am after reading what i said in previous post and it struck me that Ireland has alot of the similarities

* alcoholism

* near bankruptcy

* fat public sector

oh dear 0

0 -

Advertisement

-

Interesting idea.

What about this. A company needs to reduce staff by 10 to reduce costs. Government steps in and agrees that they will reduce the company's tax bill by each of the 10 staff that they keep on.

So salary for the 10 is 250000.00 Euro in total. The company keep these staff on but reduce there tax bill by 250000.00. The people keep their jobs and the government taxes their salaries. The tax deal would have to be for a limited period, say two years.

The company maintains productivity and reduces costs.

The employee remains working.

The Government probably saves money as the company makes more profit with more production and they tax the employees. They lose the 250k but the cost of retraining the unemployed person and paying them dole is gone.

..........waits for the backlash.0 -

If I owned a company then I would hire 2,000 people at minimum wage, then turn to the government and say that I want to fire 1999 of them because they are too expensive. Then the government would pay my staff for me.

Meanwhile my mate nextdoor didnt get the government grant because business was good so had to pay his staff from company funds. I can undercut him and he goes out of business.(or he has to ask for a grant too)

The weak company survives and the strong business model dies. State support to private enterprise like this doesnt work in the long run. We need real, strong, independent industries not reliant on charity.

Then the general idea of negative taxation in general. I will open a massive sweatshop, hire 1000's people from all over the EU for minimum wage and let the government pay the rest of their salaries. Excellent.

Every business with low paid unskilled workers will be subsidised by the government?

I think people need to really think about what this means.

-I agree with flat taxation mind you- No TFA's for anyone. Everyone pays tax. Everyone at the same rate. Real incentive to work, and to better oneself through advancement etc.0 -

If I owned a company then I would hire 2,000 people at minimum wage, then turn to the government and say that I want to fire 1999 of them because they are too expensive. Then the government would pay my staff for me.

Meanwhile my mate nextdoor didnt get the government grant because business was good so had to pay his staff from company funds. I can undercut him and he goes out of business.(or he has to ask for a grant too)

The weak company survives and the strong business model dies. State support to private enterprise like this doesnt work in the long run. We need real, strong, independent industries not reliant on charity.

Then the general idea of negative taxation in general. I will open a massive sweatshop, hire 1000's people from all over the EU for minimum wage and let the government pay the rest of their salaries. Excellent.

Every business with low paid unskilled workers will be subsidised by the government?

I think people need to really think about what this means.

-I agree with flat taxation mind you- No TFA's for anyone. Everyone pays tax. Everyone at the same rate. Real incentive to work, and to better oneself through advancement etc.

You would obviously have to prove that the people you are letting go are genuinely not affordable. The tax break is for a limited period. The business would have to be viable.0 -

-

In order to see a sharp decline in cost of living you would have to believe that people would have less disposable income - this would be achieved by companies reducing the amount they are paying workers (which would happen as a result eliminating the minimum wage).

I don't see positive benifits coming from this. Companies would reduce what they pay workers and the goverment would top it up (far more preferable to have the private sector pay the entire wage for obvious reasons) and the money saved would presumably be taken as profits by the companies owners (bad thing as they are either foreign and taking it out of the country which is a disaster, or well off Irish people who have a much higher prepensity to save and therefore less useful for stimulating the economy)

The problem of companies lowering wages in the face of the minimum wage is one of the largest problems I would see with this idea.

Almost everything you buy has some people working minimum wage at some point in the production or sale of it, whether it's a coffee or a washing machine. Reducing the amount these businesses have to pay will have the knock-on effect of reducing how much they'll charge. I don't agree with you that this will just be "taken as profits", as the market has become a lot more competitive now that consumer spending is going down.fluffer wrote:Then the general idea of negative taxation in general. I will open a massive sweatshop, hire 1000's people from all over the EU for minimum wage and let the government pay the rest of their salaries. Excellent.

Every business with low paid unskilled workers will be subsidised by the government?

I think people need to really think about what this means.

-I agree with flat taxation mind you- No TFA's for anyone. Everyone pays tax. Everyone at the same rate. Real incentive to work, and to better oneself through advancement etc.

Those thousands of people, if unable to find other work, would get about €10,000 a year on unemployment benefit. They'd only move into full-time work from that if they could see a tangible benefit in how much they take home, so I can't see many "sweatshop" jobs being filled without at least a basic salary. Even if thousands of people were working for next to nothing, that would still mean a net reduction of costs to the government (from them moving off the dole) and a boost to our exports, so I don't necessarily see a problem with it.

Regarding EU migrants, I could see this being somewhat of a problem, and would imagine that something like a 2-year residency requirement would have to be in place for anyone claiming negative tax.0 -

This idea will serve only one purpose: to prop up underpaid unskilled jobs in a market that naturally shouldnt be able to be competitive in that field. More and more tax money will have to be poured into it in coming years to make it sustainable. This means taxing the professional class more and more. Is this really what we want?

Put a time limit on it? -The jobs will evaporate whenever the grant expires.

Well I hired 2000 people with the intention of getting the grant. I cant support them without the grant.You would obviously have to prove that the people you are letting go are genuinely not affordable. The tax break is for a limited period. The business would have to be viable.

I'll close my operation once the limited period is up. But I'll scream in the media how the government doesnt want to save 2000 jobs by keeping the scheme open.

The busines is viable. But only with the grants etc.

This is what I'm saying. We do not want to go down the road of paying peoples salary. It supports jobs that otherwise would naturally not exist. Think of Korean rice farmers. The government introduced taxes and price controls to protect their industry during their rapid industrialisation in the last few decades. Now with rice farmers having been propped up for decades the Korean people pay more for rice than almost anywhere else in the world. The government wants to drop the tariff, and the rice farmers are going mental. Who wins in the long term by artificially supporting a market?0 -

Excellent idea, well done!

It was interesting enough that i actually read the entire thing, a pretty big achievement.

This is the kind of innovation that we need. The current tax system is so complex and convoluted that it cant work efficiently.

two questions though.

1. would unemployment welfare still be funded from prsi or would prsi be scrapped?

2. is this a college thesis or something?0 -

My simpler version of this plan: cut dole in half and say that if you get any job then you get the other half.0

-

I really enjoyed your well thought out and well constructed post. Some really good ideas that I have not come across before.

2 points.

1)

In order to see a sharp decline in cost of living you would have to believe that people would have less disposable income - this would be achieved by companies reducing the amount they are paying workers (which would happen as a result eliminating the minimum wage).

I don't see positive benifits coming from this. Companies would reduce what they pay workers and the goverment would top it up (far more preferable to have the private sector pay the entire wage for obvious reasons) and the money saved would presumably be taken as profits by the companies owners (bad thing as they are either foreign and taking it out of the country which is a disaster, or well off Irish people who have a much higher prepensity to save and therefore less useful for stimulating the economy)

The problem of companies lowering wages in the face of the minimum wage is one of the largest problems I would see with this idea.

Which leads me to...

2)

Consider a slight variation on your plan. Essentially what I am suggesting is limiting your 'negative taxation' to a small number of companies to get the maximum benifit of it without creating a wage deflationery effect accross the entire economy.

We set up a number of 'State' companies. These companies are very specific companies that can not compete with companies in the private sector and are staffed by people who are currently unemployed. People in these companies are paid €300 / week (50% increase on what they would get otherwise).

The cost to the governemtn of these workers is therefore ~€100 / week

I can think of two companies offhand that could be set up and staffed with these workers

Irish Callcentre limited:

This company competes with (for example) Indian companies offering English speaking callcentre operations. At €100 / person / week cost this company could potentially be competitive internationally and could at least cover its costs (prehaps it would even be able to make a contribution to the €200 / week as well)

Irish construction limited:

This company could take constuction workers currently on social welfare and again pay them €300 / week (as above) to complete some of the capital projects on the national development plan (only the ones that have already been canceled - as otherwise this company would be competing with, and distorting, the private sector). This company (in contrast to Irish Callcentre limited) would cost the government money (as the €100 / week plus materials would not be re couped) but would be a significantly cheaper way to engage in the type of economic stimulas package currently going on in the US (also we get our national development plan!).

My flatmate has already pointed out to me that both Irish construction limited, and Irish callcentre limited would immediately fall foul of EU State Aid rules - which pretty much rules them out. However from a pure economic point of view I think they are relatively sound.

add 1 more "State Companies" to the list

3. Irish Trash Recycling -- for non skilled dole receipients wishing to work.... its a dirty job that needs doing --- no need to pay privatised companies to deal with it -- cos it is a nasty job pay em a wee bit more than the dole.0 -

Advertisement

-

This post has been deleted.0

Advertisement

https://www.youtube.com/watch?v=czcUmnsprQI

https://www.youtube.com/watch?v=czcUmnsprQI