Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Corporation tax: Unfair Advantage?

Options

Comments

-

Eh the post wasn't addressed to you. I do find it quite ironic that you are complaining about high unemployment while with the other hand trying to take away Ireland's main competitive advantage though.HellFireClub wrote: »My interest in the matter is too obvious to be stated, I've friends and relations who are unemployed and are struggling to exist, but I see vastly wealthy businesses dictating the direction that this country is heading in.

And before you come back with, "the social welfare bill is too high in this country and needs to be cut", of course this is the case, but it needs to be cut by giving people hope and getting them off the dole and back into work as opposed to making them homeless because they cannot afford to live on 196 Euro a week and cutting the dole back down to 170 Euro or something similar.

I never suggested hiking up CT as you have incorrectly stated, there is a clear case for it to be increased by a notional degree, in line with every other tax heading that is going to be increased. That means that I think it should be increased by 1% or 2.5% at the maximum.

There is a clear moral hazard in allowing any industry or group of industries to start dictating how we are to set out a tax framework in this country. We have the IMF in town this very day, because we allowed one industry to become too close to government and influence tax policy.0 -

Amhran Nua wrote: »If a MNC is highly dependent on labour, it will be following Dell to Poland, then probably some other Eastern European country, before ending up in India or the Philippines. You end up chasing your own tail down a hole of diminishing returns. The distinguishing factor for many of the MNCs in Ireland is that they are not sensitive to labour costs.

As has been said to you over and over again, we get plenty of tax from FDI in the form of income tax and other levies.

OK, but there seems to be a contradiction here. If MDCs that are labor-intensive are leaving, then you can't claim that there is "plenty of tax" from income tax on MDC workers in Ireland.

I like Jimmycrackcorn's point about thinking about tax loopholes that encourage hiring. I also think that changing tax and finance laws to make it easier to both start and wind down a business are important, especially since Ireland really needs to develop more indigenous industries. This is one advantage that Finland has, despite its being a small country on the edge of Europe. Today the Finns are synonymous with Nokia; what is Ireland's flagship company? The most famous Irish brand is Guinness.

Ireland does need to have a serious conversation about where future revenues are going to come from, because I don't think the current system is sustainable; it is way too reliant on consumption:Revenue Source as a % of Annual Revenue Stream (2010 estimate)

Customs 0.6%

Excise Duties 11.5%

Capital Gains Tax 6.5%

Capital Acquisitions Tax 0.8%

Stamp Duties 5.6%

Income Tax 28.0%

Corporation Tax 13.6%

Value Added Tax 32.2%

Levies 0.0%

Non-tax revenue 1.2%

TOTAL CURRENT RECEIPTS 100.0%0 -

You certainly can. The MNCs that are here might not employ huge numbers of people individually, but they pay the people they do employ quite well. Lower earners pay little to no tax. And there are quite a few of them.southsiderosie wrote: »OK, but there seems to be a contradiction here. If MDCs that are labor-intensive are leaving, then you can't claim that there is "plenty of tax" from income tax on MDC workers in Ireland. 0

0 -

Amhran Nua wrote: »You certainly can. The MNCs that are here might not employ huge numbers of people individually, but they pay the people they do employ quite well. Lower earners pay little to no tax. And there are quite a few of them.

Then why would you be opposed to tax policies meant to encourage companies to hire people?0 -

Another little fact that the multinationals would rather that we not mention, is that their profits after tax are sent back to their base country. If an Irish company makes 100K profit after CT tax, in all probability, the profit stays in the country. It's no different really from a Polish worker having a job here and sending money home every month, they have every right to do so but it hurts our economy by displacing cash to overseas...0

-

Advertisement

-

Corporation tax, to me, is one of those things that should be either up to each EU member to decide or else decided for all of Europe in Brussels. At the moment it's just a stick to bash small countries with who don't have the clout of UK/Germany/France.0

-

HellFireClub wrote: »Another little fact that the multinationals would rather that we not mention, is that their profits after tax are sent back to their base country. If an Irish company makes 100K profit after CT tax, in all probability, the profit stays in the country. It's no different really from a Polish worker having a job here and sending money home every month, they have every right to do so but it hurts our economy by displacing cash to overseas...

If the multinational company is here because of our tax rate, the alternative is that the profit would be earned and taxed in some other country. Which would you prefer - 12.5% of something, or 100% of nothing?0 -

Huh? The income levy and health levy add up to 0.0% of the total tax take? Is this possible or are these "levies" not really "levies"?southsiderosie wrote: »Revenue Source as a % of Annual Revenue Stream (2010 estimate)

Customs 0.6%

Excise Duties 11.5%

Capital Gains Tax 6.5%

Capital Acquisitions Tax 0.8%

Stamp Duties 5.6%

Income Tax 28.0%

Corporation Tax 13.6%

Value Added Tax 32.2%

Levies 0.0%

Non-tax revenue 1.2%

TOTAL CURRENT RECEIPTS 100.0%0 -

If that's all the advantage you've got, there are places, some of them in the EU, where sub-€100 a month wages can be had. You want to compete with that while simultaneously bringing in labour intensive industries as FDI, and still somehow making a few cent on the rest of the taxes? I don't think this cunning plan will work.southsiderosie wrote: »Then why would you be opposed to tax policies meant to encourage companies to hire people?

These are not Irish companies we need to encourage to hire more people, these are large MNCs that can go anywhere they like, and often do.0 -

Amhran Nua wrote: »As has been said to you over and over again, we get plenty of tax from FDI in the form of income tax and other levies.

Where is the infrastructure then ?0 -

Advertisement

-

Padding out the pockets of persistent expenses. Can you please answer the question put to you previously.keithclancy wrote: »Where is the infrastructure then ?0 -

Amhran Nua wrote: »You just mentioned the construction bubble collapse one post up. I suspect you are trolling at this stage tbh. Can you tell us, in one sentence, why you feel so strongly that Ireland should do something as colossally stupid as hiking up its corporate tax rate. What is your interest in the matter..

If Ireland raised its Tax Rate from 12.5 to 20% and the company had a choice between the Netherlands and Ireland with NL's 25% why would they pick the Netherlands, or Germany, or anywhere else for that matter.

I think your mixing up some sort of uniform tax rate across Europe with Ireland needing money into the coffers to pay its bills and develop its Infrastructure.

What Corporates pay into the coffers is just a drop in the ocean to the money being pushed through the state:

http://www.bloomberg.com/news/2010-10-21/google-2-4-rate-shows-how-60-billion-u-s-revenue-lost-to-tax-loopholes.html

The country is in a situation wherby its in debt and now Germany and the other EU contributors are expected to pay for it ?

Can you see why they would think that a low corporate tax rate is stealing from their pockets when the country has just about enough money to do it for a few months ?0 -

Amhran Nua wrote: »As has been said to you over and over again, we get plenty of tax from FDI in the form of income tax and other levies.

It's worth quoting Ronan Lyons's article here to back the fact uphttp://www.ronanlyons.com/2010/11/16/and-its-hard-to-craft-a-budget-when-youre-watched-by-olli-rehn-open-letter-to-soon-to-be-european-overlords/

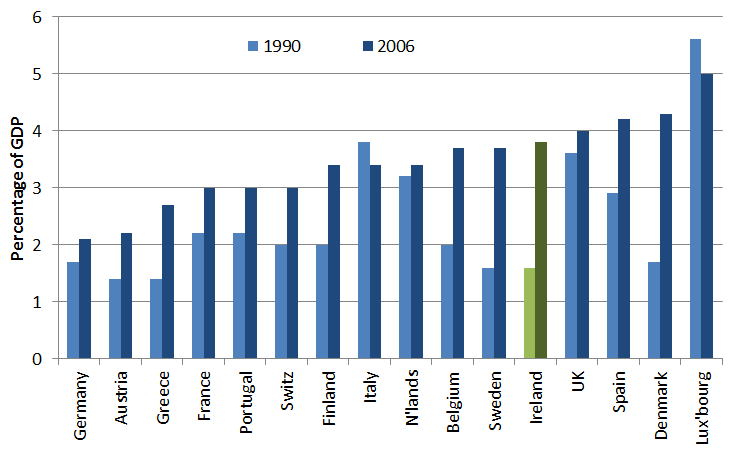

So, have no fear, the one thing Ireland is most certainly not doing is shooting ourselves in the foot with our corporate tax policy. Indeed, relative to size, Ireland brings in almost twice as much in corporate tax revenues than Germany. (Don’t worry, we won’t run off trying to give the Germans tips about how to run their public finances just yet!) The fiscal success of Ireland’s corporate tax policy is clear from this first glance, before even considering the second-round effects on VAT and income tax of having more than 150,000 extra jobs in the country due to foreign investment into Ireland.

Perhaps what threw you was simply the fact that 12.5% looks low. In fact, Ireland’s effective corporate tax rate is about 15.5%, a little bit below Portugal’s, Estonia’s and Luxembourg’s (which are all below 20%) but above those of Hungary, Cyprus and Iceland. But in a sense that’s completely irrelevant. It’s not what you have, it’s what you do with it. And Ireland has used its corporate tax rate – combined with its openness to workers and its gateway location between the US and Europe – not just to the benefit of Ireland’s Exchequer, or indeed the wider Irish economy, but to the benefit of the whole of the EU. 0

0 -

keithclancy wrote: »Can you see why they would think that a low corporate tax rate is stealing from their pockets when the country has just about enough money to do it for a few months ?

No, because they are free to set their corporation tax rates the same or lower than ours. In the present circumstances, increasing our rate will not increase our revenue - it would in fact be the reverse.

As John Bruton pointed out on RTE radio this lunchtime, low corporation tax rates have been a central plank of our FDI policy since the 50s - before the EU existed. In fact, as you may remember, CT rates for exporting firms and firms in places like the IFSC were 10% until the EU competition authorities said we couldn't distinguish between these types of firm and others. We called their bluff and put all firms on a standard 12.5% rate.0 -

Huh? The income levy and health levy add up to 0.0% of the total tax take? Is this possible or are these "levies" not really "levies"?

The Income Levy is returned under PAYE as an Income Tax, the Health Levy as PRSI.Mad Men's Don Draper : What you call love was invented by guys like me, to sell nylons.

0 -

-

No, because they are free to set their corporation tax rates the same or lower than ours. In the present circumstances, increasing our rate will not increase our revenue - it would in fact be the reverse.

As John Bruton pointed out on RTE radio this lunchtime, low corporation tax rates have been a central plank of our FDI policy since the 50s - before the EU existed. In fact, as you may remember, CT rates for exporting firms and firms in places like the IFSC were 10% until the EU competition authorities said we couldn't distinguish between these types of firm and others. We called their bluff and put all firms on a standard 12.5% rate.

Explain to me how this keeps a business in the country long term and why unemployment is now at an all time record high ?

Tax Breaks only work in the short term, its been proven over and over again:

http://www.chron.com/disp/story.mpl/business/steffy/6672097.html

The Netherlands for example has a tax incentive to draw in Foreign knowedge workers which creates a large pool of skilled people to work, this works for a limited period of time but you get a rotation of workers in that time period.

At the moment a large company in the Netherlands is hiring workers through an agency based in Dublin at about 100 workers per month simply because those skilled workers cannot find jobs in Ireland (that and the Dutch won't work shift) or its financially better for them to work in the Netherlands, with a better quality of life.

What company is going to come to Ireland to create jobs if there is a lack of local talent because all of the tax burden is being placed on the individual?

If anything the companys core function will be outside Ireland and its financial function i.e. pushing money through the country will create relatively minimal employment.

In the meantime the there is little to no investment in infrastructure during all these cuts and levies.

You cannot get a train from Dublin, the capital city of the country to anywhere.

Its like renting a luxury apartment that has no toilet.

My other point is that the public feeling in the other EU Countries that contribute to the EU funds is that Ireland is a recipient of EU funds, it has a massive deficit and while it has a plan to plug the hole in that deficit, there is no confidence in that happening (as displayed by the markets) without an EU bailout.

Thats the public perception anyway.0 -

keithclancy wrote: »Explain to me how this keeps a business in the country long term and why unemployment is now at an all time record high ?

The topic of the thread is whether having a low corporate tax rate is an unfair advantage to us. Whether or not it is an advantage, it is self-evidently not unfair, as other countries have an absolute right to set their rates to whatever they like.keithclancy wrote: »You cannot get a train from Dublin, the capital city of the country to anywhere.

What a lot of nonsense, in keeping with all your other fact-free sweeping generalisations. I live in Westport - hardly a huge metropolis - and there is an excellent service with five modern, comfortable trains a day in each direction.0 -

The topic of the thread is whether having a low corporate tax rate is an unfair advantage to us. Whether or not it is an advantage, it is self-evidently not unfair, as other countries have an absolute right to set their rates to whatever they like.

I like the way you just swept over everything in my post.What a lot of nonsense, in keeping with all your other fact-free sweeping generalisations. I live in Westport - hardly a huge metropolis - and there is an excellent service with five modern, comfortable trains a day in each direction.

How is that a sweeping generalisation ... there is no train from Dublin Airport ?

In short, yes it is an unfair advantage because the country cannot pay its debts and now the other countries have to chip in to pay them for Ireland after already chipping in to develop its infrastructure.

On the other hand its seen as a cash cow, but in the long term it doesn't develop a healthy economy, just a false one as per my post above.0 -

The selfishness of this government is actually hard to describe. The IMF is now here in Dublin, checked into the Merrion Hotel and are starting work in the morning.

This evening, Brian Lenihan and also Batt O' Keefe, have made it their business to come out in front of TV camera's and state that UNDER NO CIRCUMSTANCES, will our precious Corporation Tax rate be changed or interfered with.

This is breaktaking I think. Has any government minister come out and stated that people like those on the dole or on state pensions will be protected from homelessness, should savage upcoming cuts in their already meagre income push them over the threshold of their hall door and out onto the streets?

Has any government minister come out today and said that kids with disabilities and special needs will be protected from the savage health cuts that we have already been told are on the way?

As we all know well, no they have not.

But two government ministers have come out to assure what are in the following cases, the wealthiest organisations on the earth such as Microsoft, Intel, Google, IBM, etc, that we will not ask for another penny from them.

Figure that out if you can.

The argument that MNC's will up tools and leave if we up CT is utterly defective for the following reasons:

(1) Even if we were to increase our CT rate to 15%, where would these MNC's then decide to move to, in order to get a lower CT rate??? We would still be one of the lowest CT rates at 15%...

(2) If our 12.5% CT rate is so critical to our economy, so important for job creation, then explain how on earth we have half a million people on the dole/umemployed and tens of thousands emmigrating every year???

(3) Germany has a CT rate of 30%, their economy enjoys stable controlled, prolonged growth. They are good at what they do, they are a business nation, they are a manufacturing and design powerhouse of the world. Yet we say that we cannot do anything here unless we throw an artifically low CT rate of tax at foreign businesses to come here and do our entrepreneurial heavy lifting for us. Something doesn't add up here, and it's pretty obvious that you do not need a stupidly low CT rate in order to build a successful economy with low unemployment.0 -

Advertisement

-

HellFireClub wrote: »(1) Even if we were to increase our CT rate to 15%, where would these MNC's then decide to move to, in order to get a lower CT rate??? We would still be one of the lowest CT rates at 15%...

Part of our economic policy has been a commitment to stable and low corporation tax, by starting to increase it we destabilise that expectation. Also Germany doesn't want our Corp Tax nudged up a % or 2, it wants it upped to something more akin to the EU average.HellFireClub wrote: »(2) If our 12.5% CT rate is so critical to our economy, so important for job creation, then explain how on earth we have half a million people on the dole/umemployed and tens of thousands emmigrating every year???

The MNC portion of our economy is the only bit performing at the moment, its the sole reason we are not much worse off. It employs and supports employment for @300k people. The MNC part of our economy can do its bit, but it can't drive growth when the domestic economy is utterly ruined. MNCs are hiring, exports are growing, our Balance of payments is moving into surplus.HellFireClub wrote: »(3) Germany has a CT rate of 30%, their economy enjoys stable controlled, prolonged growth. They are good at what they do, they are a business nation, they are a manufacturing and design powerhouse of the world. Yet we say that we cannot do anything here unless we throw an artifically low CT rate of tax at foreign businesses to come here and do our entrepreneurial heavy lifting for us. Something doesn't add up here, and it's pretty obvious that you do not need a stupidly low CT rate in order to build a successful economy with low unemployment.

Germany has a huge installed industrial base, that can't easily be relocated and as such it can reap good returns from a higher Corp Tax, we have no such installed industrial base, nor the ability to grow one. Germany has historically always been a manufacturing powerhouse.0 -

90% of our exports are by Foreign owned Companies so they are very important to us. This bail out will affect our International reputation. We should hold onto any advantages we do have at the minute and Corporation Tax and our tax laws are one of those.

Mad Men's Don Draper : What you call love was invented by guys like me, to sell nylons.

0 -

Part of our economic policy has been a commitment to stable and low corporation tax, by starting to increase it we destabilise that expectation. Also Germany doesn't want our Corp Tax nudged up a % or 2, it wants it upped to something more akin to the EU average.

Maybe you haven't noticed, but our economic policy has been a complete and utter failure. We are a bankrupt country that the IMF have only landed in today, we cannot borrow on financial markets, we are a laughing stock of the world.The MNC portion of our economy is the only bit performing at the moment, its the sole reason we are not much worse off. It employs and supports employment for @300k people. The MNC part of our economy can do its bit, but it can't drive growth when the domestic economy is utterly ruined. MNCs are hiring, exports are growing, our Balance of payments is moving into surplus.

MNC's are pulling out of Ireland because even our super dooper 12.5% CT rate isn't enough to keep them here anymore.Germany has a huge installed industrial base, that can't easily be relocated and as such it can reap good returns from a higher Corp Tax, we have no such installed industrial base, nor the ability to grow one. Germany has historically always been a manufacturing powerhouse.

We have an industrial base that cannot be just dug up and transplanted into another country, for example semiconductor fabs, relocating these type of production facilities is not done lightly, they cost billions to build. Also, many of these organisations would have to repay substantial grants if they decided to leave over an increase in the CT rate, so a lot of this waffle about upping and leaving if CT is raised is just a load of hot air.

All I'm trying to say is that we should NEVER tolerate a situation to arise in this country again whereby we are having ANY industry, group of industries or vested interest, dictating to us as to what is best for them and not us.

It is alarming that ministers of this government are literally queuing up to defend our CT rate, and they have absolutely nothing to say to people who will be impacted in a very very real way when this budget is delivered.

Some of the organisations making threatening demands in relation to the CT rate are the weathiest entities on earth. We should be asking ourselves what is going on when our government ministers are queuing up to pander to these organisations. It's not good enough that we cannot even have a decent figure based discussion on CT, without being constantly threatened, these businesses do not even want us to be allowed to have a dicussion on raising our CT rate.0 -

HellFireClub you say you are't for a major increase in this tax and that you just wanted to say that it shouldn't be off the table.

TBH from the past couple of pages, it is clear your sole agenda is to argue for an increase in this tax.

Misleading starting point and you've yet to provide any evidence that increasing it won't drive business away.

If businesses are already leaving despite it been low then you must concede that increasing it just gives companies more incentive not less to leave?0 -

HellFireClub wrote: »Maybe you haven't noticed, but our economic policy has been a complete and utter failure. We are a bankrupt country that the IMF have only landed in today, we cannot borrow on financial markets, we are a laughing stock of the world.

Thats due to other disasterous policies, our low Corp Tax and huge FDI from large MNCs is one of the few success stories in our economy now.HellFireClub wrote: »MNC's are pulling out of Ireland because even our super dooper 12.5% CT rate isn't enough to keep them here anymore.

Thats simply not true, MNC employment numbers remain static even through the recession. What you see are unskilled manufacturing jobs such as Dell, Chubb etc. leaving, and being replaced by service based MNCs such as Google, Ebay, Facebook, Kelloggs etc.HellFireClub wrote: »We have an industrial base that cannot be just dug up and transplanted into another country, for example semiconductor fabs, relocating these type of production facilities is not done lightly, they cost billions to build. Also, many of these organisations would have to repay substantial grants if they decided to leave over an increase in the CT rate, so a lot of this waffle about upping and leaving if CT is raised is just a load of hot air.

We have a few companies like Intel, Pfizer etc. that can't up and leave at the stroke of a pen, but we have far more who can - Amazon, Ebay, Microsoft, Facebook, Google, Ingersoll Rand etc etc etcHellFireClub wrote: »All I'm trying to say is that we should NEVER tolerate a situation to arise in this country again whereby we are having ANY industry, group of industries or vested interest, dictating to us as to what is best for them and not us.

It is alarming that ministers of this government are literally queuing up to defend our CT rate, and they have absolutely nothing to say to people who will be impacted in a very very real way when this budget is delivered.

Our Corp Tax rate is a good thing, lowering it would not equal more revenue, it would equal less, I really can't simplify that fact anymore.HellFireClub wrote: »Some of the organisations making threatening demands in relation to the CT rate are the weathiest entities on earth. We should be asking ourselves what is going on when our government ministers are queuing up to pander to these organisations. It's not good enough that we cannot even have a decent figure based discussion on CT, without being constantly threatened, these businesses do not even want us to be allowed to have a dicussion on raising our CT rate.

Indeed they are, but they are not Irish nor do they owe us anything, the only performing part of our economy is currently based on these MNCs, only around 1m people pay tax in this country and getting on for one third of them work for the companies we are talking about.0 -

90% of our exports are by Foreign owned Companies so they are very important to us. This bail out will affect our International reputation. We should hold onto any advantages we do have at the minute and Corporation Tax and our tax laws are one of those.

Yeah that sounds familar that strategy. I think we now refer to it as, "having too many of your eggs in one basket"... Our first priority should be restoring a viable tax base and start dismantling what has been a failed policy framework in relation to taxation.

For the same reason why we should start dragging all those low paid workers into the tax net where they should have been all along, we need to stop trying to people please everyone and stop trying to convince the rest of the world that we are some sort of economic wonderworld where the usual rules of taxation can be set aside and that a the same time we can still be an economic marvel. Our low tax framework has been proven to be something that shouldn't be touched with a bargepole. We need to stop trying to play fancy football and basically show off, and go back to basics, which is matching expenditure with income. This means reducing expenditure and increasing income...0 -

HellFireClub you say you are't for a major increase in this tax and that you just wanted to say that it shouldn't be off the table.

TBH from the past couple of pages, it is clear your sole agenda is to argue for an increase in this tax.

Misleading starting point and you've yet to provide any evidence that increasing it won't drive business away.

If businesses are already leaving despite it been low then you must concede that increasing it just gives companies more incentive not less to leave?

The whole approach is what bothers me. We appear to have learnt absolutely nothing here. Sending the wealthiest companies on earth a message that they are completely untouchable in terms of our critically serious budgetary situation, while cutting the poorest people in the state, it's disgusting, there is no other word for it.

There is a serious moral hazard in dealing with vested interests on this basis...0 -

-

HellFireClub wrote: »Sending the wealthiest companies on earth a message that they are completely untouchable in terms of our critically serious budgetary situation, while cutting the poorest people in the state, it's disgusting, there is no other word for it.

The simple fact is alot of these companies are only here for our low Corp Tax rates, EU Membership and dual taxation agreements. We can't ease our budget deficit by taxing them as they can and will leave for other places.0 -

Advertisement

-

HellFireClub wrote: »

We have an industrial base that cannot be just dug up and transplanted into another country, for example semiconductor fabs, relocating these type of production facilities is not done lightly, they cost billions to build. Also, many of these organisations would have to repay substantial grants if they decided to leave over an increase in the CT rate, so a lot of this waffle about upping and leaving if CT is raised is just a load of hot air.

All I'm trying to say is that we should NEVER tolerate a situation to arise in this country again whereby we are having ANY industry, group of industries or vested interest, dictating to us as to what is best for them and not us.

It is alarming that ministers of this government are literally queuing up to defend our CT rate, and they have absolutely nothing to say to people who will be impacted in a very very real way when this budget is delivered.

Some of the organisations making threatening demands in relation to the CT rate are the weathiest entities on earth. We should be asking ourselves what is going on when our government ministers are queuing up to pander to these organisations. It's not good enough that we cannot even have a decent figure based discussion on CT, without being constantly threatened, these businesses do not even want us to be allowed to have a dicussion on raising our CT rate.

Industry is actually the first sector that will up and leave for lower cost economies.Mad Men's Don Draper : What you call love was invented by guys like me, to sell nylons.

0

Advertisement