Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

DAFT report - less than 2000 homes to rent in Dublin!

Options

Comments

-

Are you saying individuals are paying 1100 a month or are they sharing with others?

Those individuals if they exist in said numbers have to have the usual solid job, solid savings record, no debts or bad credit record and substantial deposit ready.

Source for 10% unemployment rate? By the way emigration has decimated the 15-30 age group.http://www.cso.ie/en/media/csoie/releasespublications/documents/population/2012/popmig_2012.pdf

Source for 4th highest salaried city in Europe?

Most people dont have that so must stay renting, keeping supply tight.

But there are a lot of people who do have the means too and these are the ones that can take advantage.

I wonder are there figures on that 15 - 30 demographic in Dublin.

The rest of the country is a basket case and will remain so for a long time. I think Dublin is the only place where there is going to be big economic activity or immigration for years to come. Good news for anybody looking to buy a nice big cheap house down the country in the years to come.0 -

liffeylite wrote: »some interesting points here. the obvious problem with Dublin when compared to say the UK market, is that because prices have fallen so hugely you would expect rents to fall in a similar pattern.

this hasn't happened at all.

so if you buy an apartment for 100k, or even 80k as a repossession as mentioned in the post above. if you can then rent out that flat for 800 euros a month, you have a fantastic profit margin!

in the uk, if a flat was worth 100k in say Manchester city centre, the rental value would be in line with an average 25yr mortgage payment. so around 450 quid a month.

however in Dublin, this same property valued at 100k will rent for 1000 euros a month! totally out of kilter.

I actually think that when a bank enters the irish market that is cash rich and actually lends to people, house prices will go up pretty quickly because there has to be thousands of people in Dublin that could afford a repayment mortgage of say 700 euro a month but are currently paying 1100 a month to rent a similar property.

the unemployment rate in Dublin is now just under 10% (nationally 14% but this takes into account unemployment rates of 18-19% in parts of the west) Dublin has the lowest unemployment rates in the country and is I believe the 4th highest salaried city in Europe.

provide these people with access to mortgages at a fair level and the bubble starts over again....

Rents did drop for a good few years. But now you have a situation where there are major influences on the supply side. There is huge upward pressure on rents.

I think these things have a huge influence on supply.

People with property arent selling because they think, rightly or wrongly, that prices are at or very near the bottom.

Those who couldnt make their properties wash their own faces before, possibly can now or very close to it, so these will not be selling at this point either. These people could even still be on very cheap trackers.

People renting, who have good deals on rent are more inclined to stay at the moment, because moving will probably mean higher rent.

People renting, who are waiting for the right time to buy, either cant get the finance or are just still waiting because they want prices to go lower.

Properties that were on the RAS scheme are leaving in droves because they can get a lot more rent that the RAS gives. So those, living in them are having to move out and rent at the low end, and will stay in them for fear of having to pay more if they move and RA will be too low. That will suck up all the low value properties.

Then you have

Landlords can now increase rents because the market as a whole is moving up. This allows them to add in the extra taxes and charges that they are paying.

Since supply is tight landlords have no problem letting. They can advertise at an increased price and still get it.

Renters can no longer hold their landlord over a barrel about vacant periods if they leave, so either must leave and take up another property anyway, most likely at the same or higher rent, but they could go for lower in quality and therefore lower rent.

Yields are abnormally high at the moment attracting investors who will snap up any property on the market at the right price. Looks like these are selling at the right price now.

Banks are actually lending, but only to people with money already. Those with money have no competition from Joe public so can go in for the easy pickings.

If you have the ability to get a mortgage you can buy for monthly payments up to half what the rent costs you for some properties. Or the same or less than the monthly payments on an average car.

Rents are still lower than 2000 levels. Thats a long long time ago now.

There is a migration on to Dublin. People are moving where the jobs are.

as an aside, I have a relative who moved up to Dublin instead of commuting from Courtown. Luckily they could commute together. They got rid of one of the cars, which was costing €600 in fuel alone commuting (not including car payments, maintenance, tolls, car tax, insurance, depreciation, which probably come to another couple of hundred a month) and rented a 1 bed apartment for €800, leaving the house in Courtown empty and only for weekends and hols and mnaybe move back someday (they want to keep the house so dont want to sell it. it wouldnt get much anyway). Now they are going to buy a 1 bed apartment because it will only cost them €500 a month in mortgage and they can rent or sell it in the future. They have the deposit already so after that, they are actually saving money month to month and will make back the deposit soon enough.

Savings would be even more if they had of been commuting separately as a lot of couples do.0 -

:rolleyes:

Here we go again.

As usual, lets take Dublin only, because the rest of the country is basket case as far as property is concerned.

Would you agree that yields are very high at the moment? In parts of Dublin

Would you agree that there are repossessions happening at the moment and more to come? a tiny amount are happening

Would you agree that rents are rising? only in part of Dublin (but due to supply being withheld)

Would you agree that property prices are if not still falling, at least not rising very fast? Still falling, every report shows this

Put all of these things together and, even if you have no knowledge or experience of the business, you can get some idea of whats happening.

If you have knowledge and experience of the business you can glean a lot more from this information too.

You still havent answered my main question about this list of bargain properties that are sold at under current market price.0 -

nomoreindie wrote: »You still havent answered my main question about this list of bargain properties that are sold at under current market price.

And I wont be answering it either.0 -

-

Advertisement

-

Sounds like those bargain properties are at Allsop?

Anyway talk of a "cash rich foreign bank" entering has just not happened. We already have cash rich foreign owned banks and they have not entered the mortgage market yet, they obviously don't see the market as lucrative or viable for them.0 -

nomoreindie wrote: »I am not surprised as I feel there is a bit of "Walter Mitty" about you and MMAGirl.

Fair enough. But arent you going off topic.

I already got reeled into a troll trap in another thread and would like to avoid that here if you dont mind.

PM me if you want to discuss anything sensible thats off topic for this thread.0 -

-

Sounds like those bargain properties are at Allsop?

Anyway talk of a "cash rich foreign bank" entering has just not happened. We already have cash rich foreign owned banks and they have not entered the mortgage market yet, they obviously don't see the market as lucrative or viable for them.

There were one or two of their properties I was interested in but the auction aspect put me off. im not good enough at auctions.

I agree on cash rich foreign banks. They are out of the game for a good while to come yet. Risk is a dirty word for banks these days and they will go the opposite way.

Banks will rent to plenty of people at the moment though and that will be those with money in the bank, no negative equity and jobs paying much higher than the average wage.

I think it will be a long time before someone on the average wage will be able to buy property without years of saving and planning. Its another pressure on rental supply.0 -

The lists do exist.

You want proof? Have a look at the property price register, and see how many properties on there that sold weren't advertised for selling.

Employee in a bank is responsible for offloading btls. He knows that Phil has the money, a track record of buying and can close really quickly.

Why would he waste his time or effort with an ordinary joe-soap when he can get a sale quicker by going straight to the likes of Phil.

Say he has 50 contacts who he gives the list to containg 50 properties.

25 are interested and take one each. Now he only has to deal with 25 properties that are being sold by tge bank instead of 50. Have the ordinary joe soaps to deal with and it makes him look good to his superiors, increasing his chances of getting the office in the corner when the manager moves on.

In a way it's like insider trading. Only no penalties.0 -

Advertisement

-

so basically the whole process is corrupt despite public money been sloshed around NAMA/Banks - what a country.My agent got in touch with me yesterday. One of my tenants, on a lease that I was just going to roll over at the current rent, said he wasnt going to pay the current rent anymore and gave an ultimatum. Reduce the rent or he leaves. And he was very aggressive about it, accusing the agent of robbing him and so on.

Agent says they are getting €75 a month more than the tenant is currently paying for the same apartments in the same building.

I've told him to tell the tenant the rent is going up by €75 and to give him notice if hes not happy with that. And just to be sure I went looking at ads and there are none vacant at all in the area, which i havent seen in years. There is definitely short supply. And with extra taxes and rent reductions over the years, rents are still only just getting back to what they were in 2000.

I think there is more upward movements in rents to come.

NAMA wont release property the way people expect them to. As they do, it will be bought by investors until yields go back to more normal levels. For the moment renting is becoming the more popular option for the average person. For a while it was choice, but I think from now on its going to be more the way things just happen to be.

Then eventually building can start again when purchase prices rise enough above building costs, but that is a long long way away.

You can buy apartments now that arent even advertised to the public for €80k and rent them for €800+ . Thats a terrific yield and until that yield reduces, those properties will always be snapped up before they get to joe public.

I get a list of repossessions every month from some contacts I have in the banks. Some of them that I am interested in looking at are already sold when I call their EA about them.0 -

Are you saying individuals are paying 1100 a month or are they sharing with others?

Those individuals if they exist in said numbers have to have the usual solid job, solid savings record, no debts or bad credit record and substantial deposit ready.

Source for 10% unemployment rate? By the way emigration has decimated the 15-30 age group.http://www.cso.ie/en/media/csoie/releasespublications/documents/population/2012/popmig_2012.pdf

Source for 4th highest salaried city in Europe?

my mistake. now the 2nd highest in the world

www.therichest.org/.../the-top-10-highest-average-salary-per-country

the 25 to 35 age group in Dublin which is the prime house buying sector is higher than it has ever been. look at some of the old and new cso stats.

Dublin is a different beast to the rest of the country and a bank that played its cards right and entered the market strategically would make good profits from dublin. the problem is the market of Ireland is too small to catch the radar of internationals.

but investors can see the benefits and they are increasing in numbers.0 -

liffeylite wrote: »my mistake. now the 2nd highest in the world

www.therichest.org/.../the-top-10-highest-average-salary-per-country

the 25 to 35 age group in Dublin which is the prime house buying sector is higher than it has ever been. look at some of the old and new cso stats.

Dublin is a different beast to the rest of the country and a bank that played its cards right and entered the market strategically would make good profits from dublin. the problem is the market of Ireland is too small to catch the radar of internationals.

but investors can see the benefits and they are increasing in numbers.

this is a govt stat from 2011, but figures in dublin have faired even better over the last 2 years. but I cant find the info off hand.

Regional

There is considerable variance in unemployment rates across the country with the highest rate of unemployment currently in the South-East (18.1%) and the lowest in Dublin (11.5%)0 -

-

Once Irish family homes become repossessable we might see some action there. Until then no sane bank will lend into Irish property. Just too risky. German defaulters get repossessed, so long term fixed interest rates of 3% can be had in Germany today.Sounds like those bargain properties are at Allsop?

Anyway talk of a "cash rich foreign bank" entering has just not happened. We already have cash rich foreign owned banks and they have not entered the mortgage market yet, they obviously don't see the market as lucrative or viable for them.0 -

While "Walter Mitty" is hardly the worst name calling, it can only mean the thread descend into retorts and off-topicness. Let's not go there.nomoreindie wrote: »I am not surprised as I feel there is a bit of "Walter Mitty" about you and MMAGirl.

If you have a problem with a post, report it. don't call people trolls.I already got reeled into a troll trap in another thread and would like to avoid that here if you dont mind.

Moderator0 -

liffeylite wrote: »the 25 to 35 age group in Dublin which is the prime house buying sector is higher than it has ever been. look at some of the old and new cso stats.

How do you know the age structure of the Dublin population? I haven't seen it in any of the CSO stats. Its certainly decimated for the country as a whole from the link I posted earlier.liffeylite wrote: »Dublin is a different beast to the rest of the country and a bank that played its cards right and entered the market strategically would make good profits from dublin. the problem is the market of Ireland is too small to catch the radar of internationals.

but investors can see the benefits and they are increasing in numbers.

How do you know? Its quite startling that you think there are good profits to make in Dublin unless you are talking about mega rich investors getting onto the BTL scene?liffeylite wrote: »this is a govt stat from 2011, but figures in dublin have faired even better over the last 2 years. but I cant find the info off hand.

Regional

There is considerable variance in unemployment rates across the country with the highest rate of unemployment currently in the South-East (18.1%) and the lowest in Dublin (11.5%)

So 11.5% in Dublin, still quite a bit high. That link is a bit ambiguous. first they say "average salary", then they say "disposable income" in some of their descriptions. It does not say what their sources are for such a list?0 -

How is it corrupt?

you have access to information from banks (one or more which may be nationalised) that is not available to the public, which gives you an advantage over others in terms of information and decision making.

some of these banks are dependent upon public money to stay in operation yet they are selectively choosing to whom they give information.

should you have access to this information or can anyone ring up the institution in question and access the same info?0 -

you have access to information from banks (one or more which may be nationalised) that is not available to the public, which gives you an advantage over others in terms of information and decision making.

some of these banks are dependent upon public money to stay in operation yet they are selectively choosing to whom they give information.

should you have access to this information or can anyone ring up the institution in question and access the same info?

I am part of the public. I have created a business relationship with people who can give me information that I request. It is up to them whether it is worth their effort to get me this information. There is nothing stopping you from creating the same relationship. If they think you are not just wasting their time they can and will help you out.0 -

I am part of the public. I have created a business relationship with people who can give me information that I request. It is up to them whether it is worth their effort to get me this information. There is nothing stopping you from creating the same relationship. If they think you are not just wasting their time they can and will help you out.

You are a part of the public. So is Michael Lowry.

you have access to information that is selectively given to you, and i presume other preferred individuals, which in turn you use to your financial gain.

You can call it business but that doesn't make it open or transparent. Especially when public money is involved in the operation of these banks. if it were or is a private institution then of course they can chose to do business with whoever they like so long as it is within the law.

can you confirm whether or not you are dealing with a nationalised or part nationalised bank?0 -

Advertisement

-

You are a part of the public. So is Michael Lowry.

you have access to information that is selectively given to you, and i presume other preferred individuals, which in turn you use to your financial gain.

You can call it business but that doesn't make it open or transparent. Especially when public money is involved in the operation of these banks. if it were or is a private institution then of course they can chose to do business with whoever they like so long as it is within the law.

can you confirm whether or not you are dealing with a nationalised or part nationalised bank?

I can neither confirm nor deny anything. What I can say is that I also get offered jobs that arent advertised because im known by the people who have access to those jobs - and known to be skilled in the area of those jobs and open to offers.

Why dont you go into your friendly bank manager and ask them can they help you out. If they dont think you are wasting their time then they will be only too happy to deal with you. There is nothing different about it to any other relationship.

I dont get access to talk to U2 about booking them for a concert, but I am still free to make my case for access.0 -

How do you know the age structure of the Dublin population? I haven't seen it in any of the CSO stats. Its certainly decimated for the country as a whole from the link I posted earlier.

How do you know? Its quite startling that you think there are good profits to make in Dublin unless you are talking about mega rich investors getting onto the BTL scene?

So 11.5% in Dublin, still quite a bit high. That link is a bit ambiguous. first they say "average salary", then they say "disposable income" in some of their descriptions. It does not say what their sources are for such a list?

the cso download gives you the age profiling.

there are 760,000 people aged 25-34 in Ireland.

250,000 of them live in county Dublin! so a third of the entire countries population of this age. if you include greater Dublin, it goes up to 330,00 or 44% of the countries population of this age group.

as I said earlier, the price of an apartment in Dublin is not consistent with the rent it can achieve. so a 100k apartment will rent for 1000 euro a month.

with a reasonable deposit, your mortgage wont cost 1000 a month- so you have a yield profit margin that is high.

11.5% is quite high, but they are old stats. I have certainly seen more recent ones where they give the figure as 10% in south county Dublin it was lower again.

I will have another look to see if I can find.0 -

liffeylite wrote: »the cso download gives you the age profiling.

there are 760,000 people aged 25-34 in Ireland.

250,000 of them live in county Dublin! so a third of the entire countries population of this age. if you include greater Dublin, it goes up to 330,00 or 44% of the countries population of this age group.

Can you give a link for this? I know the CSO site is quite laborious to find stuff, I just couldn't find the age structure for Dublin on a county or city basis, only countrywide.liffeylite wrote: »as I said earlier, the price of an apartment in Dublin is not consistent with the rent it can achieve. so a 100k apartment will rent for 1000 euro a month.

with a reasonable deposit, your mortgage wont cost 1000 a month- so you have a yield profit margin that is high.

Agree, rents are quite good in Dublin for good locations beside work\university. I think they are ridiculously high for reasons discussed but i'm a realist in that if the yield fits, go for it.liffeylite wrote: »11.5% is quite high, but they are old stats. I have certainly seen more recent ones where they give the figure as 10% in south county Dublin it was lower again.

I will have another look to see if I can find.

Cool 0

0 -

Lack of rental property = Rent increases due to raises demand and people want RA decreased

Or abolished , that works too. Just because the government is nice enough to use my tax money to give other people a house doesn't mean it deserves to be in dublin. Plenty of commuter towns in kildare, wicklow and meath that rents arent rising rapidly in.0 -

In my view, rising rents were to be expected for a couple of reasons, linked with property moving to and from the sales market.

Anecdotally, I would agree that rents are up and that this is linked to supply. I've had personal experience of moving house because landlords are either cashing in their chips, or, to be frank, being compelled to cash in their chips. I've also noted houses turning up on the price register that I never saw openly on sale.

Ultimately, I also think there is a tendency in this country to look at things over the short term and assume it means anything. Rents spiked end 2006 early 2007 from what I remember because a glut of property went on the sales market and came off rental. As sales started to slow down, the trend started reversing and houses moved back to rental, temporarily at least.

I don't think we're out of this phase to be honest. I've had people talk to me about cash rich foreign investors but I've never really gotten more than a whiff of rumour or wishful thinking from that. I'm not surprised to see rents going up but I don't think it's necessarily sustainable at the moment. Interestingly enough, sales prices showed some marginal improvement in Dublin last year off the back off quite small trading volume.

I think the property market hasn't really stabilised either rental or sales so I'd be unwilling to read too much into how things are now because it's still only a snapshot. I will say this though; rents are comparatively high for average earners and sales properties are in my view still too expensive. In the event that the city of Dublin is insane enough to start inflating property prices again and think it's a good thing, then I'll be certain that trouble isn't over. The most important lesson which people needed to take out of the last 10 years is that property is not easy or free money, and that constantly spiralling house prices are a bad thing.

I'm not sure that lesson has really been learned yet though.0 -

Can you give a link for this? I know the CSO site is quite laborious to find stuff, I just couldn't find the age structure for Dublin on a county or city basis, only countrywide.

Its in the Small Area Stats. Hours of fun to be had here.

http://www.cso.ie/en/census/census2011smallareapopulationstatisticssaps/0 -

In my view, rising rents were to be expected for a couple of reasons, linked with property moving to and from the sales market.

Anecdotally, I would agree that rents are up and that this is linked to supply. I've had personal experience of moving house because landlords are either cashing in their chips, or, to be frank, being compelled to cash in their chips. I've also noted houses turning up on the price register that I never saw openly on sale.

Ultimately, I also think there is a tendency in this country to look at things over the short term and assume it means anything. Rents spiked end 2006 early 2007 from what I remember because a glut of property went on the sales market and came off rental. As sales started to slow down, the trend started reversing and houses moved back to rental, temporarily at least.

I don't think we're out of this phase to be honest. I've had people talk to me about cash rich foreign investors but I've never really gotten more than a whiff of rumour or wishful thinking from that. I'm not surprised to see rents going up but I don't think it's necessarily sustainable at the moment. Interestingly enough, sales prices showed some marginal improvement in Dublin last year off the back off quite small trading volume.

I think the property market hasn't really stabilised either rental or sales so I'd be unwilling to read too much into how things are now because it's still only a snapshot. I will say this though; rents are comparatively high for average earners and sales properties are in my view still too expensive. In the event that the city of Dublin is insane enough to start inflating property prices again and think it's a good thing, then I'll be certain that trouble isn't over. The most important lesson which people needed to take out of the last 10 years is that property is not easy or free money, and that constantly spiralling house prices are a bad thing.

I'm not sure that lesson has really been learned yet though.

it's the avoidance of tackling the mortgage arrears problem for the last 6 to 7 years that has resulted in the supply of property being restricted. That and NAMA of course, which is gaming the market against buyers, but is determined to see prices increasing even though it is a guaranteed billions of euro loss making entity.0 -

it's the avoidance of tackling the mortgage arrears problem for the last 6 to 7 years that has resulted in the supply of property being restricted. That and NAMA of course, which is gaming the market against buyers, but is determined to see prices increasing even though it is a guaranteed billions of euro loss making entity.

It is the cessation of building and an increasing household formation rate which is causing the supply of rental property to be restricted. More repossessions would likely restrict the supply of rental property further. Repossessions would bring prices down but given that there is no finance for investors the upshot would be more owner occupiers and fewer properties available for rental.0 -

liffeylite wrote: »the cso download gives you the age profiling.

there are 760,000 people aged 25-34 in Ireland.

250,000 of them live in county Dublin! so a third of the entire countries population of this age. if you include greater Dublin, it goes up to 330,00 or 44% of the countries population of this age group.

as I said earlier, the price of an apartment in Dublin is not consistent with the rent it can achieve. so a 100k apartment will rent for 1000 euro a month.

with a reasonable deposit, your mortgage wont cost 1000 a month- so you have a yield profit margin that is high.

11.5% is quite high, but they are old stats. I have certainly seen more recent ones where they give the figure as 10% in south county Dublin it was lower again.

I will have another look to see if I can find.

I think you'll find that about a third of the country's population of all ages lives in Dublin too.0 -

Advertisement

-

liffeylite wrote: »the cso download gives you the age profiling.

there are 760,000 people aged 25-34 in Ireland.

250,000 of them live in county Dublin! so a third of the entire countries population of this age. if you include greater Dublin, it goes up to 330,00 or 44% of the countries population of this age group..

Found it from Stillwaters link

http://census.cso.ie/sapmap2011/Results.aspx?Geog_Type=ST&Geog_Code=35001

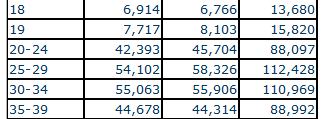

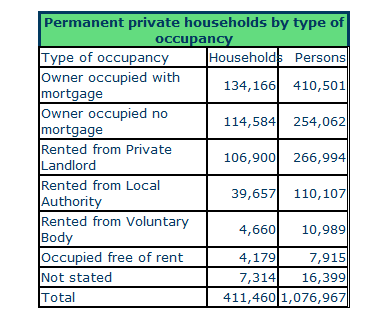

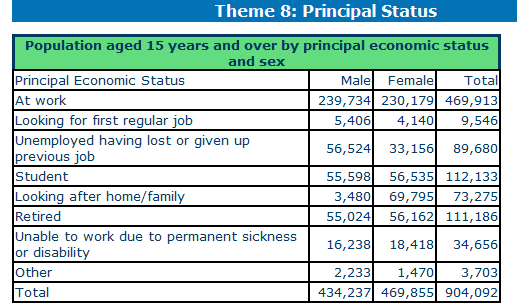

In the age group 25-34 there are 213,000 people. I make it about 100,000 "available for work" adults of all ages out of a job in Dublin.

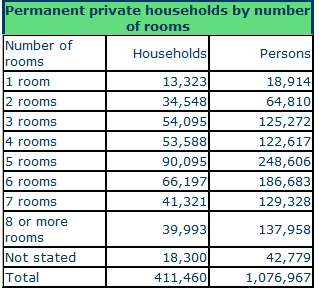

Pity we can't get info of the age range and economic status of those in rented accommodation, it would give a truer picture. Snipped below.

Look at the amount of people living in 5 and 6 bedroom properties! :eek: 0

0

Advertisement