Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi all! We have been experiencing an issue on site where threads have been missing the latest postings. The platform host Vanilla are working on this issue. A workaround that has been used by some is to navigate back from 1 to 10+ pages to re-sync the thread and this will then show the latest posts. Thanks, Mike.

Hi there,

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

Paradise papers

Comments

-

Wanderer78 wrote: »thank god for 'trickle down', shur we d be screwed if it wasnt for that!:D

We would.

Most people in ireland have a good quality of life with jobs from major companies investing here.

Im grateful for that.0 -

Wheeliebin30 wrote: »Wanderer78 wrote: »thank god for 'trickle down', shur we d be screwed if it wasnt for that!:D

We would.

Most people in ireland have a good quality of life with jobs from major companies investing here.

Im grateful for that.

That's not trickle down economics.that's called a job.those companies get a well educated work force,stable country politically and low crime.all financed by the government and tax payer.0 -

That's not trickle down economics.that's called a job.those companies get a well educated work force,stable country politically and low crime.all financed by the government and tax payer.

You really don't think that companies would be here if the corporation tax doubled, but all those other factors remained?

I know the place I work re-located here for three reasons:- The low rate of corporation tax

- The weakness of the Euro (at the time)

- As a hedge against Brexit (that turned out to be quite prescient)

Since Brexit, even with the strengthening of the Euro, all the growth in the firm has been in Dublin (at the expense of the UK end of the operation). So yes, the firm may be getting a generous tax rate but there are several dozen people working in it paying income tax, USC, etc than would otherwise be the case - never mind the amount we've spent on leases, office fitout, equipment, vehicles etc0 -

Our 12.5% corporation tax is a bit of a sham. In reality it can equate to a lot less than that. At best we are facilitating tax avoidance on a huge scale and in some cases it seems to be a case of tax evasion masquerading as tax avoidance.

This is why an EU wide response is needed. If Ireland acts unilaterally, these companies will move their operations to another EU country. These companies should also be forced to pay tax on where sales are carried out. To do business in the EU they should have an office in every country and sales should be booked to that country. A lot of bureaucracy but a necessary evil to stop them avoiding tax.0 -

Ahh FFS stop trying to lay it on so thick.

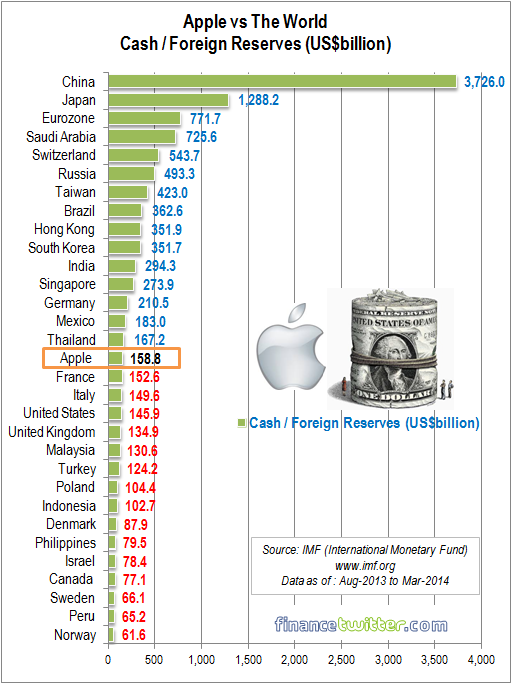

There are cash reserves and there are Apple's cash reserves which are as much as those of a pretty rich country.

It makes perfect business sense to protect profits. So they have been wildly successful over the past decade, not their fault. And it isn't just Apple who do this. 20 years ago Apple almost went bankrupt. It took a loan from rivals Microsoft to prevent that. When you are that close to going out of business, I am sure it would spur a company to prevent that ever happening again.

How about General Electric? (circa $119 billion at the end of 2015 in cash, dwarfing Apple). They just posted a pretty sh*t quarter. There are calls for them to cut their dividend which was unthinkable. It is currently selling off divisions that are valued less than $25 billion. Bet the company is glad it has some cash to weather the current climate it finds itself in. The GE Capital division almost took them down in 2008/2009. Cash is king. These are huge companies with complex operations. Their tax system is as complex as a result.

GE is an industrial. A stodgy, blue chip. Apple is a tech company. The history of tech businesses are littered with once huge companies that became extinct or obsolete. Polaroid. Blackberry. To maintain a cash pile is business sense. Such cash will help them survive, merge with other companies, acquire other emerging tech companies to remain current. That's just business sense.

I mentioned “foreign reinvested earnings”. There is estimated to be over $2 trillion dollars under such arrangements. Microsoft ($108 billion), Apple ($91 billion), Pfizer ($74 billion), IBM ($61 billion), Merck ($61 billion), Cisco ($58 billion), Johnson & Johnson ($53 billion), Exxon Mobil ($51 billion), and Google ($47 billion). *Figures are from December 2015 note.

Here's a list from 2014.

http://www.auditanalytics.com/blog/wp-content/uploads/2015/04/IRE-April-20151.png

As a side note, the criticism of such companies is a political question. If a country can waste $1.5 Trillion dollars on a fighter jet (F35) that doesn't actually work then it's no surprise to me that global companies would rather give an unpatriotic middle finger to the IRS and the exorbitant rate of tax needed to pay for such follies. So $2 trillion is kept overseas while $1.5 trillion is squandered on a failed fighter. I guess if there were more prudent expenditure of tax dollars then some arrangement could be sought to repatriate some of that $2 trillion. My guess is that the zeal to attack these companies, labeling them unpatriotic tax dodgers, is to help pay for some of that absolute stupidity.

That tax code is made for the industrial age. It's the digital age now and the code needs to change to be more sensible to that end. 35% is exorbitant when dealing with billions so it's no surprise companies look to protect profits. I think that's how Buffet and Berkshire Hathaway became so big. They very rarely sell their holdings. To do so would incur enormous capital gains tax, which is when you think about it just a stupid thing to do in such a position. They simply let the historical investments made in Coke, Geico, Amex etc compound. The maths simply makes them grow. Any company whether it's a local shop or a multinational should always look to reduce expenses of which Tax is one expense. That's business sense.0 -

I'd love not to pay taxes and maintain a cash pile too for the rainy day.

Cash pile is just a fancy way of saying I'm greedy and don't believe in paying my fair share of tax.0 -

This post has been deleted.0

-

Wheeliebin30 wrote:We would.

Hahaha, I love it. Keep it up, great entertainment!

You do realise, we 're actually creating a 'rentier class' which includes large corporations, financial institutions etc etc, effectively creating a 'trickle up' effect, and the only thing truly trickling down is debt!0 -

This post had been deleted.

Well these other European countries with lower rents, will have lower rents until the IT companies move in, if they do, but most don't. Personal tax is high everywhere in Europe, companies dont care about weather and the food is fine here. Also English speaking.The Hays 2016 Global Skills Index ranks Ireland very poorly in terms of the gap between the skills workers have and the skills that employers demand. A policy of compulsory Irish in schools means that the Irish do not study foreign languages from early childhood, as people do in other European countries -- and so companies like Facebook, Google, and PayPal have to import a high percentage of their workers from elsewhere in Europe anyway.

They import native speakers for those jobs so that is moot, it just gets your high horse about Irish out again. And the PISA results for Ireland are above the OECD average. And thats a legitimate test not a recruitment site.

Edit:

I looked into that test, Ireland does best for educational flexibility out of all the countries I checked. Of course there are still skill shortages, or a talent mismatch. Thats because employers dont want to train anymore, particularly in IT. I got a job demanding five years experience in the iPhone OS in 2008 once. Needless to say, I didnt have 5 years experience of a 1 year old technology (months in fact).The only thing keeping these companies (and jobs) in Ireland is the low tax rate.

No, it's the EU itself, English speaking, relatively well educated STEM graduates, high wages etc.0 -

Advertisement

-

This post had been deleted.

But you couldn't resist posting something It makes perfect business sense to protect profits. So they have been wildly successful over the past decade, not their fault. And it isn't just Apple who do this. 20 years ago Apple almost went bankrupt. It took a loan from rivals Microsoft to prevent that. When you are that close to going out of business, I am sure it would spur a company to prevent that ever happening again.

It makes perfect business sense to protect profits. So they have been wildly successful over the past decade, not their fault. And it isn't just Apple who do this. 20 years ago Apple almost went bankrupt. It took a loan from rivals Microsoft to prevent that. When you are that close to going out of business, I am sure it would spur a company to prevent that ever happening again.

How about General Electric? (circa $119 billion at the end of 2015 in cash, dwarfing Apple). They just posted a pretty sh*t quarter. There are calls for them to cut their dividend which was unthinkable. It is currently selling off divisions that are valued less than $25 billion. Bet the company is glad it has some cash to weather the current climate it finds itself in. The GE Capital division almost took them down in 2008/2009. Cash is king. These are huge companies with complex operations. Their tax system is as complex as a result.

GE is an industrial. A stodgy, blue chip. Apple is a tech company. The history of tech businesses are littered with once huge companies that became extinct or obsolete. Polaroid. Blackberry. To maintain a cash pile is business sense. Such cash will help them survive, merge with other companies, acquire other emerging tech companies to remain current. That's just business sense.

For a start you claim GE's $119 billion in cash reserve dwarfs Apples when in fact Apple's is estimated at over $250 billion and it is the other way around.

Here is a chart from 2015 showing cash held abroad and you will see Apple's is much more than GE.

Here is another chart showing US corporate cash holdings as of 2016.

I don't even see GE on it.

And this is Apple in comparison to nation states. I mentioned “foreign reinvested earnings”. There is estimated to be over $2 trillion dollars under such arrangements. Microsoft ($108 billion), Apple ($91 billion), Pfizer ($74 billion), IBM ($61 billion), Merck ($61 billion), Cisco ($58 billion), Johnson & Johnson ($53 billion), Exxon Mobil ($51 billion), and Google ($47 billion). *Figures are from December 2015 note.

I mentioned “foreign reinvested earnings”. There is estimated to be over $2 trillion dollars under such arrangements. Microsoft ($108 billion), Apple ($91 billion), Pfizer ($74 billion), IBM ($61 billion), Merck ($61 billion), Cisco ($58 billion), Johnson & Johnson ($53 billion), Exxon Mobil ($51 billion), and Google ($47 billion). *Figures are from December 2015 note.

What have some of those names in common ?

Irish operations come to mind and questionable tax practices would be the another.As a side note, the criticism of such companies is a political question. If a country can waste $1.5 Trillion dollars on a fighter jet (F35) that doesn't actually work then it's no surprise to me that global companies would rather give an unpatriotic middle finger to the IRS and the exorbitant rate of tax needed to pay for such follies. So $2 trillion is kept overseas while $1.5 trillion is squandered on a failed fighter. I guess if there were more prudent expenditure of tax dollars then some arrangement could be sought to repatriate some of that $2 trillion. My guess is that the zeal to attack these companies, labeling them unpatriotic tax dodgers, is to help pay for some of that absolute stupidity.

The F35 does work, but not near as well as all the various aircraft it was destined to replace.

The reason for that was that it tried to be all things to all branches of the military in the US.

It was literally meant to replace 5 different aircraft (F16, F15, F18, A6 and AV8/Harrier) which had specific and often very diverse strengths.

Your argument is that the multinationals do not want to pay tax because they think it would be wasted.

So to use your argument why should any of us pay any tax ?

Do you want to give more of your earnings in tax so that a multinational can give less ?

I then presume you a shareholder of one of the multinationals you are so ardently defending.

BTW some of the companies you listed above actually do quite well out of government spending and defense spending.I am not allowed discuss …

0 -

As reasons not to pay tax, people always quote government failures. They never quote the funding of children's hospitals, nurses, fire-fighters, teachers, basic infrastructure, social welfare, etc. Military spending is a small fraction of overall government spending.0

-

This post had been deleted.

I didn't say the rate has to be the same across Europe. But enforcement should be consistent and if the headline rate is 12.5% then we should try to stick to it. 12.5% is still a reasonable figure. But companies like Apple don't end up paying anywhere near that. At most they pay 1% through various tax avoidance loopholes. The EU wide response should be something like Apple paying corporation tax to the Italian government for profits on all iPhones bought in Italy. Of course there is the issue of research and development costs and other costs, so these would be negotiated. It would probably go something like this. Let's say Apple sells 1 million iphones in Italy a year. The cost of each iPhone when parts, labour, research and development is taken into consideration is 250 euro. Apple makes a profit lets say of 200 million in Italy alone. They then pay Italy the local corporation rate on this. No shifting of funds, just paying the corporation tax for profits in the country where the profit is actually made.0 -

Ardently defending them? Just giving another view point.

I probably hold shares in these companies? Ask anyone with a pension which is more than likely invested in an index tracker. See those lists provided to see what companies will be held in said tracker.

They should pay what is necessary. And under the current system in the US, they do. The tax structure regarding repatriation in the US is the problem. It is designed for US companies that traded primarily in the US. It was an incentive to keep business domestic. But then companies towards the end of the century went global and some of them became behemoths.

It has resulted in these corporations hoarding cash. Can you blame them? I wouldn't. I blame the insular tax system in the US. It's complex and I don't pretend to fully understand the complexities and vagaries of tax 'avoision'. My point is that this is a problem (the tax structure) that should have been changed long ago to avoid this situation. The more successful companies became, the more the tax rate ought to have reduced.

Should it surprise anyone that if there was a means to avoid tax and companies decided to avail of it? The attacks on Apple is purely a political one. Look at their cash pile! They should pay more taxes! The companies argument is effectively what did you expect? You didn't keep up so hands off.

If a corporation files a form indicating that the money they generated will be kept permanently overseas, then there is no tax. If the money is bought back home, there is a 35% tax applied to the income. The corporation's didn't set that rule. The government did.

Say Exxon made $100 billion this year in Brazil. Say they wanted to return the money to HQ in Texas to pay dividends or buy back some shares? To transfer the $100 billion from the brazilian bank to a US domiciled account would cost them $35 billion in tax to Uncle Sam. Maybe it would be good business to reinvest the whole $100 billion back into Brazil? You don't need an MBA to see that is probably a better move. Where's the incentive? There is none because of the tax code. If it was something like 12% then that might be more palatable. To do otherwise is pure idiocy imo.

That set up is why Apple has so much cash on hand. So much that they have the power to negotiate favourable terms. For whatever reason people are willing to continually pay hundreds and even thousands of dollars for their products worldwide. Apple is an outlier to that extent and is why they have more than the other's on that list. Instead of using the cash hoard to pay dividends and complete share buy backs, they actually borrow billions to do so instead of repatriating the cash to the US. In 20 years time will people still be buying iPhones? They'll probably still be drinking coke that's for sure but with tech being fickle it's why they are doing what they are doing controversial as it is.

California, Apple HQ, if it was a country would be the 5th biggest economy in the world.

Is the government there looking to resolve this instead of attacking which will further alienate these companies? Are they looking to change the tax code on a sliding scale to entice repatriation? Or is this something they're perfectly happy to allow these corporations to continue as is by ignoring such ridiculous repatriation rates? Or will they dig their heels in and say that was always the rate and that's that so stump up?0 -

So basically they don't want to pay tax, any tax. Greed is good. Got it.0

-

If you were given the option of paying 3% tax or 15% tax, which one would you choose? The only difference is that the 3% tax requires you to sign a couple of pieces of paper.Shurimgreat wrote: »So basically they don't want to pay tax, any tax. Greed is good. Got it.

You'd go for the 15%, right? Wouldn't want to be accused of immorality now...0 -

Advertisement

-

Shurimgreat wrote: »So basically they don't want to pay tax, any tax. Greed is good. Got it.

They don't want to pay a repatriation tax. Which as mentioned is simply incurred when moving money between accounts depending on how they are domiciled.

Say you bought shares a few years ago with money that had already been taxed. CGT at the time was 20%. It was a big risk for you to invest your savings of €10,000 but you did so anyway. A few years later the company turned out to be wildly successful which vindicates your initial investment. Your 10k is now worth 100k. A ten-bagger!

You decide to sell up but you now see that the CGT tax is no longer 20% when you invested initially. It is now 33% presumably because the government decided to save a toxic bank and the extra 13% is needed to help pay for a fcku up you had nothing to do with.

So you now find yourself in a position where instead of having to incur 18,000 in tax, you now have to incur 29,700. More than your initial investment itself. Remember you took the risk with money you earned and were already taxed on. It feels to you like a punishment for taking a risk, for being correct which rankles with you.

I think you'd be better off keeping the money invested and divest gradually over the following ten years instead of taking a wallop in tax.

That's what needs to happen with these companies going forward, just like how an investor here can keep the first €1,270 of profit untaxed, similar needs to happen with the companies in that list. Instead we see them attacked and maligned for being businesses who were good at being businesses.0 -

Shurimgreat wrote: »As reasons not to pay tax, people always quote government failures. They never quote the funding of children's hospitals, nurses, fire-fighters, teachers, basic infrastructure, social welfare, etc. Military spending is a small fraction of overall government spending.

Maybe not in the US as their military spending dwarfs the rest of the world nearly put together. Ardently defending them? Just giving another view point.

Ardently defending them? Just giving another view point.

I probably hold shares in these companies? Ask anyone with a pension which is more than likely invested in an index tracker. See those lists provided to see what companies will be held in said tracker.

They should pay what is necessary. And under the current system in the US, they do. The tax structure regarding repatriation in the US is the problem. It is designed for US companies that traded primarily in the US. It was an incentive to keep business domestic. But then companies towards the end of the century went global and some of them became behemoths.

It has resulted in these corporations hoarding cash. Can you blame them? I wouldn't. I blame the insular tax system in the US. It's complex and I don't pretend to fully understand the complexities and vagaries of tax 'avoision'. My point is that this is a problem (the tax structure) that should have been changed long ago to avoid this situation. The more successful companies became, the more the tax rate ought to have reduced.

Should it surprise anyone that if there was a means to avoid tax and companies decided to avail of it? The attacks on Apple is purely a political one. Look at their cash pile! They should pay more taxes! The companies argument is effectively what did you expect? You didn't keep up so hands off.

If a corporation files a form indicating that the money they generated will be kept permanently overseas, then there is no tax. If the money is bought back home, there is a 35% tax applied to the income. The corporation's didn't set that rule. The government did.

Say Exxon made $100 billion this year in Brazil. Say they wanted to return the money to HQ in Texas to pay dividends or buy back some shares? To transfer the $100 billion from the brazilian bank to a US domiciled account would cost them $35 billion in tax to Uncle Sam. Maybe it would be good business to reinvest the whole $100 billion back into Brazil? You don't need an MBA to see that is probably a better move. Where's the incentive? There is none because of the tax code. If it was something like 12% then that might be more palatable. To do otherwise is pure idiocy imo.

That set up is why Apple has so much cash on hand. So much that they have the power to negotiate favourable terms. For whatever reason people are willing to continually pay hundreds and even thousands of dollars for their products worldwide. Apple is an outlier to that extent and is why they have more than the other's on that list. Instead of using the cash hoard to pay dividends and complete share buy backs, they actually borrow billions to do so instead of repatriating the cash to the US. In 20 years time will people still be buying iPhones? They'll probably still be drinking coke that's for sure but with tech being fickle it's why they are doing what they are doing controversial as it is.

California, Apple HQ, if it was a country would be the 5th biggest economy in the world.

Is the government there looking to resolve this instead of attacking which will further alienate these companies? Are they looking to change the tax code on a sliding scale to entice repatriation? Or is this something they're perfectly happy to allow these corporations to continue as is by ignoring such ridiculous repatriation rates? Or will they dig their heels in and say that was always the rate and that's that so stump up?

Ehh your whole argument is that the 35% tax rate in the US is too high so why should they pay it.

In that case why don't they pay Ireland's 12.5% and when the rules were changed here re Double Irish they sought to find another tax haven in order not to pay anything.

Thus they moved to Jersey.

And you keep harping on about how they need to put cash aside in case they hit bad times, even like in the past.

Can we all use that argument with revenue services?

I would love to see the answer. :rolleyes:

Please stop bullshi**ing about US tax rates, military spending in the US being a waste, etc, etc, and just admit they do not want to pay anything anywhere.I am not allowed discuss …

0 -

If you were given the option of paying 3% tax or 15% tax, which one would you choose? The only difference is that the 3% tax requires you to sign a couple of pieces of paper.

You'd go for the 15%, right? Wouldn't want to be accused of immorality now...

I'm not given the choice. That's the point.

These corporations are given the choice.

When you give people a choice how or where they want to pay their tax, guess how much they will pay.

Governments need to remove their freedoms to pay tax where they feel like it.0 -

If you were given the option of paying 3% tax or 15% tax, which one would you choose? The only difference is that the 3% tax requires you to sign a couple of pieces of paper.

You'd go for the 15%, right? Wouldn't want to be accused of immorality now...

Anyone with an ounce of cop on would realise that us paying 3% or whatever is totally unsustainable. Sure look at Saudi Arabia - the punters rounded up there over the weekend are going to have a good chunk of their wealth confiscated by the looks of things.

Last year I paid an effective rate of 37.5% or thereabouts between income tax, USC and PRSI. Fine by me. I still lead lead very, very comfortable life. Of course I'd like to see the Government do a better job of spending it. But I helped elect them and I could always get into politics if I wanted to change things, as could all of us.0 -

If you were given the option of paying 3% tax or 15% tax, which one would you choose? The only difference is that the 3% tax requires you to sign a couple of pieces of paper.

You'd go for the 15%, right? Wouldn't want to be accused of immorality now...

+1 it's like if you wanted to move 100 euro from your AIB account to a joint account you have in BOI.

If they charged you 35 euro to do so would you do it? You'd be an idiot.

And if Bank of Jersey opened a branch that allowed you to transfer all of your 100 euro with a 2 euro fee then you'd be a moron to keep banking with AIB.0 -

Advertisement

-

They don't want to pay a repatriation tax. Which as mentioned is simply incurred when moving money between accounts depending on how they are domiciled.

Hang on are you still on about a repatriation tax to the US, their technical HQ in both administration and design/development terms ?

Fine they did not want to pay 35% of their earnings to uncle Sam, but they did not want to pay 12.5% of them to uncle Mick in Dublin Castle either and this was plain for all to see when they moved their name plated companies tax affairs to jersey.

The plain unvarnished truth is Apple do not believe in paying taxes on earnings.Say you bought shares a few years ago with money that had already been taxed. CGT at the time was 20%. It was a big risk for you to invest your savings of €10,000 but you did so anyway. A few years later the company turned out to be wildly successful which vindicates your initial investment. Your 10k is now worth 100k. A ten-bagger!

You decide to sell up but you now see that the CGT tax is no longer 20% when you invested initially. It is now 33% presumably because the government decided to save a toxic bank and the extra 13% is needed to help pay for a fcku up you had nothing to do with.

So you now find yourself in a position where instead of having to incur 18,000 in tax, you now have to incur 29,700. More than your initial investment itself. Remember you took the risk with money you earned and were already taxed on. It feels to you like a punishment for taking a risk, for being correct which rankles with you.

I think you'd be better off keeping the money invested and divest gradually over the following ten years instead of taking a wallop in tax.

That's what needs to happen with these companies going forward, just like how an investor here can keep the first €1,270 of profit untaxed, similar needs to happen with the companies in that list. Instead we see them attacked and maligned for being businesses who were good at being businesses.

It is a lot easier to "be good at being businesses" when you pay shag all taxes and can then use your massive cash reserves to buy up other companies, removing possible competitors and adding more technology to your own portfolio.

The likes of Microsoft have bought up numerous companies down through the years exactly because of their massive profits that have been untaxed due to their use of the old Double Irish/Dutch Sandwich systems.

Most of the companies you mentioned earlier like Microsoft, Facebook, Google, Pfizer, Abbott all make use of the Double Irish system.

The money saved not paying taxes means Google can afford to play with driverless cars, take chances with Google Glass whereas other companies do not have that luxury.

I just wonder where you want to go with this ?

Do you eventually want a playing field where no company pays tax or is it just ok for the big guys not to pay tax ?

If companies no longer pay tax who then carries the shortfall, the pure smucks at the bottom and middle I guess ?I am not allowed discuss …

0 -

Maybe not in the US as their military spending dwarfs the rest of the world nearly put together.

Ehh your whole argument is that the 35% tax rate in the US is too high so why should they pay it.

In that case why don't they pay Ireland's 12.5% and when the rules were changed here re Double Irish they sought to find another tax haven in order not to pay anything.

Thus they moved to Jersey.

And you keep harping on about how they need to put cash aside in case they hit bad times, even like in the past.

Can we all use that argument with revenue services?

I would love to see the answer. :rolleyes:

Please stop bullshi**ing about US tax rates, military spending in the US being a waste, etc, etc, and just admit they do not want to pay anything anywhere.

Don't think I believe all the corporations and their boards of directors are all good and lovely and want to save the world. They seem to be perfectly happy to pay the very minimum they can. It's an interesting moral debate that's for sure. They are businesses and they want to make as much bottom line as possible. That some have grown to be as powerful as countries themselves is a failure of governance. Should Apple pay the €18 billion to Ireland in back taxes. I think they should. But do they have the means and the ability to up sticks and leave 6,000 people unemployed as a consequence, as a fcku you to Corporate Ireland? They do. Any party who canvas that Apple's back taxes be paid will get my vote. Alternatively, anyone of the 6k Apple employees wouldn't support that. How did we reach such a situation? Politics.

It's quid pro quo to that end. Apple hold all the cards. $18 billion is, quite ridiculously, a pittance to them. To the economy here it would be brilliant. They were given all the cards by our attractive corp tax rate.

It's a political question. Taxation on corporate earnings. What had been the response? Negotiating that they repay in tranches or bending over and letting them off the hook? The latter.0 -

That's not trickle down economics.that's called a job.those companies get a well educated work force,stable country politically and low crime.all financed by the government and tax payer.

You really don't think that companies would be here if the corporation tax doubled, but all those other factors remained?

I know the place I work re-located here for three reasons:- The low rate of corporation tax

- The weakness of the Euro (at the time)

- As a hedge against Brexit (that turned out to be quite prescient)

Since Brexit, even with the strengthening of the Euro, all the growth in the firm has been in Dublin (at the expense of the UK end of the operation). So yes, the firm may be getting a generous tax rate but there are several dozen people working in it paying income tax, USC, etc than would otherwise be the case - never mind the amount we've spent on leases, office fitout, equipment, vehicles etc

Funny i passed apple hq in hollyhill this morning as i always do and they still seemed to have their 6000 people working away.i wonder will they fit all those folk in st.helier since they moved their taxes to jersey?0 -

If you were given the option of paying 3% tax or 15% tax, which one would you choose? The only difference is that the 3% tax requires you to sign a couple of pieces of paper.

You'd go for the 15%, right? Wouldn't want to be accused of immorality now...

This is a projection. Not everybody minimises their tax. In any case even if everybody would get away with something if not policed, and this something was injurious to society in general, it would still need to be policed by society in general even if society in particular were opposed.

A run on a bank happens because individuals are acting in their individual interest but not in their collective interests.0 -

Hang on are you still on about a repatriation tax to the US, their technical HQ in both administration and design/development terms ?

Fine they did not want to pay 35% of their earnings to uncle Sam, but they did not want to pay 12.5% of them to uncle Mick in Dublin Castle either and this was plain for all to see when they moved their name plated companies tax affairs to jersey.

I think they do want to repatriate at a lower level than 35%. They are clear that they think most of the value was created in the US -- The Irish operations in Cork are more of a necessary cost, i.e. support, than they are

If they pay Ireland then the US gets nothing much or nothing at all ( I think US senators don't understand this).0 -

If Trump reduces the corporation rate to 20%, it is still unlikely they will repatriate profits.

From what I can see, these corporates don't believe in paying tax, period.

Their freedom to pay tax where and how they want needs to be removed. Tax needs to be forcibly taken off them and severe penalties and sanctions should be imposed if need be.0 -

Just reading up on Apple's tax structure and it's head melting. The topsy turvy machinations to effectively pay as little as financially possible is mind boggling. It's interesting to read about our role in all of this. Apple in the mid-90's was all but obsolete. But it still had it's tax structure in place. The so called double irish arrangement. And following a revival in Apple in the early 00's, to the point of becoming one of the largest companies in the world, that very same tax structure remained throughout that time frame which allowed their realised gains to amass using the same structure they created over 20 years earlier. To complain about Apple you must also recognize the complicity, and turning of a blind eye of our own country in enabling them to accrue such untaxed profits legally until such time as legislators actually copped on and moved to counter act such practices.0

-

server down wrote: »I think they do want to repatriate at a lower level than 35%. They are clear that they think most of the value was created in the US -- The Irish operations in Cork are more of a necessary cost, i.e. support, than they are

If they pay Ireland then the US gets nothing much or nothing at all ( I think US senators don't understand this).

That is what they want the US authorities to believe.

But lets not be naive here, they have gotten used to paying next to nothing and when the party in Ireland was coming to a close they (and a lot of the others) managed to get a transfer or wind down period introduced, just so that it would allow them time to find the next complicit bolthole that would allow them get away with no tax.Just reading up on Apple's tax structure and it's head melting. The topsy turvy machinations to effectively pay as little as financially possible is mind boggling. It's interesting to read about our role in all of this. Apple in the mid-90's was all but obsolete. But it still had it's tax structure in place. The so called double irish arrangement. And following a revival in Apple in the early 00's, to the point of becoming one of the largest companies in the world, that very same tax structure remained throughout that time frame which allowed their realised gains to amass using the same structure they created over 20 years earlier. To complain about Apple you must also recognize the complicity, and turning of a blind eye of our own country in enabling them to accrue such untaxed profits until such time as legislators actually copped on and moved to counter act such practices.

It aint just Apple.

Microsoft, Google and all the other big guys based here are fond of the Double Irish/Dutch Sandwich.

We only moved to counteract it when the pressure was put on.

Even then we allowed them time until 2020 to find a new tax haven.

People are lauding Apple in particular, but when you look at all these huge multinationals like Microsoft, Google, Facebook, Amazon, Starbucks that have come to dominate over the last couple of decades they have been able to siphon off their profits at a rate never been seen before.

We, together with all those British dominions, are basically screwing taxpayers around the world and aiding in the biggest transfer of wealth to a few that has ever been seen in history.

We have helped create multiple corporations that are now bigger than nations.

And as can be seen from leaked documents they are already trying to ensure a friendly compliant democracy that works for them.

It aint like in the movies where it is an oil or mining company that are trying to put in a friendly dictator in some African backwater.

The likes of the modern tech giants are going to be doing it in the Western and it will be a lot more subtle than sending in the dogs of war.I am not allowed discuss …

0 -

It's not. Everyone minimises their tax as much as they are capable; within their level of knowledge and income.server down wrote: »This is a projection. Not everybody minimises their tax.

That's a different matter. If an activity is injurious to society, then society needs to legislate/regulate to protect against it.In any case even if everybody would get away with something if not policed, and this something was injurious to society in general, it would still need to be policed by society in general even if society in particular were opposed.

Tax is a funny one. Because people understand the necessity for tax. And that refusing to pay tax is immoral. But we also understand that we require the organs of state to calculate the appropriate levels of tax payable. And we agree to pay those levels of tax.

Thus, anyone who is paying the level of tax which has been calculated as payable by the organs of state, is acting morally regardless of how much tax they have actually paid.

Being able to find loopholes and workarounds doesn't change the fact that they are paying the legally calculable amount of tax as determined by the state. And are therefore acting morally.

If that calculation is wrong, then the state must fix the method of calculation. It's not up to the individual to try and guess what the appropriate amount is and volunteer it.

I don't disagree at all that these companies should pay more tax. And that their continued leeching of profits is unsustainable. But that doesn't change the fact that the moral or ethical onus is not on these companies to re-invent our tax calculations for us. It's for our state(s) re-invent our own tax code to ensure that tax is collected at a sustainable rate.0 -

It's not. Everyone minimises their tax as much as they are capable; within their level of knowledge and income.

That's a different matter. If an activity is injurious to society, then society needs to legislate/regulate to protect against it.

Tax is a funny one. Because people understand the necessity for tax. And that refusing to pay tax is immoral. But we also understand that we require the organs of state to calculate the appropriate levels of tax payable. And we agree to pay those levels of tax.

Thus, anyone who is paying the level of tax which has been calculated as payable by the organs of state, is acting morally regardless of how much tax they have actually paid.

Being able to find loopholes and workarounds doesn't change the fact that they are paying the legally calculable amount of tax as determined by the state. And are therefore acting morally.

If that calculation is wrong, then the state must fix the method of calculation. It's not up to the individual to try and guess what the appropriate amount is and volunteer it.

I don't disagree at all that these companies should pay more tax. And that their continued leeching of profits is unsustainable. But that doesn't change the fact that the moral or ethical onus is not on these companies to re-invent our tax calculations for us. It's for our state(s) re-invent our own tax code to ensure that tax is collected at a sustainable rate.

I suspect you didn't see the panorama show the other night? If you think the actions of applyby and pwc are moral or ethical then i feel sorry for you.0 -

Advertisement

-

Funny i passed apple hq in hollyhill this morning as i always do and they still seemed to have their 6000 people working away.i wonder will they fit all those folk in st.helier since they moved their taxes to jersey?

Probably not, but I'm guessing they'd just run it down over time. Why make stuff you're trying to sell in China, the US etc here and give yourself the disadvantage of bring remote from your markets unless that cost is more than offset by other benefits?

If we stopped competing on tax we'd lose a huge chunk of economic activity - first the easy-to-move stuff like service companies, but eventually manufacturing would go as there'd be no incentive to invest or upgrade facilities.0 -

How many times do people have to be told before they get it through their thick heads.

Apple pay 12.5% corporation tax in Ireland to revenue which they are meant to.

There is secret arrangements where they pay 1%.

It really as simple as that.0 -

Probably not, but I'm guessing they'd just run it down over time. Why make stuff you're trying to sell in China, the US etc here and give yourself the disadvantage of bring remote from your markets unless that cost is more than offset by other benefits?

If we stopped competing on tax we'd lose a huge chunk of economic activity - first the easy-to-move stuff like service companies, but eventually manufacturing would go as there'd be no incentive to invest or upgrade facilities.

There's 5 new cranes gone up there in the last few months. They moved their tax to jersey over a year ago. Are you seriously telling me it's all about the tax?if that's the case why doesn't every manufacturer in the world automatically move to the cheapest tax zone available?0 -

There's 5 new cranes gone up there in the last few months. They moved their tax to jersey over a year ago. Are you seriously telling me it's all about the tax?if that's the case why doesn't every manufacturer in the world automatically move to the cheapest tax zone available?

They moved the administration of the money because of the ending of the "double Irish" and the "non-residency tax" loophole.

They'll still benefit from the low corporation tax rate, and the patent box (about half the headline rate of corporation tax), not to mention whatever other grants, incentives etc they're getting.

And if it's all about skills, proximity to market, stable political climate, decent courts etc how come every manufacturer isn't in the U.K., France, Italy or Germany?

We don't compete on tax with everyone, because not everyone is in the EU. Sure, a company could set up in a zero or ultra low tax jurisdiction, but the tariffs they'd face getting into the EU market would make it a poor proposition.0 -

Wheeliebin30 wrote: »How many times do people have to be told before they get it through their thick heads.

Apple pay 12.5% corporation tax in Ireland to revenue which they are meant to.

There is secret arrangements where they pay 1%.

It really as simple as that.

No there is not any “secret arrangement” . Apple take advantage of loopholes...its as simple as that!0 -

There were 2 cranes for a period on the Holyhill Campus. That is now reduced to 1.There's 5 new cranes gone up there in the last few months. They moved their tax to jersey over a year ago. Are you seriously telling me it's all about the tax?if that's the case why doesn't every manufacturer in the world automatically move to the cheapest tax zone available?

The building they are currently working on could potentially house up to 1000 workers.

With regards to numbers currently on the campus i think its floating around 3500. There are a good number on working from home support jobs also.

At a guess approximately 1500-2000 of these workers are in call centre support roles. These are not particularily well paying, but they are far better paid than they are in alot of their home countries.

A significant proportion of workers are from overseas, mostly EU with some african, asian, US in the mix also.0 -

Outkast_IRE wrote: »

There were 2 cranes for a period on the Holyhill Campus. That is now reduced to 1.There's 5 new cranes gone up there in the last few months. They moved their tax to jersey over a year ago. Are you seriously telling me it's all about the tax?if that's the case why doesn't every manufacturer in the world automatically move to the cheapest tax zone available?

The building they are currently working on could potentially house up to 1000 workers.

With regards to numbers currently on the campus i think its floating around 3500. There are a good number on working from home support jobs also.

At a guess approximately 1500-2000 of these workers are in call centre support roles. These are not particularily well paying, but they are far better paid than they are in alot of their home countries.

A significant proportion of workers are from overseas, mostly EU with some african, asian, US in the mix also.

6000. 2 of my friends are managers there. They also recently moved the i tunes from lux to the hollyhill campus. Wouldn't set up in france/germany over language barriers.wouldn't set up in uk over increased costs.lying about the cranes.i'll post a picture next time i take a stroll around there.0 -

America's most popular politician laid out once again in the Senate how the rich are ****ing over everyone.

I've read some shocking stats but christ when I heard that 3 people (yes 3, Jeff Bezos, Warren Buffett and Bill Gates) have as much wealth as the bottom 50% of Americans, I was flabbergasted. I don't care what political ideology you ascribe to, anyone who thinks that this is acceptable is sick in the head. Capitalism has well and truly destroyed this planet when 3 people own as much as 160million people.

Nothing will come from these papers, nor will they come the next time leaks emerge. The rich will continue to find ways to **** over everyone else so long as capitalism rules the world.0 -

MightyMandarin wrote: »

America's most popular politician laid out once again in the Senate how the rich are ****ing over everyone.

I've read some shocking stats but christ when I heard that 3 people (yes 3, Jeff Bezos, Warren Buffett and Bill Gates) have as much wealth as the bottom 50% of Americans, I was flabbergasted. I don't care what political ideology you ascribe to, anyone who thinks that this is acceptable is sick in the head. Capitalism has well and truly destroyed this planet when 3 people own as much as 160million people.

Nothing will come from these papers, nor will they come the next time leaks emerge. The rich will continue to find ways to **** over everyone else so long as capitalism rules the world.

Aren't Buffett and Gates two of the most generous philanthropists in the world today? And hasn't Bezos spoke about being philanthropic in the future, he just wants to decide how he'll go about it?

Paying taxes isn't the only way someone can contribute to the greater good.

In fact, if you look at what the Gates Foundation (to which Buffett has also made significant donations) is doing especially in relation to HIV, malaria, neglected tropical diseases, education etc you could pretty much guarantee that even if they did pay more tax those issues would not receive the level of attention they are getting now if it was left to the US government. What would the government have spent the increased tax revenue on?0 -

Advertisement

-

MightyMandarin wrote: »

America's most popular politician laid out once again in the Senate how the rich are ****ing over everyone.

I've read some shocking stats but christ when I heard that 3 people (yes 3, Jeff Bezos, Warren Buffett and Bill Gates) have as much wealth as the bottom 50% of Americans, I was flabbergasted. I don't care what political ideology you ascribe to, anyone who thinks that this is acceptable is sick in the head. Capitalism has well and truly destroyed this planet when 3 people own as much as 160million people.

Nothing will come from these papers, nor will they come the next time leaks emerge. The rich will continue to find ways to **** over everyone else so long as capitalism rules the world.

Aren't Buffett and Gates two of the most generous philanthropists in the world today? And hasn't Bezos spoke about being philanthropic in the future, he just wants to decide how he'll go about it?

Paying taxes isn't the only way someone can contribute to the greater good.

In fact, if you look at what the Gates Foundation (to which Buffett has also made significant donations) is doing especially in relation to HIV, malaria, neglected tropical diseases, education etc you could pretty much guarantee that even if they did pay more tax those issues would not receive the level of attention they are getting now if it was left to the US government. What would the government have spent the increased tax revenue on?

What about the saudi royal family?russian oligarchs spending billions on yachts.for every gates there's a waster too.if this was a dole bashing thread you'd talk of some outlier spending all her money on fags and drink and not on a mother retraining and ensuring her kids are well fed and dressed.0 -

What about the saudi royal family?russian oligarchs spending billions on yachts.for every gates there's a waster too.if this was a dole bashing thread you'd talk of some outlier spending all her money on fags and drink and not on a mother retraining and ensuring her kids are well fed and dressed.

Oligarchs etc - yeah, I'd have no problem with wealth being stripped away from people who got it through corrupt, nepotistic, or other ill-gotten means.

But the poster didn't mention any of those - he mentioned Gates, Buffett and Bezos......and at least one of those has mentioned that they'd pay higher taxes if they were levied, and has advocated that taxes should, in fact, be higher.0 -

If regular people had access to these tax avoidance techniques it would be shut down pretty fast. Teachers and gardai have their pay sent to a company in the Bahamas which lends them money via some shell companies.0

-

If regular people had access to these tax avoidance techniques it would be shut down pretty fast. Teachers and gardai have their pay sent to a company in the Bahamas which lends them money via some shell companies.

Again......that's disguised remuneration which has been defined as evasion, not avoidance.0 -

6000. 2 of my friends are managers there. They also recently moved the i tunes from lux to the hollyhill campus. Wouldn't set up in france/germany over language barriers.wouldn't set up in uk over increased costs.lying about the cranes.i'll post a picture next time i take a stroll around there.

I work there and am involved in the construction. I know how many cranes are on our site. Its 1 currently it was 2 . You can see the crane from almost any location in cork city on the southside of cork city, you dont need to take a stroll up there.

To the best of my knowledge 6000 is the planned numbers when you factor in the new building next year open and at full occupancy, various protacabins on the site and working from home numbers.

Please dont accuse people of lying, when its clear your knowledge of the situation up there is 2nd & 3rd hand.

Back on topic - They are a good employer and have provided some jobs to people in the surrouuding area mostly in support roles (canteen, cleaning & maintenance). They help prop up the economy in Cork and are a key employer in the city. However legally they may be correct in how they move money about - morally they are not - ethically they are not. " A man without ethics is a wild beast loosed upon the world " Albert Camus - This is how i feel about most of the major corporations in the world currently and their position on taxes etc.0 -

Outkast_IRE wrote: »I work there and am involved in the construction. I know how many cranes are on our site. Its 1 currently it was 2 . You can see the crane from almost any location in cork city on the southside of cork city, you dont need to take a stroll up there.

To the best of my knowledge 6000 is the planned numbers when you factor in the new building next year open and at full occupancy, various protacabins on the site and working from home numbers.

Please dont accuse people of lying, when its clear your knowledge of the situation up there is 2nd & 3rd hand.

Back on topic - They are a good employer and have provided some jobs to people in the surrouuding area mostly in support roles (canteen, cleaning & maintenance). They help prop up the economy in Cork and are a key employer in the city. However legally they may be correct in how they move money about - morally they are not - ethically they are not. " A man without ethics is a wild beast loosed upon the world " Albert Camus - This is how i feel about most of the major corporations in the world currently and their position on taxes etc.

It depends on your definition of "ethics" - what about obligations to shareholder value? Maybe that's misguided but the legal situation is that boards are, essentially but with some exceptions, maximise shareholder value.

I wonder how people would feel if the dividends on which their pensions are based were reduced because firms decided to organise their tax affairs in a way that got them some good PR but led to more money being transferred to the government than would otherwise be the case if they only followed the law?0 -

Advertisement

-

-

Clearly being a landlord is no longer a money spinner.0

-

-

It depends on your definition of "ethics" - what about obligations to shareholder value? Maybe that's misguided but the legal situation is that boards are, essentially but with some exceptions, maximise shareholder value.

I wonder how people would feel if the dividends on which their pensions are based were reduced because firms decided to organise their tax affairs in a way that got them some good PR but led to more money being transferred to the government than would otherwise be the case if they only followed the law?

be very happy. Is there any evidence at all that stock prices are affected by the corporation tax?0 -

Over time,the rich have avoided lots of taxes , while the poor and average people face the consequences of paying0

-

Advertisement

Advertisement