Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi all! We have been experiencing an issue on site where threads have been missing the latest postings. The platform host Vanilla are working on this issue. A workaround that has been used by some is to navigate back from 1 to 10+ pages to re-sync the thread and this will then show the latest posts. Thanks, Mike.

Hi there,

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

Burton - "Welfare keeps the economy ticking"

-

11-07-2013 11:17am#1http://www.irishtimes.com/news/welfare-keeps-economy-going-says-joan-burton-1.1459503

Burton claims that welfare is a stimulus. Do boardsies think she right or wrong?

If she is right then why don`t we up our welfare spending or go the whole hog and become communists?

If she is wrong then how do we make reforms or cuts with a minister with an attitude like this?

If we do not deal with things sooner rather than later then we are looking at unemployment rates around 10% in the year 2020"

https://www.esri.ie/publications/latest_publications/view/index.xml?id=3770

Medium-Term Review: 2013-2020

https://www.esri.ie/UserFiles/publications/MTR12.pdf

They run 3 Scenarios:

1) Recovery

2) Delayed Adjustment

3) Stagnation

With a Recovery scenario based on the EU economy recovering and domestic issues both resolving. Under this scenario the unemployment rate could be 6% by 2020.

The Delayed Adjustment model is based on EU recovery but with Ireland failing to resolve the issues in the domestic economy thus requiring budget cutbacks over a longer period. Unemployment in this scenario would be "in double digits" for most of the decade.

Stagnation: Basically if the EU does not return to growth in the near future then we are looking at the same unemployment rate in 2020 that we have today.

Scenario #2 is looking like the best case scenario now and the country has been shaping up for this politically for quite some time with the likes of Noonan claiming the economy is about to rocket (said it a year ago still waiting) and Burton claiming we can borrow our way to riches.2

Comments

-

I guess it could be considered a stimulus in the sense that the government are taking money off people who will probably save it, giving it to people who will spend it.

But of course if you take it off the people who might save it, you may be strangling any potential growth in domestic industry and new job creation. Bit of a catch-22.

You might be able to achieve something similar, without so many negative consequences, by more carefully planned tax bands.0 -

But-but the bank balance sheets and liquidity? I find taking money from people who work, and giving to people who see work as a option simply immoral, and at odds with the throwaway comment "most vulnerable in society." I'm going to have to agree with the ESRI and stick with the 3.1 billion cut rather than delay cuts to welfare. A bit of pension reform no harm either (for those who can well afford it)Dannyboy83 wrote: »I guess it could be considered a stimulus in the sense that the government are taking money off people who will probably save it, giving it to people who will spend it.

But of course if you take it off the people who might save it, you may be strangling any potential growth in domestic industry and new job creation. Bit of a catch-22.

You might be able to achieve the

Running a huge deficit with little benefit long term is not stimulus0 -

Dannyboy83 wrote: »I guess it could be considered a stimulus in the sense that the government are taking money off people who will probably save it, giving it to people who will spend it.

But of course if you take it off the people who might save it, you may be strangling any potential growth in domestic industry and new job creation. Bit of a catch-22.

You might be able to achieve something similar, without so many negative consequences, by more carefully planned tax bands.

Saving money is good for an economy as it generates investment and liquidity which is a major problem with the economy in Ireland0 -

Deleted User wrote: »Saving money is good for an economy as it generates investment and liquidity which is a major problem with the economy in Ireland

only up to a point. Spending not saving generates liquidity in the economy, saving only generates liquidity for those holding the cash or money.

Once savings rates go above about 7% they start to have a restrictive impact. Our savings rates are running at about 12% and even the Central Bank have acknowledged that's too high.

Burton is 'right' in the sense that welfare claimants spend, but while they spend on essentials, there is still a certain amount of waste.

If you increase welfare you'll get some more spending (and perhaps a bump in certain tax revenues) - if you give tax breaks people will save and / or pay down debt, which is a form of saving.

Politically, I doubt raising welfare is a goer - but I reckon a meaningful tax break for people on and just above the minimum wage would be economically beneficial, politically acceptable and send out the right signal of work not welfare being the government's priority.0 -

This is the same theory that a large public service that you pay high wages to drives the economy. We learned this the hard way in the late 1980's when the country nearly went bust. Joan is spouting the same theory that was prevelent then as we got the deficit under control that we could ease off the cuts and this would drive the economy.

From 2008 to 2010 we were told that if we did XY and Z growth would allow us to recover late 2011 on. This has not happened and there is still no sign of 3%+ growth and we may not see it before the late teens 2016 on. Joan and the Labour party have a fad about core social welafre payments. She considers that this helps the ''vunerable'' I see that they are so busy that they have to double park and block roads around Social Welfare Offices in there cars and jeeps. They have not got the time to walk to drop in a form or sign on.

She talks about core welfare payments she fails to do anything about the core of recipents that have never worked in there life. We have a large section on disability and because of this we fail to look after those with real disability instead we cut there top up's to benifit those working the system

It is the same with carer's allownce there are people that really need it however there are those that have targeted it as a method of not having to work.

We have a huge problem with SW and at some stage it will have to be addressed but I am afraid that Labour is not the party of the working people in Ireland rather it serves a aristorcracy that is similar to the absentee British landlord class that contrived to cause the famine by draining the country of money.0 -

Advertisement

-

Deleted User wrote: »Saving money is good for an economy as it generates investment and liquidity which is a major problem with the economy in Ireland

Certainly, I was just addressing whether it was a stimulus or not.

It does essentially bring forward spending, and that can eat out of future job creation - a bit like a car scrappage scheme (assuming the people from whom the wealth was redistributed actually intended to invest it in a business, rather than buy a new Masserati or put it in a Swiss bank)

There are of course loads of negative aspects, not to mind the morality issue.

I seriously think a third tax band should be created and reduce the middle band, in order to stimulate the domestic economy.

We are paying 52% on any income above the SRCOP, not to mind the new consumption or property taxes coming online, and the domestic economy has hit a new post crash low.0 -

Tea drinker wrote: »Running a huge deficit with little benefit long term is not stimulus

Agreed. Stimulus would be building infrastructure that would have a net benefit to the economy, like schools, roads or telecoms. Simply spending for no net benefit is running to standstill and we're even more in debt by the end.Dannyboy83 wrote: »Certainly, I was just addressing whether it was a stimulus or not.

It does essentially bring forward spending, and that can eat out of future job creation - a bit like a car scrappage scheme (assuming the people from whom the wealth was redistributed actually intended to invest it in a business, rather than buy a new Masserati or put it in a Swiss bank)

There are of course loads of negative aspects, not to mind the morality issue.

I seriously think a third tax band should be created and reduce the middle band, in order to stimulate the domestic economy.

We are paying 52% on any income above the SRCOP, not to mind the new consumption or property taxes coming online, and the domestic economy has hit a new post crash low.

Believe it or not, we need people on lower earnings to pay more income tax. Gross earnings are lower in other EU countries and they pay tax on all their earnings.0 -

......

Believe it or not, we need people on lower earnings to pay more income tax. Gross earnings are lower in other EU countries and they pay tax on all their earnings.

Sorry, but that's bonkers - gross earnings may be lower in other EU countries but services are infinitely better.

I'd say people on lower incomes tend to have younger children - they could stand even lower incomes if we had decent healthcare free at the point of delivery and decent free or subsidised childcare. If you were to eliminate those expenses you'd ease the burden on lower earners and lower the barriers for people going to work.

One of the main issues is savings - there should be more spending, but the relentless negativity of the government drives out all positive sentiment.

Maybe increasing DIRT is a [very negative] way of increasing spending - just throwing it out there, I'm not convinced myself it would work.0 -

Moderators, Science, Health & Environment Moderators, Society & Culture Moderators Posts: 3,372 Mod ✭✭✭✭

Join Date:Posts: 3262

Join Date:Posts: 3262

She's sorta right. As she kinda mentions, In economics welfare is what's known as an automatic stabilser, and acts to dampen fluctuations in GDP. They're Keynesian in the sense that Keynes would have advocated for government spending to make up for a lack of private spending, in a situation in which (for whatever reason) private consumption/investment is depressed, until such time as private consumption is no longer depressed.0 -

I'd say she's wrong, plain and simple, as so much of our consumer expenditure is on stuff that we import. We'd even import a fair whack of our food needs (which you might expect a disproportionate amount of social welfare to be spent on), as our domestic industry basically produces beef, dairy and a few other things for export.Deleted User wrote: »http://www.irishtimes.com/news/welfare-keeps-economy-going-says-joan-burton-1.1459503

Burton claims that welfare is a stimulus. Do boardsies think she right or wrong?<...>

This is widely known, but it always seems to be a problem to connect what we know to public comments like the one you've linked - it's like there's a parallel dialogue, that never meetshttp://www.irisheconomy.ie/index.php/2010/07/22/unpleasant-stimulus-arithmetic/

<...>But, of course, Ireland is not the US and fiscal multipliers here will be smaller because much of the stimulus will be spent on stuff that is made in other countries. If you’re reading this, there’s a pretty good chance you’re familiar with the elementary multiplier formula 1 / 1-c, where c is the marginal propensity to consume. In the open economy case, this is 1/(1-c+m) where m is the marginal propensity to import. Stick in reasonable figures for Ireland and the US and you’ll see why our fiscal multipliers are likely to be far smaller.

These considerations mean that any attempt at fiscal stimulus will see the Irish budget deficit increase, not decrease.<...>0 -

Advertisement

-

Why not increase tax on earnings over xx in the first place? In most likely people on higher wages are the ones saving most. We seem to have a growing gap between the classes. edit - I don't want to get into a situation where we equate saving = bad. It's something we all should aspire to.One of the main issues is savings - there should be more spending, but the relentless negativity of the government drives out all positive sentiment.

Maybe increasing DIRT is a [very negative] way of increasing spending - just throwing it out there, I'm not convinced myself it would work.

http://www.thejournal.ie/average-disposable-income-silc-ireland-793882-Feb2013/OVER HALF of Irish homes are forced to go into debt to pay essential household bills, while a similar amount have to borrow from friends or family – or spend their savings – simply to make ends meet, new research has claimed.

Data from price comparison service uSwitch found that 56 per cent of Irish homes said they had used credit cards, overdrafts or the services of doorstep lenders to meet the costs of their everyday household bills in the last 12 months.

A slightly higher number, 57 per cent, told a survey that they had dipped into savings, or borrowed money from family and friends to meet their essential bills.0 -

Why not increase tax on earnings over xx in the first place?

Tax on high earners is already high and becoming counter productive. It's already pushing some to go overseas, adding more will simply cause an exodus. For instance, do you think multinational executives would like to locate in Ireland if half their earnings go on income tax.

It's low earners in Ireland who don't actually pay much tax.0 -

lets get one thing straight here...the unemployment rate isn't 14%+ because some people are saving some money.

we should never get the idea that savings is a bad thing. spending beyond your means is bad, borrowing to spend beyond your means is worse and taxing those who save up so they don't get loans is even worse0 -

Tea drinker wrote: »Why not increase tax on earnings over xx in the first place? In most likely people on higher wages are the ones saving most. We seem to have a growing gap between the classes. edit - I don't want to get into a situation where we equate saving = bad. It's something we all should aspire to.

http://www.thejournal.ie/average-disposable-income-silc-ireland-793882-Feb2013/

High earning households are still saving historically high amounts - I think there may be scope for a very modest increase in the higher rate - 1% or maybe 1.5% but definitely no more than that.

For the simple reason that the government won't spend it efficiently - if it doesn't go to pay down debt it'll end up funding more 'boondoggles' in ministers' constituencies and the like, rather than being allocated on the basis of need.....

......by the way, I reserve the right to vary this position if we get a minister in our constituency:D0 -

only up to a point. Spending not saving generates liquidity in the economy, saving only generates liquidity for those holding the cash.

We have a pension timebomb in this Country. Saving money is precisely what people should be doing to solve it. Generous Welfare (and other guaranteed income) fuels price inflation and discourages price competition.0 -

leftwing cos youre broke wrote: »Generous Welfare (and other guaranteed income) fuels price inflation and discourages price competition.

What is your solution then?

(seeing that €188 per week spent on basic survival by 400k people is unlikely to inflate an economy of €160 billion plus).0 -

Deleted User wrote: »lets get one thing straight here...the unemployment rate isn't 14%+ because some people are saving some money.

we should never get the idea that savings is a bad thing. spending beyond your means is bad, borrowing to spend beyond your means is worse and taxing those who save up so they don't get loans is even worse

It's a spillover effect - high savings suggest lack of confidence and also mean less money circulating. In that type of environment who is going to take on workers and / or invest in expanding their business?

It's also aggravated by high home ownership - other countries with high savings rates (Switzerland, Germany) are doing better because most people are not saddled with a mortgage, they rent.

At the moment between negative equity, the perception of declining wages and increasing prices people 'feel' poor (or maybe less wealthy would be a better description) which creates an impetus to save or pay down household debt.

There's an optimal level of saving - too much and too little are bad in their own way.

I'm not saying if the saving rate drops unemployment will disappear, but if it drops for the right reason then 'some' unemployment might disappear.0 -

leftwing cos youre broke wrote: »We have a pension timebomb in this Country. Saving money is precisely what people should be doing to solve it. Generous Welfare (and other guaranteed income) fuels price inflation and discourages price competition.

That's premised on a retirement age of 65 - the reality is people are and will work longer, some because they have to, some because they want to.

Welfare only drives inflation if the supply of goods doesn't expand - in most cases what welfare gets spent on (food, fuel etc) are commodities that easier to supply in greater quantities.0 -

spank_inferno wrote: »What is your solution then?

(seeing that €188 per week spent on basic survival by 400k people is unlikely to inflate an economy of €160 billion plus).

I'd start by slashing rent allowance. Nobody should have a pre-ordained right to live inside the M50 if they're not working. That will deflate the whole market and put money back in peoples pockets. Also, reduce Welfare rates for people who have worked the least.

i doubt anyone would suggest we solve the pension timebomb by increasing the pension to 400 per week, so keeping Welfare so high across the board would make no more sense.0 -

Moderators, Science, Health & Environment Moderators, Society & Culture Moderators Posts: 3,372 Mod ✭✭✭✭

Join Date:Posts: 3262

Join Date:Posts: 3262

With regard to the who savings thing, it sounds like people are referring to [the paradox of thrift](http://en.wikipedia.org/wiki/Paradox_of_thrift). It is the case that sometimes, people saving can be a bad thing.0 -

Advertisement

-

leftwing cos youre broke wrote: »I'd start by slashing rent allowance. Nobody should have a pre-ordained right to live inside the M50 if they're not working. That will deflate the whole market and put money back in peoples pockets. Also, reduce Welfare rates for people who have worked the least.

i doubt anyone would suggest we solve the pension timebomb by increasing the pension to 400 per week, so keeping Welfare so high across the board would make no more sense.

- The RA has already been cut.

The impact of same has had a much larger impact on those living in urban areas.

- The vast majority of renters in Ireland are not those on RA.

Despite the cuts in RA payments the rental market has been inflating.

(lack of mortgage credit, shortage of houses in urban areas).

- What money would go back into whose pockets?

I don't ever remember getting a tax refund for monies unspend.... thats not how it works!

- Those on JSA are and for some time have been actively encouraged to take up employment or training.

Failure to do so repeatedly will and does lead to a cut or suspension of their welfare payments.

I encourage you to read up on how things actually work.

Otherwise you just sound like a Daily Mail editor... ranting on.0 -

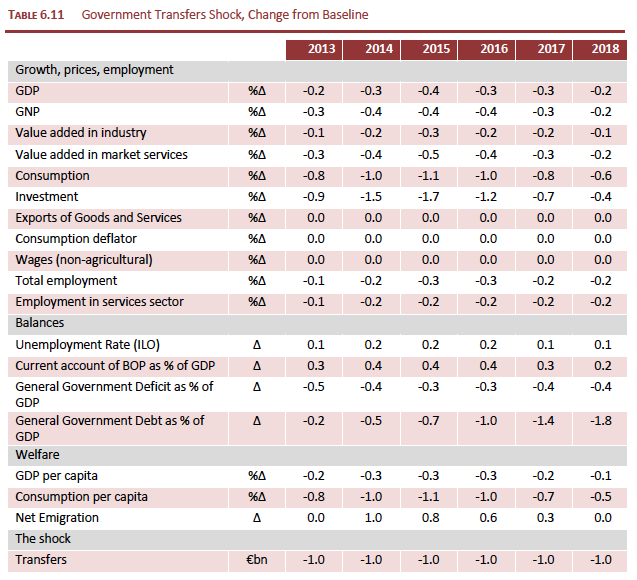

The effects of a €1 billion cut in transfers (i.e. social protection)

This is according to the ESRI in yesterday's mid term review. Consumption and employment would be clear losers, and this adds credence to what Joan Burton is saying.

the ESRI add that while there would be a reduction in Government defect:GDP, this would be partially offset by higher unemployment and lower tax take, which diminishes any gains of cutting welfare.

http://www.esri.ie/UserFiles/publications/MTR12.pdf 0

0 -

When the government talk about unemployment they fail to address the dependancy issue. Between single parent allowance, unemplyment benifit, disability allowance, and carers allowance we have a massivedependancy rate. People talk about headline rates 188/week which is amoung the highest if not the highest in the EU they fail to take into account the added extra's such as Medical Card, rent allowance, back to school allowance etc, and the practise of allowing those on DA and SPA to work a little and recieve the allowance.

This make it a no brainer for these to consider work unless they have a high level job in the private sector or a public service job. We cannot afford this the social welfare budget like the health budget has remained high . The idea that we can increase taxes to sustain this and disecourage those at work and keep adding cost into the economy and make it uncompeditive is ludricous.

Kenyian economics were born at a time when there was a minimal if any welfare floor there and when governments had little or no debt and low tax rates. Because governments had no debt they were able to stimulate a economy by printing money and the choice for a person was work or starve. this is not the case now during our boom the givernment spend the lolly as fast as it came in and we are limited in what we can borrow there fore the choices are either continue to rise taxes on those tha work and disencentive them from working or cut dependancy payments and encourage these people to take low paid employment as it comes available.

Becasue of Labour's drivel about headline SW they have cut those that are really vunerable compared to those that work the dependancy culture0 -

A lot of what appears to be saving is actually hoarding cash in order to pay down debt. We've turned the economy into debt servicing mode and one sense, it's good because it enables us to reduce the debt burden but on the other hand, it means that cash is being sucked out of all other sectors of the economy.Sorry, but that's bonkers - gross earnings may be lower in other EU countries but services are infinitely better.

I'd say people on lower incomes tend to have younger children - they could stand even lower incomes if we had decent healthcare free at the point of delivery and decent free or subsidised childcare. If you were to eliminate those expenses you'd ease the burden on lower earners and lower the barriers for people going to work.

One of the main issues is savings - there should be more spending, but the relentless negativity of the government drives out all positive sentiment.

Maybe increasing DIRT is a [very negative] way of increasing spending - just throwing it out there, I'm not convinced myself it would work.She's sorta right. As she kinda mentions, In economics welfare is what's known as an automatic stabilser, and acts to dampen fluctuations in GDP. They're Keynesian in the sense that Keynes would have advocated for government spending to make up for a lack of private spending, in a situation in which (for whatever reason) private consumption/investment is depressed, until such time as private consumption is no longer depressed.

I see where you're coming from but Keynesian spending is not about spending for the sake of it. It's about spending on something that will provide a tangible net benefit. Paying 100 people to build a new school in an area where it's needed is good. Paying 100 people so that they can then spend that money in a local shop but do little else productive is not what Keynesianism is all about.0 -

Yeah, but that assumes a closed economy. What might help the Irish economy is if one of our main trading partners, like the UK, decided to spend loads more on the kind of products we produce. But Irish people spending more on the imported goods you typically find in Irish shops does damn all for us.With regard to the who savings thing, it sounds like people are referring to [the paradox of thrift](http://en.wikipedia.org/wiki/Paradox_of_thrift). It is the case that sometimes, people saving can be a bad thing.

But, in fairness, the ESRI are talking self-evident nonsense, if that's what they mean. As some have said, with that logic we should increase transfers by €1 billion, confident in the knowledge that consumption and employment will generate more than €1 billion in extra taxes.Cody Pomeray wrote: »The effects of a €1 billion cut in transfers (i.e. social protection)

This is according to the ESRI in yesterday's mid term review. Consumption and employment would be clear losers, and this adds credence to what Joan Burton is saying.

We know that's hokum, because we know our consumption expenditure has a high import content.0 -

You mean like some form of Keynesianism?GCU Flexible Demeanour wrote: »Y

But, in fairness, the ESRI are talking self-evident nonsense, if that's what they mean. As some have said, with that logic we should increase transfers by €1 billion, confident in the knowledge that consumption and employment will generate more than €1 billion in extra taxes.

I don't think what the ESRI is saying is "self-evident nonsense". Their report seems to come without a particular ideological agenda - after all, they are suggesting faster austerity, not slower.

They're simply highlighting the downside of cutting government spending on welfare - and that downside applies to jobs, consumption, and emigration.0 -

In fairness, I said "if that's what they mean". Looking at the table, what they say is that a €1 billion cut in transfers would reduce GDP by one fifth of one percent. GDP is around €160 billion. So they're effectively saying the effect of that reduction is only a €320 million fall in GDP.Cody Pomeray wrote: »I don't think what the ESRI is saying is "self-evident nonsense". Their report seems to come without a particular ideological agenda - after all, they are suggesting faster austerity, not slower.

They're simply highlighting the downside of cutting government spending on welfare - and that downside applies to jobs, consumption, and emigration.

Now, that means (playing fast and loose with the figures) you'd need a €1 billion cut to reduce the deficit by €700 million. But that's only telling us the extent to which far more radical action is needed to get a grip on the national finances - a degree of change far beyond what has been attempted politically.

Incidently, I don't notice the ESRI account saying much about the problem of the effect of increasing debt repayments on Government spending. Maybe it's there, and I just haven't noticed it.0 -

Actually, the figure for the 2014 Budget, which is the next budget, is 0.3, which is closer to a €500 million reduction in GDP.GCU Flexible Demeanour wrote: »Now, that means (playing fast and loose with the figures) you'd need a €1 billion cut to reduce the deficit by €700 million.

Obviously the figure is even higher for GNP.

rather than seeing how much our policies diminish our GDP, it might be nice if we actually tried to boost our GDP. But of course, we prefer to ignore that side of the debt:GDP ratio. The troika has spoken.0 -

Keynesian theories only work if you follow them all the time.

You can't opt for Keynes in one part of the cycle and then someone else (Mises?) in another part.

Plus I reckon if the Depart of Fiance are all about to become Keynesians they've picked the wrong part of the cycle for their road to Damascus moment.

On the point about rents, it's difficult to reconcile what's going on in the market when you look at the supply of properties - if someone is effectively getting a house for a subsidised rent they should go where the houses are - if they want the option to choose then pay for it themselves.

RA should be set at the minimum required to rent the cheapest property in the country - if someone wants to live somewhere else let them fund it.0 -

Advertisement

-

Tbh, same difference. The point is that it causes a lesser reduction in GDP. Looking at the other end of the telescope, it means a stimulous won't pay for itself.Cody Pomeray wrote: »Actually, the figure for the 2014 Budget, which is the next budget, is 0.3, which is closer to a €500 million reduction in GDP.

It may or may not, but it's not obvious when you consider that our GNP is about €30 billion less than GDP. (And when you consider why our GNP is €30 billion less, you start getting an inkling as to why there's little point in talking as if there was some close connection between what we consume and what we produce.)Cody Pomeray wrote: »Obviously the figure is even higher for GNP.

Not really - what we're pointing to is the pointlessness of a debt-financed consumption boom. It that was sustainable, it would still be sustained.Cody Pomeray wrote: »rather than seeing how much our policies diminish our GDP, it might be nice if we actually tried to boost our GDP. But of course, we prefer to ignore that side of the debt:GDP ratio. The troika has spoken.0 -

But I think, more crucially in our case, they're only relevant for a closed (or semi-closed) economy.Keynesian theories only work if you follow them all the time.

Also, joining the Eurozone in particular means that it make little sense to talk about the Irish economy in isolation, as if it was an independent national economy. We're really just a region of the Eurozone economy, and the only economic tool at our disposal is competitiveness. If we're low-cost, we'll do well. Otherwise, not really.0 -

GCU Flexible Demeanour wrote: »But I think, more crucially in our case, they're only relevant for a closed (or semi-closed) economy.

Also, joining the Eurozone in particular means that it make little sense to talk about the Irish economy in isolation, as if it was an independent national economy. We're really just a region of the Eurozone economy, and the only economic tool at our disposal is competitiveness. If we're low-cost, we'll do well. Otherwise, not really.

It's maybe arguable that his theories generally apply, but they only seem to come to the fore during slowdowns or recessions - politically, counter-cyclical policies are unacceptable during booms or periods of expansion.

I agree Keynesian policies would be very difficult for us to implement given the lack of control we have over monetary policy, but I think there's merit in adapting and applying some of his theories.0 -

Conceivably, but consider that the usual tool used by Irish Governments to avoid a huge import leakage was to incentivise demand for newly-built housing, on grounds that building and construction has a low import content. They're doing some of that now, with their 'stimulous package' of public investment. The only problem is those public investments are unlikely to generate any income to repay the borrowing we're doing to finance them.I agree Keynesian policies would be very difficult for us to implement given the lack of control we have over monetary policy, but I think there's merit in adapting and applying some of his theories.

So the effect of that will, probably, just be that we'll be poorer in future years.

I think our analysis of 'stimulous' arguments needs to be quite pragmatic. We need to ask what the money will be spent on, and ask how that will generate any meaningful economic activity. I think the answers out of that would suggest, quite strongly, that the policy has little to give us.0 -

Moderators, Science, Health & Environment Moderators, Society & Culture Moderators Posts: 3,372 Mod ✭✭✭✭

Join Date:Posts: 3262

Join Date:Posts: 3262

[QUOTE=gaius c;85482000

I see where you're coming from but Keynesian spending is not about spending for the sake of it. It's about spending on something that will provide a tangible net benefit. Paying 100 people to build a new school in an area where it's needed is good. Paying 100 people so that they can then spend that money in a local shop but do little else productive is not what Keynesianism is all about.[/QUOTE]

Actually, that's exactly what Keynesian spending is about. As i understand it, the point is to maintain a certain level of consumption in the economy via government spending, for a limited period of time, so as to prevent a 'bad' equilibrium from taking hold.GCU Flexible Demeanour wrote: »Yeah, but that assumes a closed economy. What might help the Irish economy is if one of our main trading partners, like the UK, decided to spend loads more on the kind of products we produce. But Irish people spending more on the imported goods you typically find in Irish shops does damn all for us.

But, in fairness, the ESRI are talking self-evident nonsense, if that's what they mean. As some have said, with that logic we should increase transfers by €1 billion, confident in the knowledge that consumption and employment will generate more than €1 billion in extra taxes.

We know that's hokum, because we know our consumption expenditure has a high import content.

I understand that the fact that Ireland being an open economy limits the fiscal multiplier and the extent to which the paradox is true. But that's not to say that there's no fiscal multiplier, or that the paradox of thrift isn't to an extent applicable to Ireland. It might be more applicable to larger economies which are more closed, but it's still operative here.

My general aim, though, was just to link what people were saying here to the relevant economic concepts, since I figured people might find it useful or interesting.0 -

That's true in principle, but we can find the fiscal multiplier in an open economy is just so weak that it's actually counterproductive - particularly if it's just horsed into consumer expenditure.I understand that the fact that Ireland being an open economy limits the fiscal multiplier and the extent to which the paradox is true. But that's not to say that there's no fiscal multiplier, or that the paradox of thrift isn't to an extent applicable to Ireland. It might be more applicable to larger economies which are more closed, but it's still operative here.

And it is valuable to introduce those concepts, and consider how they apply to real-world problems. The link you supplied is a good account of the concept - and it includes the very point we're discussing, about the impact of openness.My general aim, though, was just to link what people were saying here to the relevant economic concepts, since I figured people might find it useful or interesting.

And we always have to keep the fact that Ireland is a small open economy to the fore. You'll appreciate, it's not just that we're an SOE, it's that we're one of the most open economies in the world. That has profound implications for many economic propositions - even if it wasn't compounded by our membership of the Eurozone.0 -

Advertisement

-

Moderators, Science, Health & Environment Moderators, Society & Culture Moderators Posts: 3,372 Mod ✭✭✭✭

Join Date:Posts: 3262

Join Date:Posts: 3262

GCU Flexible Demeanour wrote: »That's true in principle, but we can find the fiscal multiplier in an open economy is just so weak that it's actually counterproductive - particularly if it's just horsed into consumer expenditure.And it is valuable to introduce those concepts, and consider how they apply to real-world problems. The link you supplied is a good account of the concept - and it includes the very point we're discussing, about the impact of openness.

And we always have to keep the fact that Ireland is a small open economy to the fore. You'll appreciate, it's not just that we're an SOE, it's that we're one of the most open economies in the world. That has profound implications for many economic propositions - even if it wasn't compounded by our membership of the Eurozone.

Something I've sorta been wondering about, though, is the extent to which expectations are operative in terms of the transmission and effectiveness of fiscal policy. Even if the direct multiplier is so low as to make fiscal stimulus pointless, maybe there's an indirect multiplier such that fiscal policy would have enough of an effect upon expectations as to make some kind of 'stimulus' worthwhile.

In ordinary circumstances I don't think this expectations effect would be particularly strong. But people have been exposed to a huge amount of negative publicity with regard to austerity, in tandem with a huge amount of publicity which says that stimulus is the way out. People are utterly anchored to the idea that a stimulus is the way to go. Maybe, then, people would perceive some kind of stimulus package as a strong sign that the economy will finally move out of recession, and set their expectations in such a way as to make that expected growth a reality.

It wouldn't even have to be a big stimulus policy, so long as it changed people's expectations about the future path of government expenditure and the economy more generally.0 -

not too many people on social welfare that I know who are struggling.

ok, maybe if they smoke, drink a lot and flitter away money on crap food every week then they are in need, but generally families on social welfare do ok.0 -

Is it fair to say, what you're building on that idea that weather forecasts don't change the weather, but economic forecasts can change the economy.It wouldn't even have to be a big stimulus policy, so long as it changed people's expectations about the future path of government expenditure and the economy more generally.

I'd make a few observations. The first is to bear in mind the extent to which the open economy features still have to be considered. As the bulk of what we make is exported, its really expectations about the European/global economy that you need to manage.

Also, consider that its possible for Government to raise expectations about the wrong thing. You could argue that tax reliefs for construction was an example of the State trying to change people's expectations. What a legacy that left. The Upper Shannon Rural Renewal Scheme alone seems to be responsible for 20% of all ghost estates. Do we need to similarly delude people that there's scope for more retailers in Ireland, rather than less?

I think the bottom line is, tbh, what economic theory broadly suggests. A small, open economy can't usefully engage in demand management. Now, there might be a political need to be seen to be doing something - such as The Gathering. And that's not to be sniffed at, if it can be done for the price of a few posters, because political stability is important. But, if you're an SOE, you really need to drill into the detail of where exactly your money is going.0 -

I think 'classical' economists would suggest that open economies can't engage in demand management using the conventional instruments of fiscal and monetary policy.

However, neuro-economists would argue strongly that sentiment and confidence can be manipulated to stimulate or suppress demand.

In that vein, it's not the abolition or introduction of measures that's important it's the language or the dialogue that people are exposed to that influences them to a degree.

Take the example of the last few budgets - the relentless doom and gloom from September onwards with ministers almost vying with each other to come out with the most pessimistic statement can't have helped confidence.

I think the government's strategy was based on driving people's expectations down - to make things sound so dreadful that when budget day came and it was bad, it wasn't as bad as people expected and that allowed them to claim 'victory' as they sought to grab credit for deflecting the worst of the cuts.

I'm not advocating Enda and Michael go skipping through the daisies to tell us everything will be honey and sunshine, but I think the budget process needs to be either completely confidential or [my preferred option] completely transparent. Cut out the spin and the strategic leaking because at the moment the process is more damaging than the output.0 -

For my own part, I haven't at all suggested that sentiment and confidence can't be manipulated to stimulate or suppress demand. I've pointed to property-related tax reliefs as an example of where that was done in Ireland.<...>

However, neuro-economists would argue strongly that sentiment and confidence can be manipulated to stimulate or suppress demand.<..>

What I'm suggesting, in that respect, is that it is not good for Government in a country with a small open economy to encourage people to spend money they don't have. It only potentially makes sense for Government to encourage people to spend money they don't have where that money can be corralled within the domestic economy.

Although, if I can add to that, I'd suggest it never makes sense for Government to encourage people to waste money.0 -

Advertisement

-

I'm not advocating Enda and Michael go skipping through the daisies to tell us everything will be honey and sunshine, but I think the budget process needs to be either completely confidential or [my preferred option] completely transparent. Cut out the spin and the strategic leaking because at the moment the process is more damaging than the output.

The reason for the confidentiality, as I've been told at least, is to prevent tax evasion.

I would also prefer to see it completely transparent, but I think the political class would not agree to that, as it would be too democratic.

Regardless, you are right.

Confidence is smashed every time another round of kite-flying begins.

I'm sure this phrase will make some people shiver - but it actually is time to stop talking down the economy!0 -

However, neuro-economists would argue strongly that sentiment and confidence can be manipulated to stimulate or suppress demand.

In that vein, it's not the abolition or introduction of measures that's important it's the language or the dialogue that people are exposed to that influences them to a degree.

Take the example of the last few budgets - the relentless doom and gloom from September onwards with ministers almost vying with each other to come out with the most pessimistic statement can't have helped confidence.

So the neuro-economists say that "we are talking ourselves into a recession, and we should try talk ourselves out." Oh dear.0 -

And to the thread title, "Welfare keeps the economy ticking". No, no, no!!! Whats left of the economy keeps welfare ticking.0

-

If you increase welfare you'll get some more spending (and perhaps a bump in certain tax revenues) - if you give tax breaks people will save and / or pay down debt, which is a form of saving.

If you increase welfare less people will opt to work, you will have a lesser supply of goods and services chased by more money. This is what is absurd about the claim welfare keeps the economy ticking. It is people producing goods and services in the economy that allows welfare cheques to actually buy something. It is the economy that keeps welfare ticking.0 -

It all makes me wonder why there is any poverty, everyone should just talk themselves into prosperity while raising taxes and welfare.0

-

And all this psuedo intellectual bull**** talk surrounding multipliers and gdp is bloody tiring, if its simply spend and increase gdp = economy growing, a counterfeiter with lavish spending habits rather than being a criminal would actually be a blessing. You don't need “the stimulus wouldn’t work here we’re an open economy” jargon or the fussing over useless aggregate statistics, spending for the sake of spending/unproductive spending does not benefit the economy.0

-

Thing you've got to remember about multipliers and all that, is that the economy is burdened by a lot of private debt, and that stimulus today will help deleveraging that debt, even though the debt will keep 'multipliers' low.Something I've sorta been wondering about, though, is the extent to which expectations are operative in terms of the transmission and effectiveness of fiscal policy. Even if the direct multiplier is so low as to make fiscal stimulus pointless, maybe there's an indirect multiplier such that fiscal policy would have enough of an effect upon expectations as to make some kind of 'stimulus' worthwhile.

In ordinary circumstances I don't think this expectations effect would be particularly strong. But people have been exposed to a huge amount of negative publicity with regard to austerity, in tandem with a huge amount of publicity which says that stimulus is the way out. People are utterly anchored to the idea that a stimulus is the way to go. Maybe, then, people would perceive some kind of stimulus package as a strong sign that the economy will finally move out of recession, and set their expectations in such a way as to make that expected growth a reality.

It wouldn't even have to be a big stimulus policy, so long as it changed people's expectations about the future path of government expenditure and the economy more generally.

The private economy is not going to recover until a lot of that debt is paid down, so you don't need big multipliers right away, you just need to get everyone working/earning, so they can actually pay down the debts and sort that out, at which point the private economy gradually starts recovering and workers start moving back away from temporary public employment, into private employment.

The 'stimulus' should soak up unemployed workers into a temporary public employment program (all of them - so it would have to be a big stimulus), because the private economy doesn't want all those workers right now - then when the private debt problem starts tapering down, aggregate demand increases (because people have more to spend, due to both public employment and less debt), and private industry begins soaking up the workers out of temporary public employment (eventually ending the temporary employment program - at which point we have 100% recovery).

It's not a psychological problem in the economy, it's a real problem of private debt loads.0 -

That depends on how you fund welfare. If Ireland funds it on its own, using our (comparatively) high-interest debt, it is a greater burden on our economy than it needs to be.And to the thread title, "Welfare keeps the economy ticking". No, no, no!!! Whats left of the economy keeps welfare ticking.

If it is funded by lower-interest centralized EU debt, or money creation (kept within inflation targets - arguments asserting it will breach these targets are 100% political, nothing to do with economics), this does not have to be such a great burden on our economy into the future.

The other issues with money creation is our external trade balance: The created money will be spent on buying resources, and if those resources can't be sourced within Europe, they will increase Europe's imports over exports, affecting currency valuation.

Considering how resource-rich Europe is, this will only affect a small number of key resources, and thus does not have to have a significant effect on valuation.

The simple solution here (even though I disagree with your conclusions), is to use the money to give people jobs instead of welfare, as that is far more efficient: You are paying people for their labour, for doing something productive, not paying them for doing nothing.If you increase welfare less people will opt to work, you will have a lesser supply of goods and services chased by more money. This is what is absurd about the claim welfare keeps the economy ticking. It is people producing goods and services in the economy that allows welfare cheques to actually buy something. It is the economy that keeps welfare ticking.

The idea that welfare keeps the economy ticking though, is a part of 'sectoral balances': A public sector deficit, is (and this is true as an accounting rule) a private sector surplus (giving the private sector much needed money, for deleveraging debts and for spending).

That 'public sector deficit' does not have to stifle the private economy in other ways (such as by taxes, inflation or devaluation - all of which are avoidable), it depends on how the money is sourced.0 -

Joan Burton must be the most single minded, self serving minister in the whole cabinet.

In each of the last two budgets she failed (by €200 m each) to do her job in reining in welfare. It now looks like she is trying to weasel her way out again.

It's all based on political cowardice and/or ambition.

Our deficit is closely watched by our international lenders. Unless we eliminate it the interest rate on our borrowings will jump - note Portugal recently. For the last six months most of the national economic news has been bad.0 -

KyussBishop wrote: »The simple solution here (even though I disagree with your conclusions), is to use the money to give people jobs instead of welfare, as that is far more efficient: You are paying people for their labour, for doing something productive, not paying them for doing nothing.

Quasi Communism? The labour party and the beards would love this. They already got a head start with the Job bridge scheme0 -

Advertisement

Advertisement