Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

The MAJOR property crash is coming

Options

Comments

-

The fact is you should have had your crash already, and the fact that you haven't is only the product of government intervention.0

-

Its a nice theory but iv seen a lot of people abandon there homes to emigrate. I know one couple renting, only to be told by the bank, that the landlord they were paying hadn't payed the mortgage in over a year and the rent was starting them in Australia. Anyone who gets to pay a 2008 size mortgage after the IMF money runs out will have won the lotto. It wont come from working as a slave.

Well its not so much a theory as my simplistic understanding as to what happened in the UK & Japan in their slumps a couple of decades ago.

I must be living in the wrong areas but unlike you I havent seen anyone (never mind lots) abandon their home to emigrate but yes I am sure it happens.

So I will go with your experience and if thousands of families emigrate and abandon properties then the economy crashes into depression, industry/employment stops, population drops and what remains of the banks collapses to zero. The country becomes a ghost land those who are left are either poverty stricken or are rich. So who is going to buy the properties? - not the ordinary man/woman he has no income at all and not the rich as there is no return on their investment.

So my point remains that the house market stops - the houses may be being offered at lower values but there is no one to buy them! Squatting may become the lifestyle choice!

We have had the hard landing with regards to property the next stage if the economy doesnt improve goes way beyond house prices falling indeed is much more serious - a full blown depression, poverty and a third world living standards.0 -

Note to anyone wondering what house prices might do in the next 12 months:

(i) There is nothing in this thread to suggest the MAJOR house price collapse is on the way.

(ii) House prices have already fallen by 60% from peak. No matter what way you cut it, even if house prices go down all the way to zero, the major part of the house price decline has already taken place.

agh , a sort like ''we have turned the corner ''

did i hear that somewhere before ?0 -

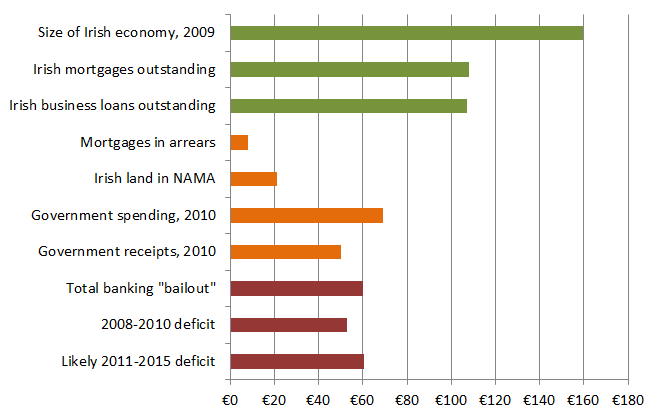

Those graphs are incredible. Though it must be pointed out that double income families have increased a lot since the 80s and play a huge role in inflating house prices.0

-

property prices might drop, but HOUSE prices won't

there ARE houses selling all over the country and that market is bottoming out

the problem is the rediculous amount of apartments in the middle of nowhere, where you have to run a car if you're going to live there eg. Sandyford, Stepaside, Belarmine.0 -

Advertisement

-

the OP is absolutley correct , property has a long way to fall yet , property is becoming toxic , even those who can afford to buy wont as thier is a serious deterrant with the introduction of a property tax , part of the reason prices went so high during the boom was due to the phenomenon of people owning more than one property , taxes on second and third homes are likely to be punaitve , thier is plenty of political capital to be made from coming down hard on the likes of frank fahey , therefore the wealthy wont touch property no matter how cheap it is

we are in an anti real estate era now , kids will grow up witnessing thier parents struggling with huge mortgages , the age old irish obsession with property could be at an end or at least a serious mindset shift0 -

sandyford is the middle of nowhere??0

-

Add this to the list of reasons why the major crash is cominghttp://www.boards.ie/vbulletin/showpost.php?p=69339504&postcount=19

THE IRISH REFORMATION

1. lowering of income tax bands and credits by 10% to yield an additional €945m in 2011 and an extra €300m in a full year

2. reduction in pension tax relief and pension related deductions

3. Social Protection expenditure reductions

4. reduction of PS employment numbers in 2011

5. reduction of existing PS pensions on a progressive basis averaging 4%

6. reduction of at least €1,800m in public capital expenditure against existing plans for 2011

7. extension of NAMA to a further €16bn of land and development loans in AIB and BOI

8. further reductions in the size of the banks

9. government to divest itself of bank participation as quickly as possible

10. minimum wage levels down by €1.00/hour

11. removal of restrictions to trade and competition in sheltered sectors - including the legal profession (implementing the recommendations of the Legal Costs Working Group), medical services (eliminating restrictions on the number of GPs qualifying) as well as restrictions on advertising and treating public patients, and the pharmacy sector - ensuring the elimination of the 50% markup under the Drugs Payment Scheme is enforced

12. looking at removing the cap on retail premises size

13. indexation of PS pensions, basis of pensions to be average career salary, new PS entrants to see a 10% pay reduction

14. banking regulation and supervision to be strengthened

15. reform of personal insolvency regime, including sole traders

16. retention of means-tested mortgage interest supplement scheme

17. agreement by AIB and BIO to provide targeted lending of €3bn each for SMEs in both 2010 and 20110 -

Potential for major damange.0

-

People saying the market is bottoming out are living in lala land.

Banks can't lend even if they wanted to as they are overexposed on lending as it is and are now being monitored to ensure they don't do anything stupid.

Potential borrowers won't borrow as they are afraid of what is to come and the banks will be harder on testing to see can people make repayments. Also the general opinion is that house prices will continue to fall so people are holding off.

People are leaving the country and many that aren't are loosing their jobs.

And this is before we look have waves of repossessions that are shortly coming as many people have not been able to pay off their mortgages for a long time already and eventually the banks do have to repossess the houses to try to regain some of their money and banks won't hold on to property to see its long term economic value.

NAMA properties will come online as it is paying developers to finish ghost estates so our already massive oversupply is actually getting bigger again.

In the future, I see a two-tiered housing market. The fire-sale houses will be those built in the boom as they have poor energy ratings which will have to be displayed when they are sold and this will be a beacon that it is a house built during the boom and that the people selling probably have high mortgages they are struggling to afford and want out. The only way around that will be if those people invest in upping the energy rating which many will not be able to afford to do.

The newer houses built to newer standards (that should have been introduced before the boom in the first place and were being discussed at the time but FF never bothered), will sell at much higher prices but still closer to market rates.

What people have to be aware of too is that there is no appetite for owing a house with the next generation as they see the ball and chain it is for their brothers/sisters/parents so they will have no problem simply not buying to avoid that issue. That and people are moving jobs more so it makes less sense to buy a house in an area as it ties you down to an area you will probably not be working in for the rest of your life.

Seriously how can anyone suggest the housing market will recover within the next 5 years given the above?0 -

Advertisement

-

Seriously how can anyone suggest the housing market will recover within the next 5 years given the above?

Well I dont see anyone on this thread suggesting the housing market will recover in 5 years.

It seems to me that you are missing the point, the biggest falls in property prices have already occurred in terms of the monetary value and that money will not be recovered without say 10-20 years of economic growth.

The next stage in a collapsing economy goes way beyond the price of your precious house - the housing market become irrelevant . A further economic downturn will be full blown depression with mass emigration, poverty and starvation - not sure why you are so fixated on property?0 -

The biggest falls in property prices have already occurred in terms of the monetary value

Why?

Where?The next stage in a collapsing economy goes way beyond the price of your precious house - the housing market become irrelevant . A further economic downturn will be full blown depression with mass emigration, poverty and starvation - not sure why you are so fixated on property?

The impending property crash is what will drive the country into depression.

Have you read the thread?0 -

Its scary to think about but its one possible path. The truth is that in 4 years we wont have anyone to bum money off. Unless FG & Lab can pull a very big rabbit out of a very small hat were up the creek. We badly need to increase employment. If we still have so many unemployed in 4 years & the crazy debt[that we will have] no bond market will touch us. Its time we started living on our tax take, in many country's civil servants get perks like houses. In our current situation with the government effectively owning every house & mortgage, things like this could reduce wages & lessen our need for cash?Well its not so much a theory as my simplistic understanding as to what happened in the UK & Japan in their slumps a couple of decades ago.

I must be living in the wrong areas but unlike you I havent seen anyone (never mind lots) abandon their home to emigrate but yes I am sure it happens.

So I will go with your experience and if thousands of families emigrate and abandon properties then the economy crashes into depression, industry/employment stops, population drops and what remains of the banks collapses to zero. The country becomes a ghost land those who are left are either poverty stricken or are rich. So who is going to buy the properties? - not the ordinary man/woman he has no income at all and not the rich as there is no return on their investment.

So my point remains that the house market stops - the houses may be being offered at lower values but there is no one to buy them! Squatting may become the lifestyle choice!

We have had the hard landing with regards to property the next stage if the economy doesnt improve goes way beyond house prices falling indeed is much more serious - a full blown depression, poverty and a third world living standards.0 -

Well its not so much a theory as my simplistic understanding as to what happened in the UK & Japan in their slumps a couple of decades ago.

I must be living in the wrong areas but unlike you I havent seen anyone (never mind lots) abandon their home to emigrate but yes I am sure it happens.

So I will go with your experience and if thousands of families emigrate and abandon properties then the economy crashes into depression, industry/employment stops, population drops and what remains of the banks collapses to zero. The country becomes a ghost land those who are left are either poverty stricken or are rich. So who is going to buy the properties? - not the ordinary man/woman he has no income at all and not the rich as there is no return on their investment.

So my point remains that the house market stops - the houses may be being offered at lower values but there is no one to buy them! Squatting may become the lifestyle choice!

We have had the hard landing with regards to property the next stage if the economy doesnt improve goes way beyond house prices falling indeed is much more serious - a full blown depression, poverty and a third world living standards.

Its scary to think about but its one possible path. The truth is that in 4 years we wont have anyone to bum money off. Unless FG & Lab can pull a very big rabbit out of a small hat were up the creek. We badly need to increase employment. If we still have so many unemployed in 4 years & the crazy debt[that we will have] no bond market will touch us. Its time we started living on our tax take, in many country's civil servants get perks like houses. In our current situation with the government effectively owning every house & mortgage, things like this could lessen our need for cash?0 -

Dannyboy83 wrote: »:rolleyes:

Thanks for that.

I'm referring to a MAJOR crash, as Morgan Kelly has alluded to, i.e. houses being bought and sold for Ca$h

Doubt the NAMA stuff will be released tbh.

Although there will be colossal losses made on it either way.

I agree with the OP, the property market is a mess and getting worse by the day. Firstly there is little if any mortgages being given or applied for. Secondly prices have plummeted and there seems be no sign of the values decreasing or stabilizing, even beyond what was described as inflated prices. Thirdly the mortgage crisis is about to implode with large scale repossessions envisaged next year. I sincerely believe the current amount of mortgage is arrears has been masked by forced forbearance on behalf of the banks, coupled with people cashing in on mortgage payment protection insurance policies which are about too dry up (normally pay out for 12 months). Some might argue this does not impact on the market? i would beg to differ as the impact will severely curtail any possibility of banks offering mortgages, as it is some are loosing their shirts on trackers.

Notwithstanding the above, the banks are in ****e, some have already exited the mortgage sector and the dogs on the street know they are avoiding new mortgage business like the plague.

You only have to take an occasional look in auctioneers windows to see ZERO movement or sales and massive reductions in asking prices.

I susepct another bailout when the mortgage crisis hits the fan!Is maith an scáthán súil charad.

0 -

Dannyboy83 wrote: »Why?

Where?

The impending property crash is what will drive the country into depression.

Have you read the thread?

Yes I have read the thread and I probably have a more pessimissitic view of the economy than you! We have moved beyond the property crash into the question of can the real economy recover or survive?

You questioned how the majority of the monetary value has already been lost even your sources illustrate that. The graph on property values 2006 - 2008 show a 30% + drop. Everybody knows the fall in prices has continued unabated with even conservative estimates say 60% drop from the peak. A 350,000 euro house in 2006 is now worth 140,000 a fall of 210,000. Even a fall of 100% to zero would be be less than the monetary value already lost!!

As I have said the property market has stopped, its dead! If they cant sell flats in Donegal for the price of a second hand car and yet you cant buy a decent family home in Galway City for 150,000 then the market is dead. Any values are theoretical.

The element of the economy relating to property and construction is gone, there is no property based industry left - we are now reliant on the 'real' economy - the source of the average industrial wage that you refer to.

If the real economy shrinks then we enter depression and a third world economy. Those left will be able to walk into abandoned houses - something I think should already be happening BTW.

I fully agree with the graphic titled "the bigger the boom, the bigger the bust" except it is clear we are already well down the 'capitulation' slope which shows that there is no bigger crash to come just a continued slide.

So my point is we have moved on from property prices being the cause of economic crisis(we all know that) to the hope that manufacturing, agricultures and services can save us. Otherwise the next decade will make the 1930's look like the halcyon days.0 -

After all the messing the government has done with the banks ,we haven't really seen them trying to stand on their own too feet.

If the government are relying on an exodus to stablise the economy ,who's going to buy anyways ?

Houses will be dead money for a long time to come ,so I can't see people investing either.0 -

Will there be a value where foreign speculators become interested? Theoretically there should be as they will have lots of Capital and the pick of the litter when it comes to location.

The actual value of what is for Sale.......By international standards Irish places were built to very high standards with expensive finishes and materials.....At some point the value of what the building is actually made of will mean that the value offered by the price will be an opportunity for those well placed to take advantage.

The return of normal valuation to the Irish market. During the boom times you could buy a palace and a pile of dog poo and you would be expected to pay the same for both. The actual value of what was for sale did not match the price, and prices were not distributed as you would expect in a normal market. With the recession, this has somewhat returned, but there is probably more to come.

Don't mistake me as an optimist here, I'm just trying to read what may come of the market in the future, the above conditions will eventually be met, it's just a matter of when.0 -

-

Looks like i'll be better off losing my house with mortgage and buying one for a fraction of what i owe for cash, in my wife's name.....:pac::pac:0

-

Advertisement

-

We are nowhere near the bottom, with all the extra taxes we have got, their is no way we can afford property at its current level and thats not counting in a forecast increase in interest rates...

Nama is currently holding on to huge amounts of development, that has to at some stage hit the market, or at least hit the rental market and when that happens prices will drop once again0 -

Remembered an article from the Mayo News from last summer. (9 August 2010). Managed to locate it. Possible drop from peak to trough of 90% in property values.

Link: http://www.mayonews.ie/index.php?option=com_content&view=article&id=10514:property-prices-predicted-to-fall-90-per-cent&catid=23:news&Itemid=46Property prices predicted to fall 90 per cent

Castlebar economic forum told worst is yet to come

A large gathering in The Linenhall in Castlebar were last week told by leading financial analyst Nicole Foss that the historical evidence suggests that the current bounce in the Irish economy is only a temporary reprieve.

Ms Foss, regarded as one of the world’s foremost authorities on financial bubbles, was the keynote speaker at the Community Solutions to the Global Economic Crisis meeting, which was attended by large numbers from all over the country. She is former editor of ‘Oil Drum’ and founder of financial analysis blog ‘The Automatic Earth’.

During her hour-long presentation, Foss argued that financial bubbles are predictable in nature: The initial phase of investment yields high benefits for the first entrants, but the subsequent yield for later investors gradually falls, until eventually any remaining investors are left holding ‘an empty bag’ of worthless assets. By this point all credit has dried up as successive lenders get their fingers burnt. Finally investors attempt to flee the market.

There is always only one outcome, says Foss: a rapid deflation of the bubble.

The collapse of the Irish housing bubble has followed this path, but there was disbelief among those present when Foss said that the value of property would fall by an average of 90 percent from its highest point.

Her assertion was illustrated by graphs depicting the trajectory of historical financial bubbles – the key message being that the finishing position in terms of worth, was always lower than the original starting point. Or as Foss put more bluntly: ‘The scale of the hangover is always proportional to the size of the party that preceded it’.

Foss also explained the recent ‘green shoots’ phenomenon, which she described as ‘gangrene’. She pointed out that all previous financial crashes had exhibited some element of bounce or rebound, usually quite early on, before the final precipitous descent set in. This bounce phase has been evident in many countries, including Ireland, over the last few months. However, Foss warned there were many signs that the second, more serious deflationary phase was now gathering momentum, both at domestic level and globally.

Having spent the bulk of the presentation describing the nature of the financial bubbles, Foss then moved onto possible remedial actions for local communities. She emphasised the importance of strengthening community, maintaining good health, reducing existing debt and learning useful post-crash skills.

A question and answer session followed the talk. Questions were fielded by Foss, Mark Garavan of Feasta and GMIT Castlebar, sustainability strategist Michael Layden of Arigna and the North West Group, and Andy Wilson, secretary of the Mayo Sustainability Forum, who organised the event.

The Mayo Sustainability Forum plans to hold a follow-up event - ‘Where do we go from here?’ - during the autumn.

This event will examine in detail some of the specific steps that local communities (and the individuals within it) can take. It will cover debt reduction, investment strategies, re-skilling, enhancing communication, sharing information, community education, initiating community projects, resilience building and how to best utilise local resources.0 -

Guys, this is a great thread! It's a good read! Thanks a lot.

Here's my plan, I'm 31 now, I never bought into the whole property bubble and have been waiting for the big crash which this thread is alluding to for a long time. Working in the private sector (IT) in Dublin during the boom was really hard, I could just about afford to live but there were no real prospects of getting any good future, I always thought that it was unresonable that an Engineer could just barely get buy so I started to make plans to move around 2008.

I finally managed to get a decent Job abroad at the end of last year, and I left.

I reckon that due to ECB intervention the prices will fall steadily for about 10 years or so. So I'm hoping to save as much money as possible and buy some cheap places in good areas back home in about 10 years or so.

I figure that in ~15 years a new generation will start working and the economy will start picking up again, so I'm going to hold out till then.0 -

Don't think it will be 10 years, freaking hope not anyway.

I believe we will get another sharp fall in the 2-3 years as people can't help but default with climbing interest rates and the state can't afford to bail them out or prop up the market any longer.0 -

There is another angle people are not considering

Prices might actually stay at the same level (lets say 200,000 average) but the euro itself becomes less valuable due to all sorts of money printing (our central bank is already at it)

what I am trying to say keep and eye on nominal prices vs real..

this is somewhat what happened in UK, prices barely moved downward but the sterling itself got more devalued0 -

Its a stickler if buying for the first time or moving. If currently holding a mortgage and living within means, as I currently am, its not so bad.

I don't get the following though:

Is this saying that 7,261 people took out mortgages totalling €1.2m???Just 7,261 people took out a mortgage in the three months at the end of the summer, compared with almost 55,000 for the same three-month period at the height of the housing boom in 2006.

====

The value of the mortgages drawn down in July, August and September of this year was just €1.2m. This compares with €11bn in the third quarter of 2006

What does "drawn down" mean?0 -

Its a stickler if buying for the first time or moving. If currently holding a mortgage and living within means, as I currently am, its not so bad.

I don't get the following though:

Is this saying that 7,261 people took out mortgages totalling €1.2m???

What does "drawn down" mean?

The figure quoted was million, but it was probably a typo in the article.

A 90% collapse from 11billion is €1.2billion approx.

€1.2 million would be more like a 9000% collapse.

(That means the average mortgage taken by those 7,261 people was €165,000 - which tells you something about the 'real' value of property, as opposed to asking prices)0 -

There is another angle people are not considering

Prices might actually stay at the same level (lets say 200,000 average) but the euro itself becomes less valuable due to all sorts of money printing (our central bank is already at it)

what I am trying to say keep and eye on nominal prices vs real..

this is somewhat what happened in UK, prices barely moved downward but the sterling itself got more devalued

Since I initially wrote this thread, there have been a lot of small developments and a few big developments.

End of the 12 month moratorium on house repossessions, Insurance companies hiking prices (VHI 45%, Aviva 15%) etc.

All of this stuff will of course contribute to the wave of mortgage defaults.

The big development tho, imo, is the fuel crisis.

Petrol is currently at €1.50 per litre and predicted to hit €1.60 per litre within the next few months.

As you said above, house prices may stay the same, while the Euro collapses in value.

A Euro collapsing in value means fuel is going to surge in cost, to the stage that we will be nostalgic about when we used to pay €1.60 per litre.

As people abandon petrol cars and switch over to diesel, the consumption charge on diesel has to be increased.

This is heavily inflationary as tractors, trucks etc. are generally diesel run.

I spoke to a few people lately who remembered the fuel crisis in the 70s, they assured me that you could barely give away rural houses during this time.

I guess if we continue along this trend with fuel, we are going to see a slightly different scenario emerging, which would see urban houses, especially in the major cities, hold their value or even climb in value.

And rural houses will utterly collapse in value.

It's not far fetched to imagine a scenario in a few years where rural people would pay more for fuel per month than the actual mortgage on their house.0 -

Dannyboy83 wrote: »Since I initially wrote this thread, there have been a lot of small developments and a few big developments.

End of the 12 month moratorium on house repossessions, Insurance companies hiking prices (VHI 45%, Aviva 15%) etc.

All of this stuff will of course contribute to the wave of mortgage defaults.

The big development tho, imo, is the fuel crisis.

Petrol is currently at €1.50 per litre and predicted to hit €1.60 per litre within the next few months.

As you said above, house prices may stay the same, while the Euro collapses in value.

A Euro collapsing in value means fuel is going to surge in cost, to the stage that we will be nostalgic about when we used to pay €1.60 per litre.

As people abandon petrol cars and switch over to diesel, the consumption charge on diesel has to be increased.

This is heavily inflationary as tractors, trucks etc. are generally diesel run.

I spoke to a few people lately who remembered the fuel crisis in the 70s, they assured me that you could barely give away rural houses during this time.

I guess if we continue along this trend with fuel, we are going to see a slightly different scenario emerging, which would see urban houses, especially in the major cities, hold their value or even climb in value.

And rural houses will utterly collapse in value.

It's not far fetched to imagine a scenario in a few years where rural people would pay more for fuel per month than the actual mortgage on their house.

And thats when they start voting for politicians who might remove/lower all those silly taxes on fuels,

as discussed in a parallel thread 2/3rds of the fuel price is tax (tax which goes up more than the underlying fuel),

strip this away and the average person can then absorb a 3x increase from todays high fuel prices

Anyways high fuel prices would hit everyone including the city dwellers who have to get their food from somewhere...0 -

Advertisement

-

And thats when they start voting for politicians who might remove/lower all those silly taxes on fuels,

as discussed in a parallel thread 2/3rds of the fuel price is tax (tax which goes up more than the underlying fuel),

strip this away and the average person can then absorb a 3x increase from todays high fuel prices

Anyways high fuel prices would hit everyone including the city dwellers who have to get their food from somewhere...

Good luck finding anyone willing to do that, all the politicians and MoF bods see is an increase in revenue as fuel prices increase, they are too myopic to see that the high cost of energy in this country is going to cripple us even further, just as long as the freakshow has enough cash to stumble a little further down the road they will be happy.

At least the Greens will not be in power over the next few years, those limp wrists would probably applaud the cutting of our carbon footprint by the enforced fuel poverty placed on the population by excessive taxation while at the same time trying to ram their badger tax through the Dail.0

Advertisement