Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi there,

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

Taxes.

-

02-10-2013 3:05pm#1cyberwolf77 wrote: »

Erm, I wish they hadn't used Bill Gates as the example of an ethical atheist. It takes a strange kind of ethics to see a charitable foundation as a way of paying both yourself and your wife a tax free six figure salary every year, and also as a way to funnel company profits offshore.1

Comments

-

Brian Shanahan wrote: »Erm, I wish they hadn't used Bill Gates as the example of an ethical atheist. It takes a strange kind of ethics to see a charitable foundation as a way of paying both yourself and your wife a tax free six figure salary every year, and also as a way to funnel company profits offshore.

Damn him for making money whilst doing good!0 -

Without knowing the specifics of the dodges you're talking about, don't these measures ensure that the tax bill of the charity is also minimised?Brian Shanahan wrote: »Erm, I wish they hadn't used Bill Gates as the example of an ethical atheist. It takes a strange kind of ethics to see a charitable foundation as a way of paying both yourself and your wife a tax free six figure salary every year, and also as a way to funnel company profits offshore.0 -

Better to the charity than the govt0

-

Brian Shanahan wrote: »Erm, I wish they hadn't used Bill Gates as the example of an ethical atheist. It takes a strange kind of ethics to see a charitable foundation as a way of paying both yourself and your wife a tax free six figure salary every year, and also as a way to funnel company profits offshore.

Only six figures!! I would have expected eight at least, poor man must be fading away with the hardship of it all.0 -

Brian Shanahan wrote: »Erm, I wish they hadn't used Bill Gates as the example of an ethical atheist. It takes a strange kind of ethics to see a charitable foundation as a way of paying both yourself and your wife a tax free six figure salary every year, and also as a way to funnel company profits offshore.

Gods damn him and his programme of inoculations!0 -

Advertisement

-

Without knowing the specifics of the dodges you're talking about, don't these measures ensure that the tax bill of the charity is also minimised?

It means that Bill Gates can use money that he should have paid for the services and priviliges (both direct and indirect) provided to him by the government (think education, health services, roads), both in the US and the third world countries his foundation makes money in, into companies like Exxon Mobil or Royal Dutch Shell. Their mantra is profit maximisation, when instead a good portion of their c.$60bn unallocated funds could be used in a socially responsible manner.

The deeper you look into the foundation's actions, the more worrying it gets. It frankly reminds me of the situation with the Commonwealth Development Corporation after it was privatised, where it essentially became an investment corporation putting money into well funded profitable ventures at the expense of its stated goal of funding development projects in developing nations.0 -

Wealthy people already pay multiples of an average salary in tax, and they certainly don't get mulitples of service for that tax.

And if you want to use it in a socially responsible manner, I think giving it to charity is far preferable than to govt schemes where it can be frittered away on "personal expenses" or campaigning or political favours or the rest of that nonsense

A well researched charity, that is, not the dodgy ones0 -

Wealthy people already pay multiples of an average salary in tax, and they certainly don't get mulitples of service for that tax.

If you actually believe that sentence I've a nice bridge in San Fransico I'd like to sell. Here's a picture.

For example here is Warren Buffet's tax bill from 2011, and may I remind you that unlike most rich people Buffet doesn't actually engage in tax dodging:Warren Buffet wrote:Buffett's adjusted gross income last year was $62,855,038

Buffett's taxable income last year was $39,814,784

Buffett paid $15,300 in payroll taxes last year

Buffett's federal tax bill came to $6,923,494, or 17.4% of his taxable income last year

Source here.

Private Eye has been banging on for years about how easy it is for the rich in the UK to ensure they've no taxes to pay. Here's a special report it ran in conjunction with Panorama. And if you think Ireland would be any different, I've also got some choice land to sell you in northern Ukraine.0 -

Here's a table which shows exactly what bluewolf has just said:Brian Shanahan wrote: »

Totting up quickly, 61% of the population earn under 35k and pay 5.5% of the nation's income tax

9.5% of the population earn over 75k and pay 60%.

0.5% earn more than 275k and pay 16.5% with an average income tax bill of 162k.

Hope this helps.0 -

Just get rid of tax altogether, forget about ability to pay.0

-

Advertisement

-

Brian Shanahan wrote: »It takes a strange kind of ethics to see a charitable foundation as a way of paying both yourself and your wife a tax free six figure salary every year, and also as a way to funnel company profits offshore.

Are you suggesting that his net personal wealth has increased overall as a result of setting up the foundation?0 -

Here's a table which shows exactly what bluewolf has just said:

<snip>

Totting up quickly, 61% of the population earn under 35k and pay 5.5% of the nation's income tax

9.5% of the population earn over 75k and pay 60%.

0.5% earn more than 275k and pay 16.5% with an average income tax bill of 162k.

Hope this helps.

There are two problems with the table which are immediately apparent:

1) You forget indirect taxes which are universally regressive, i.e. the poor pay a far larger share of their income in indirect taxes than the rich.

2) It does not take into account corporation, capital gains or other non PAYE type taxes, which is where most of the rich get their taxable income from (if its not offshored), all of which are at much lower rates than at PAYE rates. Seriously if you are earning enough to afford a half way decent solicitor and accountant, then there are myriad ways for you to reduce your tax bill to virtually nil (simply because worldwide pretty much every government over the last thirty years has moved tax evasion to tax avoidance, and declared tax avoidance to be a-ok).0 -

You're arguing about how taxes should be allocated against income. Which wasn't what you were talking about.Brian Shanahan wrote: »There are two problems with the table which are immediately apparent:

Your original statement implied that high-earners don't "pay multiples of an average salary in tax" as bluewolf claimed. That statement is easily and demonstrably false, so you should withdraw your silly reply about the Golden Gate. Or you can leave it stand if you still think that it adequately represents your views.0 -

Your original statement implied that high-earners don't "pay multiples of an average salary in tax" as bluewolf claimed. That statement is easily and demonstrably false, so you should withdraw your silly reply about the Golden Gate. Or you can leave it stand if you still think that it adequately represents your views.

Em.. when taxes (all taxes) paid as a percentage is considered middle and lower income earners pay most.

As regards taxes and other flat charges paid as a percentage of wealth the richer you are the less you pay.

Btw the lies that the rich don't get back near enough for the taxes they pay is a testament to the right-wing propaganda that people swallow and regurgitate.

Simply put the more you get out of society the more you owe it and should put back in. Don't listen to me though - listen to the 'capitalist' fanboy's favourite economist.The expense of government to the individuals of a great nation is like the expense of management to the joint tenants of a great estate, who are all obliged to contribute in proportion to their respective interests in the estate.

Adam Smith0 -

Money isn't just an accumulation of paper wealth, that can be transformed into real wealth, it is an accumulation of power over others in society, due to the legal/political advantages it provides (among more).

Earning Paying yourself craploads of money, in the cases of some CEO's extending to more than a hundred times the average salary (and I'm not talking about Ireland specifically), is giving yourself far more power over society than anyone can ever really justify.

Being paid greater and greater amounts of money isn't all 'earning' and benefiting society (two things which are by no means the same - and rarely ever in proportion with one another), it gets to a point where it is taking from society, greater and greater privilege for yourself - power over others which nobody can 'earn' or should have (even what little some of the wealthy give back in taxes, can often get redirected into 'charities' which they just use for political lobbying - the Koch's are big on this).

The least you can do is tax the crap out of that, while the wider problem remains unresolved - there must be some point, at which the power someone grants himself through money, becomes far more potentially harmful to society than beneficial? The only problem with defining that figure, is that it has to be unavoidably arbitrary.0 -

Join Date:Posts: 26436

KyussBishop wrote: »Money isn't just an accumulation of paper wealth, that can be transformed into real wealth, it is an accumulation of power over others in society, due to the legal/political advantages it provides (among more).

Indeed it is, the Vatican learned this one century's ago.The least you can do is tax the crap out of that, while the wider problem remains unresolved - there must be some point, at which the power someone grants himself through money, becomes far more potentially harmful to society than beneficial? The only problem with defining that figure, is that it has to be unavoidably arbitrary.

I agree,

But then we don't tax religious organisations, but then can get away with compensating victims.

Now thats very harmful to society 0

0 -

Join Date:Posts: 49856

the cycle to work scheme is a great scheme. but it has a curious side effect that in a general sense, the better off you are, the cheaper it is to buy a bike. if you are on the full rate, you save 52% of the value of the bike, but on the lower rate, you save 30%. and if you earn little enough to fall below the tax radar, there's no savings whatsoever.0 -

Charlie Rock wrote: »Simply put the more you get out of society the more you owe it and should put back in.

If we get the same education and a private business chooses to pay me more, how do I "owe more"?

If someone runs a business employing a load of people, giving them jobs at fair wages and benefits and helping local services and all sorts of positive knock on effects, what exactly do they "owe"?0 -

Which they pay back through tax and their employees pay through tax and so on. How does that mean they owe moremagicbastarder wrote: »they owe for the provision of infrastructure (both physical and logical) which helped them profit from their business, for a start.0 -

Advertisement

-

Being an atheist forum I'm amazed there's no mention of Religious orgs lack of tax contribution0

-

-

magicbastarder wrote: »i dunno, i didn't say they did.

do you mean 'more' in the sense that they owe more than they've already paid?

Well my earlier reply was to CR who said they did, and that's what I was questioning 0

0 -

Again, completely false, at least if you're referring to income tax. The 2009 table is here on page 6 if you want to do any calculations yourself. But here's what we get if we crunch the numbers:Charlie Rock wrote: »Em.. when taxes (all taxes) paid as a percentage is considered middle and lower income earners pay most.

From the last column, you can see that the more money you earn, not only do you pay more tax, but you pay it at a much higher percentage of your income too.

However, to reiterate for a second time, your original statement implied that high-earners don't "pay multiples of an average salary in tax" as bluewolf claimed. That statement is as false. As is your claim about the lower-paid paying a higher percentage of their salary as income tax.

Again, I hope this helps.0 -

Do you have any Irish statistics to back up either of your points?Brian Shanahan wrote: »There are two problems with the table which are immediately apparent:

1) You forget indirect taxes which are universally regressive, i.e. the poor pay a far larger share of their income in indirect taxes than the rich.

2) It does not take into account corporation, capital gains or other non PAYE type taxes, which is where most of the rich get their taxable income from (if its not offshored), all of which are at much lower rates than at PAYE rates. Seriously if you are earning enough to afford a half way decent solicitor and accountant, then there are myriad ways for you to reduce your tax bill to virtually nil (simply because worldwide pretty much every government over the last thirty years has moved tax evasion to tax avoidance, and declared tax avoidance to be a-ok).

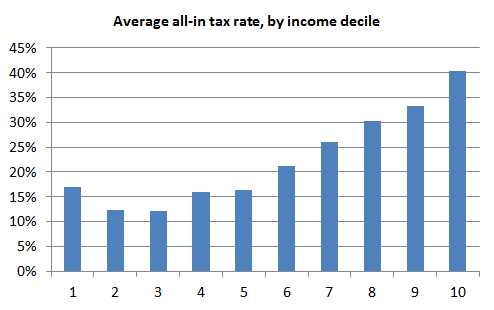

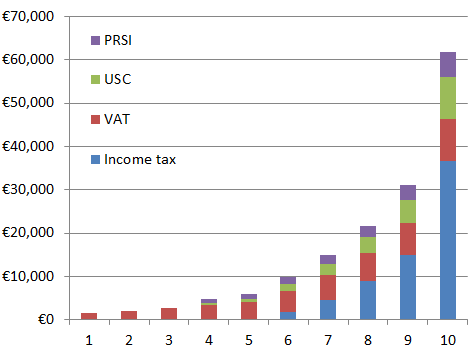

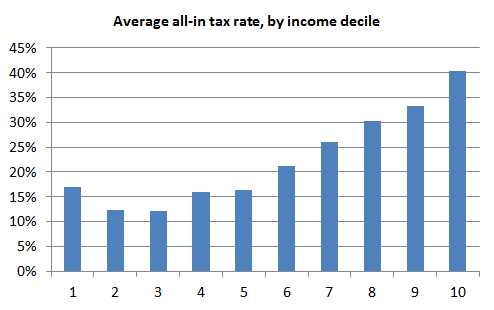

Google and Ronan Lyons suggest:

http://www.ronanlyons.com/2012/04/10/paying-tax-in-ireland-where-the-richest-and-poorest-pay/The .. graph below shows the all-in tax rate (across income tax, USC, PRSI and VAT) for each of the ten income deciles. It takes into account earned income and transfers/benefits – which as I’ve stated before I believe should be treated as any other income source, to level the playing field between work and welfare.

This includes transfers such as child benefit which help the poor proportionally more than the rich.

Taxes: 0

0 -

It's a simple matter of distributing the cost of taxes in a progressive way, not in proportion to who owes what; the more discretionary income someone has, the more they will shoulder the burden of the cost, so that we don't have a flat tax which disproportionately (as a percentage of income) puts the burden on lower socioeconomic classes, who more often need the money more, and have to work harder to earn a basic living (and since the wealthy have more access to tax evasion/avoidance abilities, that would result not in a flat tax, but a regressive tax system).Which they pay back through tax and their employees pay through tax and so on. How does that mean they owe more

If we had a system, where taxes were decoupled from government spending (using a system of non-debt-based money used for funding), then you could rewrite the tax system where taxes have no role in providing for government at all, but are used for roles such as: Promoting income equality, preventing excessive power through money, disincentivizing fraud, preventing pollution, encouraging/discouraging use of certain resources, preventing excessive inflation, among more.

In that system, I don't think it would be justified to tax income (or corporations) at all, except where it may get to the point, where people may gain excessive power through money (either personally or through corporations); but in the current system, someone has to pay for the upkeep of the state, and the primary fair way to do that, is to spread that burden more onto those who can spare more (who have greater discretionary income).

You could even argue, that since governments (outside of Europe) already have ability to access that alternative means of funding through non-debt-based money (with only a few political changes), that it's already outdated to view taxes as funding government - certainly gets people thinking of taxes in a much different way (if they are able to consider the idea without scoffing that is).0 -

Correct me if I'm wrong KB, but effectively what you're saying is that the amount of VAT one should pay should be proportionate to their income. So while Joe €30k pays 1c VAT on his pan of bread, James €1m pays 30c VAT on the same bread.

Doesn't that basically have this weird effect of devaluing the wealthier person's euro (or increasing the value of the poorer person's euro)?

So how do that work on the scale of an entire economy? If money is worth less the more of it you have, doesn't that lead to economic stagnation because of diminishing returns? That is, if I'm able to purchase the same amount of "stuff" at €40k as I am at €60k because of this floating VAT rate, what drive do I have to grow my business?0 -

I don't know where you get the VAT idea - I'm talking about tax as it relates to income, i.e. income tax.Correct me if I'm wrong KB, but effectively what you're saying is that the amount of VAT one should pay should be proportionate to their income. So while Joe €30k pays 1c VAT on his pan of bread, James €1m pays 30c VAT on the same bread.

Doesn't that basically have this weird effect of devaluing the wealthier person's euro (or increasing the value of the poorer person's euro)?

So how do that work on the scale of an entire economy? If money is worth less the more of it you have, doesn't that lead to economic stagnation because of diminishing returns? That is, if I'm able to purchase the same amount of "stuff" at €40k as I am at €60k because of this floating VAT rate, what drive do I have to grow my business?0 -

Advertisement

-

OK, I think I read your post wrong then;KyussBishop wrote: »I don't know where you get the VAT idea - I'm talking about tax as it relates to income, i.e. income tax.

You're talking about two systems;In that system, I don't think it would be justified to tax income (or corporations) at all, except where it may get to the point, where people may gain excessive power through money (either personally or through corporations)

1. The hypothetical one where we don't tax income except in the case of the mega-rich (so presumably we gather cash through things like VAT)

2. An adjustment to the current one where we "spread that burden more onto those who can spare more"

Isn't no. 2 exactly the system we have at the moment? Or are you saying that we should abolish all flat taxes and rely purely on income-related tax?

I'm not trying to refute any of your points, just trying to get clarity on what kind of system you're talking about.0 -

Yes, two systems - in the hypoethetical system, government isn't funded through taxes, but through non-debt-based (or rather, debt-free) money, and taxes are used for purposes other than funding, like some I mentioned in my previous post (the actual money from taxes gets permanently removed from circulation, since it isn't needed for funding anymore).OK, I think I read your post wrong then;

You're talking about two systems;

1. The hypothetical one where we don't tax income except in the case of the mega-rich (so presumably we gather cash through things like VAT)

2. An adjustment to the current one where we "spread that burden more onto those who can spare more"

Isn't no. 2 exactly the system we have at the moment? Or are you saying that we should abolish all flat taxes and rely purely on income-related tax?

I'm not trying to refute any of your points, just trying to get clarity on what kind of system you're talking about.

I just brought that up, as it is interesting in how you completely redefine the purpose of taxes when you look at the economy that way; it is no longer funding government, and it also makes income/corporate taxes unjust (except to prevent excessive power through wealth).

I think looking at it that way, makes a hell of a lot more sense, than looking at taxes as funding government - and gives deeper understanding of their purpose.

My point about the current system though, isn't really proposing any changes to it, just pointing out reasons why it's a progressive tax system, and how the justifications for that kind of a tax system, aren't related to some people 'owing' more, and others less etc..

Overall, I base my views on the hypothetical system: I think we should be in that system, and that there shouldn't really be any income/corporate taxes, except where it's needed to prevent excessive power through wealth).0 -

You want the state to print money to fund everything is what I've gathered from elsewhere.KyussBishop wrote: »government isn't funded through taxes, but through non-debt-based (or rather, debt-free) money, and taxes are used for purposes other than funding,

The outcome of that is hyperinflation.0 -

To print and destroy money, not to print print print endlessly. If you claim that (both printing and destroying - keeping the overall amount of money in the economy static or growing slowly) causes hyperinflation, you need to prove it.Deleted User wrote: »You want the state to print money to fund everything is what I've gathered from elsewhere.

The outcome of that is hyperinflation.

Note, that practically all historical examples of hyperinflation, are either printing endlessly (with no destruction of money, i.e. no removal from circulation), or are coupled with massive physical destruction of economies, preceding the hyperinflation.0 -

I'm not. I also note that you aren't denying that printing money endlessly will create hyperinflation.KyussBishop wrote: »If you claim that (both printing and destroying - keeping the overall amount of money in the economy static or growing slowly) causes hyperinflation, you need to prove it.

Can you give us any examples of your suggestion in action?KyussBishop wrote: »Note, that practically all historical examples of hyperinflation, are either printing endlessly (with no destruction of money, i.e. no removal from circulation), or are coupled with massive physical destruction of economies, preceding the hyperinflation.

Nominally what you seem to be suggesting - releasing cash in bad times and hoarding it in good times could be described as Keynesianism (Edit: If you used taxes to gather back the cash) The problem is having the discipline to stick to it in the good times.

I can imagine a Governor of a Central Bank somewhere ringing the Minister for Finance saying - I think we have printed enough cash now - it is time to fire up the furnace and start destroying peoples valuables - the Governor would be the only one getting fired.0 -

Deleted User wrote: »

Interesting that it stops at the lower 40%.

See, the further up that slope you get the more likely it is you'll have assets other than income that are not considered; second homes, stocks and shares, trust funds, imaginative accountants, antiques, non-domiciles avoiding tax etc. Using income tax as a gauge of who pays for what and who benefits most from their taxes is dumb.Deleted User wrote: »You want the state to print money to fund everything is what I've gathered from elsewhere.

The outcome of that is hyperinflation.

It would be preferable to printing it and handing it over to the fucks who trashed the economies the were raking it in from but that would mean the 'masters of mankind' would not have control of the money.0 -

Advertisement

-

Okey, though if you're not claiming that, then what you claim will cause hyperinflation, is not the policy/view I am advocating.Deleted User wrote: »I'm not. I also note that you aren't denying that printing money endlessly will create hyperinflation.

Specifically, printing it past the point of full employment, will push inflation, yes (if you look at how inflation is defined and how it works, full employment becomes the limit to spending).

The island of Guernsey does a version of it, here is an article on it (the author is no less than a Libertarian too):Deleted User wrote: »Can you give us any examples of your suggestion in action?

Nominally what you seem to be suggesting - releasing cash in bad times and hoarding it in good times could be described as Keynesianism (Edit: If you used taxes to gather back the cash) The problem is having the discipline to stick to it in the good times.

I can imagine a Governor of a Central Bank somewhere ringing the Minister for Finance saying - I think we have printed enough cash now - it is time to fire up the furnace and start destroying peoples valuables - the Governor would be the only one getting fired.

http://kentfreedommovement.com/profiles/blogs/the-magic-isle-of-guernsey-by-bill-still-director-of-the-best-doc

It's a policy currently being advocated by the Post-Keynesian school; basically:

In bad economic times: Reduce taxes, increase spending (helps deleverage private debt and boost aggregate demand, to reinflate private sector)

In good economic times: Increase taxes, reduce spending (to pull back from inflation)

It's possible for government to mismanage it alright, yes, but if it's managed correctly it provides far better options for both avoiding economic crisis, and resolving economic crisis.0 -

-

Ya that is pretty much it: It's also the difference between undemocratic private control over money creation (effectively in the hands of private banks, who as we have seen, heavily abuse the privilege), and democratic public control over money creation, in the hands of government (who may still grant private banks the ability to make limited use of it - there are a lot of ways to configure the system).Charlie Rock wrote: »It would be preferable to printing it and handing it over to the fucks who trashed the economies the were raking it in from but that would mean the masters of the Universe would not have control of the money.

It's a bit insane really, that when governments go into debt to provide public funding, they are often borrowing that money from banking/finance institutions, that created the money out of nothing (a privilege provided by government), and paying it back at interest; just cut-out the middle-man, and almost all right-wing economic narrative dies overnight.

It's funny/sad that the monetary system and money itself, is simultaneously the most important and least understood part of all economics.0 -

Charlie Rock wrote: »The infrastructure and apparatus of the state serves you more the more you have (and the more you have to lose).

That's just repeating yourself without answering the question...0 -

-

Advertisement

-

Perhaps the reasoning for such a position?If we get the same education and a private business chooses to pay me more, how do I "owe more"?

If someone runs a business employing a load of people, giving them jobs at fair wages and benefits and helping local services and all sorts of positive knock on effects, what exactly do they "owe"?

It depends, I'm not a fan of income brackets as they don't detail basic cost of living in the area of residence. One person could be earning €50k are year but paying pretty much all that in accommodation costs. Another could be earning €35k per year and living in an area with a very low cost of living that they can easily afford to invest €5k a year in property elsewhere. Or another person may be on €100k a year but require €15k alone a month in medical expenses. Ok, those are extreme examples but I hope they illustrate the flawed principle of income thresholds. Ideally, what a person would "owe" would be based on their financial quality of living, not income. In your specific question whether or not you owe more would depend on where that private business is based and how much of a better quality of life and finances it provides you.

I wouldn't really consider employing people as giving something back to society. Employees are very often a necessity for any business. Without them the business can't grow. If the business can't afford to have employees, it won't. If it needs to cut back on them, it well. All the while every effort will likely be made to keep their personal income consistent or increasing. Yes, it's great that the person started the business but that person isn't really giving back to society. They're just using society to make money for themselves and as an indirect mechanism of that goal they're employing people but nothing's really coming from their own pocket. Society, and its structure, has helped them prosper and all they've done is utilised its financial viability. I do believe they should give back more to help make society better. As there is the possibility that the standard of living for some of their employees may not be that great. As I said previously wages aren't everything. However, there is a caveat there too. Some business owners are worse off than other people working for other companies. So this paragraph mostly applies to business owners who happen to have high standard of life and quality of income.

So as to what do they owe? That's a difficult question but I guess the viewpoint I would have is that if you have benefited from society you should give something back. The more you have, the more you should proportionally give back. Charity is nice but it requires voluntary donations, so I do think taxes are most the pragmatic way to go. A person has prospered through effort, luck and circumstance to the higher echelons of society. It should never be forgotten that if society didn't exist the way it did they might never have got to where they were in the first place. Equally important is the fact that they're dependent on society to keep them there. Others in society who may have tried just as hard as them, or harder, may be stuck forever in a financial trap until the state or a charity lifts them out of it. Generally speaking a charities will mostly focus on people at breaking point. Others may not be stuck in dire straits but they may still be caught in a financial trap whereby barring a complete change of fortune they're stuck on the same financial quality of life until they die. A simple incentive from a state/charity may be enough to get them to learn a new skill or start a successful business. (:P) This is why I believe those with better financial quality of life should give something back, to help others move into higher brackets too. The more that move into the higher brackets the more that can help others to move into higher standards of living and the more society progresses for the betterment of everyone.

To be honest, I think this is as much an economic argument as it is an ethical and philosophical one.0 -

Ya this is a good point - too often you hear the lionizing of 'entrepreneurs' and business leaders, forgetting that the business is made up of and run first and foremost by the workers, with the leadership and owners often contributing far less to the organization, than their salary is worth.I wouldn't really consider employing people as giving something back to society. Employees are very often a necessity for any business. Without them the business can't grow. If the business can't afford to have employees, it won't. If it needs to cut back on them, it well. All the while every effort will likely be made to keep their personal income consistent or increasing. Yes, it's great that the person started the business but that person isn't really giving back to society. They're just using society to make money for themselves and as an indirect mechanism of that goal they're employing people but nothing's really coming from their own pocket. Society, and its structure, has helped them prosper and all they've done is utilised its financial viability. I do believe they should give back more to help make society better. As there is the possibility that the standard of living for some of their employees may not be that great. As I said previously wages aren't everything. However, there is a caveat there too. Some business owners are worse off than other people working for other companies. So this paragraph mostly applies to business owners who happen to have high standard of life and quality of income.

For a lot of business, it's certainly a case of taking far more than they put in, and often taking disproportionate credit for the business success, generated primarily by the employees hard work.

I don't think, personally, that this is justification for higher taxation at a certain income bracket level though (though it's still an observation worth making/highlighting); that would be punishing the genuinely deserving business managers/directors, along with the ones who reward themselves disproportionately.0 -

They're just using society to make money for themselves and as an indirect mechanism of that goal they're employing people but nothing's really coming from their own pocket.

Having owned and run small businesses for most of my working life, with many friends who are also in similar positions, I'd say your point above is typically not the case. Typically a small business will take on debt to get started up, and the banks will demand directors guarantee that debt. At the same time they take on employees. Where things go well, they try to pay off the debt and accumulate surplus. They then use this to take on more debt, more employees, and grow. For a lucky few, they sell the business, make big bucks and either retire, or start all over again. In the boom years 35%-40% of small businesses in Ireland failed in the first four years of trading. With the recession, the attrition rate is much higher and many established businesses are also failing. Typically, when businesses fail, they fail while carrying debt, which is passed on to the directors with personal guarantees. The two principal sources of this debt, in order, tend to be salaries paid and rent. So in fact, the money for employees salaries often does come out of their own pocket. Notably, in addition to the bank, the principal debtor is often the revenue, or state if you prefer, who are about as pleasant to deal with as an angry pit bull.

You also have businesses such as my own that manufacture in Ireland and sell entirely to the export market. A small economy such as Ireland needs to take money in from outside to survive, and employers who export contribute significantly more to the economy and hence society than taxes. Another way of looking at this is that the money for salaries I've paid over the last decades have not come from our society, but they benefit our society.So as to what do they owe? That's a difficult question but I guess the viewpoint I would have is that if you have benefited from society you should give something back.

Before totting up the bill, you might want to ask what they are due back. Worth noting for the self employed business person who can't keep things afloat there is no dole, there's no medical card, in fact they're often in a far more precarious position than someone who has never worked a day in their life, or contributed in any meaningful way to society financially.So this paragraph mostly applies to business owners who happen to have high standard of life and quality of income.

Very few business owners are successful without having to work extraordinarily hard over many years. At that, the vast majority are only moderately successful. Most self employed small business people consider themselves bled dry by the state for very little return.

(Phew, rant over, all better now ) 0

) 0 -

And business is a necessity for society. Businesses are only in business when they give people what they want or need. If society doesn't want or need your product, you don't have a business.I wouldn't really consider employing people as giving something back to society. Employees are very often a necessity for any business.

They exist to facilitate trade all over the place beyond what your neighbours have, there are plenty offering competition and options and products.

Completely disagree as outlined above.but that person isn't really giving back to society.

In addition to the above, what else is a job to many people?They're just using society to make money for themselves

People "use" jobs they often don't give a damn about to get money. Businesses "use" employees to continue on. Both exchange their skill and money in a trade...

Firstly, it's not about pocket, it's about skill. It's about some of those things where you say "I could have done that", but you didn't take the time or effort or research to go and do it. Or maybe you couldn't have. Someone put in a lot of effort, innovation, skill, creativity to find out what the market wants or needs, or to make advancements, and went out and did it.and as an indirect mechanism of that goal they're employing people but nothing's really coming from their own pocket.

It's a different thing entirely to showing up and doing your 9-5 and switching off again.

Secondly, I'm sure plenty does from start up capital, personal liability backing, taxes, etc.

How would society have progressed with technological advancements, consumer products, and so on? How would we be having this discussion without those selfish business people? How long would it take to cook dinner, how would we be washing clothes, and so on and so forth?Society, and its structure, has helped them prosper and all they've done is utilised its financial viability. I do believe they should give back more to help make society better.

Without business and innovation, we'd be way back.

We get a lot out of business. How is society not better as a result of all these products we have? This morning, I used a treadmill, listened to my ipod, drank an energy drink. Now I'm in work doing work I shudder to think how long it might have taken 100 years ago. What's not better about all these things?

And vice versa!It should never be forgotten that if society didn't exist the way it did they might never have got to where they were in the first place.

I hope you will find this an interesting read:

http://www.forbes.com/sites/harrybinswanger/2013/09/17/give-back-yes-its-time-for-the-99-to-give-back-to-the-1/

It's interesting we're having this discussion on a thread about taxes. A government uses the labour of people to take some of their income and spend it as it sees fit. It uses the people to keep it accustomed to its standard of living - making lots of money for itself - while claiming it knows best, and backs that up with power.

It barely keeps things running along using the fact these structures are already long in place and are almost never reformed.

Contrast that to a business which is very immediately answerable to the people: if we disagree, we will boycott, we will stop buying your product, and you will go out of business.0 -

Startups are a different scenario though - certainly, that can be a lot of very hard work, with a lot of risk (including significant personal risk in the case of directors guarantees), deserving of significant reward for success.Having owned and run small businesses for most of my working life, with many friends who are also in similar positions, I'd say your point above is typically not the case. Typically a small business will take on debt to get started up, and the banks will demand directors guarantee that debt. At the same time they take on employees. Where things go well, they try to pay off the debt and accumulate surplus. They then use this to take on more debt, more employees, and grow. For a lucky few, they sell the business, make big bucks and either retire, or start all over again. In the boom years 35%-40% of small businesses in Ireland failed in the first four years of trading. With the recession, the attrition rate is much higher and many established businesses are also failing. Typically, when businesses fail, they fail while carrying debt, which is passed on to the directors with personal guarantees. The two principal sources of this debt, in order, tend to be salaries paid and rent. So in fact, the money for employees salaries often does come out of their own pocket. Notably, in addition to the bank, the principal debtor is often the revenue, or state if you prefer, who are about as pleasant to deal with as an angry pit bull.

The problem lies more in established businesses, particularly larger enterprises and corporations, where the financial security of the company is reasonably established, and for the directors, it can become more about extracting money for themselves from the company, far beyond what they put into it themselves personally.

A valuable business like that, certainly deserves a large reward for getting it started up and running sustainably (and that reward should proportionally go to the workers who make it a success) - and moreso if there are a lot of unique difficulties/challenges that make keeping it running very difficult, and the people running the company are skilled/proficient at dealing with that.You also have businesses such as my own that manufacture in Ireland and sell entirely to the export market. A small economy such as Ireland needs to take money in from outside to survive, and employers who export contribute significantly more to the economy and hence society than taxes. Another way of looking at this is that the money for salaries I've paid over the last decades have not come from our society, but they benefit our society.

In a lot of companies though, people in leadership kind of take the piss they might be crap managers/directors who have just worked their way up the ladder, or are just lucky enough to have been there at the start and aren't contributing to the company in line with their salary/bonuses anymore.

they might be crap managers/directors who have just worked their way up the ladder, or are just lucky enough to have been there at the start and aren't contributing to the company in line with their salary/bonuses anymore.

There may also be perverse financial incentives in many corporations/companies, such as for short-term profits, where actions that are destructive to society (pollution, lawbreaking/fraud, in finance - inflating asset bubbles) are encouraged, because they can be used to boost company profits, particularly short-term profits (often at the expense of long-term financial sustainability: see the banks), which result in shareholders boosting directors salary/bonuses for 'doing a good job'.

The banking/financial industry took out our entire economy by doing this, massively boosting short-term profits which allowed directors/higher-ups to rake-in salaries/bonuses in the present (employees greatly benefited in salaries/bonuses too, though without being in the position of control), and walked away from the destruction/collapse that they knew they were creating, with no consequences personally, as very wealthy people (even making all the rest of us pay for it all...).

Those perverse incentives are still in place, and it will happen again.

That said, I don't think these arguments are usable to justify higher taxation (which is why I don't personally try to justify it along these lines - there are other good reasons to); if you used the examples of undeserved profits to boost taxation, you'd just be engaging in collective punishment for those who genuinely deserved those profits.

Roads, power infrastructure, water/sewage systems, public transport, legal system, ports/harbours/airports/railways you use for transporting/exporting goods etc?Most self employed small business people consider themselves bled dry by the state for very little return.

(Phew, rant over, all better now )

)

Like the workers who do the actual hands-on running of companies, I think that what the state provides, are both vastly underrated and their significance underplayed.

I actually disagree with taxing income and companies though (you could consider it, in a way, a disincentive for work/business, which is not good), just don't think it's practical to avoid in the current economic/monetary system.0 -

Put simply: Their earnings should be in line with what they actually contribute to society.

In addition to the above, what else is a job to many people?They're just using society to make money for themselves

People "use" jobs they often don't give a damn about to get money. Businesses "use" employees to continue on. Both exchange their skill and money in a trade...

They should not be allowed to inflate the importance/significance of their contribution, as a justification for inflating their earnings.

Startups are different to established business, with stable finances though - I agree personally, that successful startups, deserve high rewards.Firstly, it's not about pocket, it's about skill. It's about some of those things where you say "I could have done that", but you didn't take the time or effort or research to go and do it. Or maybe you couldn't have. Someone put in a lot of effort, innovation, skill, creativity to find out what the market wants or needs, or to make advancements, and went out and did it.

It's a different thing entirely to showing up and doing your 9-5 and switching off again.

Secondly, I'm sure plenty does from start up capital, personal liability backing, taxes, etc.

The workers within the company produce these things, not the 'entrepreneurs' as is the common theme - a good idea is useless without the workers who make it a reality and manufacture/sell/distribute the end product.How would society have progressed with technological advancements, consumer products, and so on? How would we be having this discussion without those selfish business people? How long would it take to cook dinner, how would we be washing clothes, and so on and so forth?

Without business and innovation, we'd be way back.

We get a lot out of business. How is society not better as a result of all these products we have? This morning, I used a treadmill, listened to my ipod, drank an energy drink. Now I'm in work doing work I shudder to think how long it might have taken 100 years ago. What's not better about all these things?

Most of the time these ideas are generated by researchers within the companies as well, not by the directors.

That's a prime example, of giving the higher-ups of companies undue credit, that is owed to the workers of a company.

When you consider that money is earned a result of labour, you see that corporations/business do the exact same thing, by taking workers labour/efforts, generating massive profits that often go disproportionately to management/directors (because of their power in the corporate hierarchy - in many cases to maintain their inflated standard of living - with the myth that 'they know best', as if it's a meritocracy, when often there is no competition for their jobs), that for a lot of companies should be going more to the workers (whose wages often get pushed down over time, often despite plenty of company profits).It's interesting we're having this discussion on a thread about taxes. A government uses the labour of people to take some of their income and spend it as it sees fit. It uses the people to keep it accustomed to its standard of living - making lots of money for itself - while claiming it knows best, and backs that up with power.

It barely keeps things running along using the fact these structures are already long in place and are almost never reformed.

Contrast that to a business which is very immediately answerable to the people: if we disagree, we will boycott, we will stop buying your product, and you will go out of business.

That's not just a slice of your wages, that's your everyday working life and all your labour, under the control of the company you work for - that's a lot of power for directors/management, and that's a lot of extraction of your efforts/time for their benefit (which if you're lucky, you'll see a proportionate amount back in good wages - for a lot of people in the world, this is not the case).

You also can't boycott a company that has a large enough share in a market, as many large corporations do - boycott's are ineffective unless a company does something particularly egregious, that generates a ton of negative publicity (even then, they'll probably survive).0 -

Perhaps the reasoning for such a position?

I wouldn't really consider employing people as giving something back to society. Employees are very often a necessity for any business. Without them the business can't grow. If the business can't afford to have employees, it won't. If it needs to cut back on them, it well. All the while every effort will likely be made to keep their personal income consistent or increasing. Yes, it's great that the person started the business but that person isn't really giving back to society. They're just using society to make money for themselves and as an indirect mechanism of that goal they're employing people but nothing's really coming from their own pocket. Society, and its structure, has helped them prosper and all they've done is utilised its financial viability. I do believe they should give back more to help make society better. As there is the possibility that the standard of living for some of their employees may not be that great. As I said previously wages aren't everything. However, there is a caveat there too. Some business owners are worse off than other people working for other companies. So this paragraph mostly applies to business owners who happen to have high standard of life and quality of income.

To be honest, I think this is as much an economic argument as it is an ethical and philosophical one.

Anyone remember the turnout in Cavan (I think) for Sean Quinn? There was a rally of supporters, who voiced their opinion that he was some sort of humanitarian, providing jobs for the locals, out of the goodness of his heart.

Simple fact is, demand was high for his services (insurance), and this extra business would have went elsewhere, had he not hired any more people. Customers are job creators! No customers, no jobs.

If employer A has 10,000 employees, and employer B has 30 employees, who would you think is worth more? It's got nothing to do with 'creating jobs', as they like to pretend, but growing their wealth.

First you get the business, then you get the money, then you get the POWER! (See: The Vatican, Denis O'Brien, Koch bros, Rockefellers, . . . )

Personally, I don't trust any human with too much wealth and power. (See: Kim Jong Dynasty, Hitler, Stalin, Louis Walsh)Brian Shanahan

unlike most rich people Buffet doesn't actually engage in tax dodging:

The Buffett Rule.The Buffett Rule is part of a tax plan proposed by President Barack Obama in 2011.[1] The tax plan would apply a minimum tax rate of 30 percent on individuals making more than a million dollars a year.[2][3] According to a White House official, the new tax rate would directly affect 0.3 percent of taxpayers

Paul Krugman, a New York Times columnist and Nobel prize winning economist, wrote in January 2012 that "such low taxes on the very rich are indefensible".[20] He stated that "the economic record certainly doesn’t support the notion that superlow taxes on the superrich are the key to prosperity" asserting that since the U.S. economy added 11.5 million jobs during President Bill Clinton's first term, when the capital gains tax rate was over 29 percent, he thinks there's no real reason to keep from raising the tax rate.[21]

A CBS News/New York Times poll released in January 2012 found that 52 percent of Americans agreed that investments should be taxed at the same rate as income.

Nearly every Republican congressman opposed the proposal. Representative Paul Ryan (R–Wis.), who is the chairman of the House Budget Committee, criticized the new tax provisions. He labeled it as class warfare and also stated that it would negatively impact job creation and investment.[25] Senate Minority Leader Mitch McConnell (R–Ken.) said the conditions of the U.S. economy were ill-disposed to raising taxes.[26] House Speaker John Boehner (R–Ohio) has spoken against the proposed rule and said that, "there's a reason we have low rates on capital gains ... because it spurs new investment in our economy and allows capital to move more quickly."

If Ryan, McConnell and Boehner are against it, then it must be good for the country and the people, (99%), unless you're a believer in 'trickle down economics'.0 -

(Phew, rant over, all better now

)

)

Rant away.:) For the majority running a business is really fecking tough. Their situation is rarely different from a large proportion of employees for other companies. I added the important caveat for a reason. A very large proportion of businesses and employees are in the same boat. Those aren't the people I'm talking about when I say "owe something to society".

As a side note, medical card should be based on quality on health not income.0 -

And business is a necessity for society. Businesses are only in business when they give people what they want or need. If society doesn't want or need your product, you don't have a business.

They exist to facilitate trade all over the place beyond what your neighbours have, there are plenty offering competition and options and products.

In addition to the above, what else is a job to many people?

People "use" jobs they often don't give a damn about to get money. Businesses "use" employees to continue on. Both exchange their skill and money in a trade...

Firstly, it's not about pocket, it's about skill. It's about some of those things where you say "I could have done that", but you didn't take the time or effort or research to go and do it. Or maybe you couldn't have. Someone put in a lot of effort, innovation, skill, creativity to find out what the market wants or needs, or to make advancements, and went out and did it.

It's a different thing entirely to showing up and doing your 9-5 and switching off again.

Secondly, I'm sure plenty does from start up capital, personal liability backing, taxes, etc.

How would society have progressed with technological advancements, consumer products, and so on? How would we be having this discussion without those selfish business people? How long would it take to cook dinner, how would we be washing clothes, and so on and so forth?

Without business and innovation, we'd be way back.

We get a lot out of business. How is society not better as a result of all these products we have? This morning, I used a treadmill, listened to my ipod, drank an energy drink. Now I'm in work doing work I shudder to think how long it might have taken 100 years ago. What's not better about all these things?

It's interesting we're having this discussion on a thread about taxes. A government uses the labour of people to take some of their income and spend it as it sees fit. It uses the people to keep it accustomed to its standard of living - making lots of money for itself - while claiming it knows best, and backs that up with power.

It barely keeps things running along using the fact these structures are already long in place and are almost never reformed.

Contrast that to a business which is very immediately answerable to the people: if we disagree, we will boycott, we will stop buying your product, and you will go out of business.

I find it hard to believe that Bill Gates wouldn't have bothered coming up with Windows, had the tax been a little higher, nor Steve Jobs. There's also plenty of gifted individuals designing free software all the time. Maybe they don't feel the need to be wealthy. A decent income, kudos and the good feeling from giving is enough for some. Although, I'm not sure how many jobs they can create.

Right now America's infrastructure is in dire need of investment and repair. Personally, I know of no other country which abhors the idea of taxes more than Americans. As far as they are concerned, countries like Sweden are practically communist ,devoid of any 'freedom'. They might change their mind fairly sharpish, if their car plunged into a river along with a segment of neglected bridge, found themselves rescued, only to be lumped with a massive hospital bill.

Only recently, Ted 'Tea Party' Cruz (R) was interviewed on 'Meet the Press', saying; "If you want health insurance, just get a job." Whatever money this pawn earns, it certainly pales in comparison to his donors (Koch bros). I think this utter contempt for those hard workers laid off, and the working ones who still can't afford health insurance, goes some way to explaining why the upper class are viewed with suspicion and hatred.

GOP politicians like to repeat this mantra; "if you're not rich, you're lazy." Hence Romney-Ryan were known as the candidates for the 1%. Romney had plenty of offshore bank accounts, he even had money here. A massive part of the 2012 campaign was Romney's refusal to release his tax returns. It was obvious to anyone that he had ways of avoiding paying tax. Does less than 14% sound like a nice figure?

Like a lot of wealthy men, Romney was born into a well off family, which is a handy start in life. I don't begrudge him one bit. I've never wanted to be a magic underwear wearing, Mexican Mormon. . . . . well maybe once.

Here's the wealthiest person in Australia; Gina Rinehart.According to the world’s richest woman, low-income people are only poor because they don’t work hard enough, and because the government has coddled them with a minimum wage that is too high. Australian Gina Rinehart, who inherited her $30 billion fortune, said, “If you’re jealous of those with more money, don’t just sit there and complain. Do something to make more money yourself — spend less time drinking or smoking and socialising, and more time working”

This old chestnut again. Not wealthy = lazy. Nothing to do with geography, circumstances of birth, health, opportunities etc. Isn't there some sort of delicious irony, when a very large woman calls people lazy? She was handed a fortune on a golden plate, for jaysus' sake.

This post is taking way too long, so I just want to say that I have massive respect for small business owners. My beef is with the 1%, who caused this recession, amongst other sh*tstorms. (but that's another thread/ forum)0 -

JFC Atlas shrugged in an adult debate? Time for the 99% to give back to the 1%?

What a truly perverse and vile religion 'objectivism' is.

I was wondering if this thread could escape turning into a libertarian circle jerk.

Btw Bill Gates is a rich man from taking other people's ideas and then building an aggressively protected, state granted, monopoly around them. As for the 'the internets was a gift from Capitalism' well that's just bullshit propaganda. The internet, like a lot of modern technology, came from the publicly funded institutions and universities.0 -

Advertisement

Advertisement