Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi all! We have been experiencing an issue on site where threads have been missing the latest postings. The platform host Vanilla are working on this issue. A workaround that has been used by some is to navigate back from 1 to 10+ pages to re-sync the thread and this will then show the latest posts. Thanks, Mike.

Hi there,

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

Brexit discussion thread III

Comments

-

Moderators, Recreation & Hobbies Moderators, Science, Health & Environment Moderators, Technology & Internet Moderators Posts: 92,704 Mod ✭✭✭✭

Join Date:Posts: 90942

Join Date:Posts: 90942

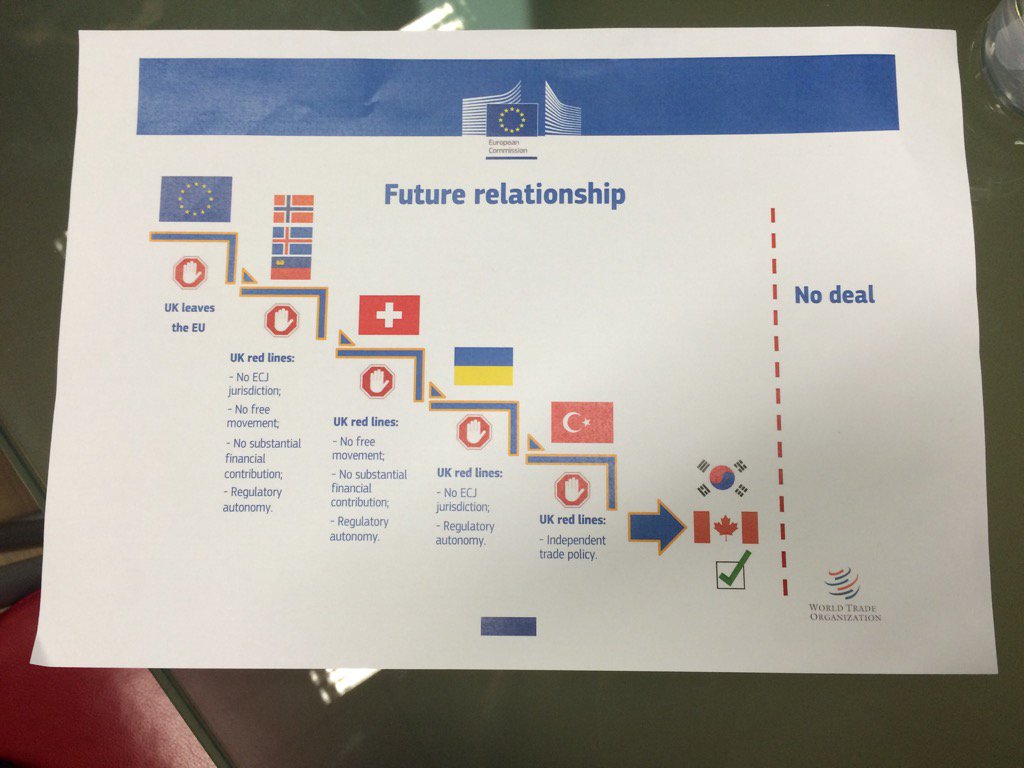

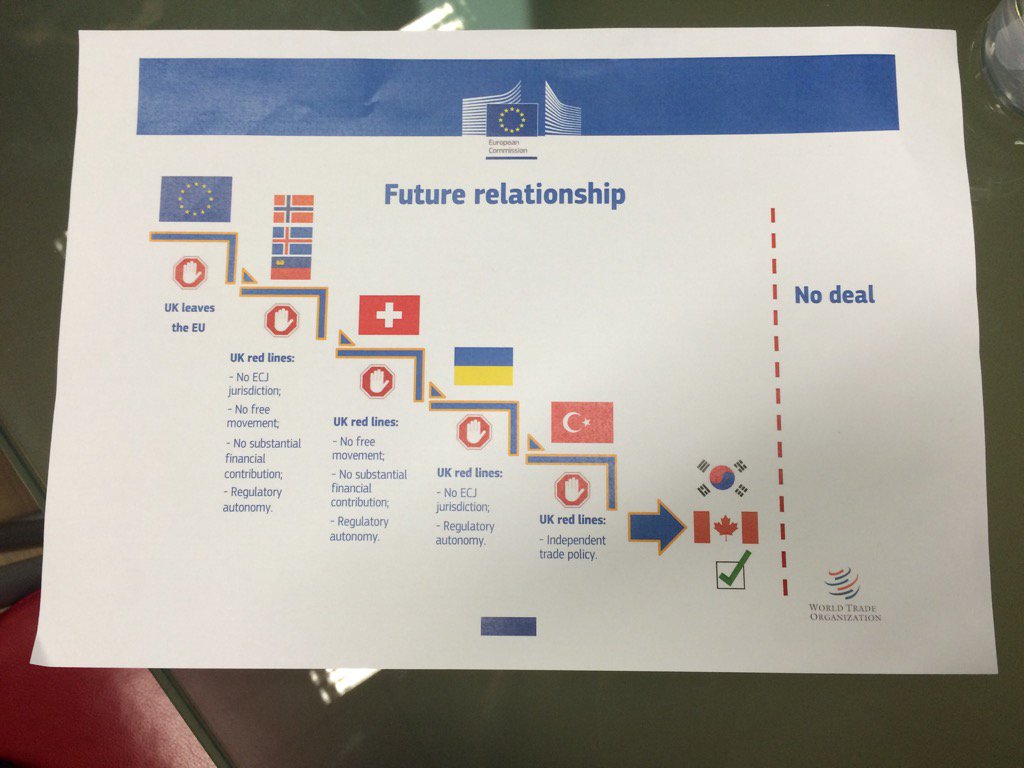

Posting larger version for clarity.

Nothing new here, but some people still have trouble grasping the concept.

Also because of the most favoured nation thing the EU can't just bump the UK to a higher step without offering the same terms to all the other countries too. And I can't see what the UK can trade for that. 0

0 -

A detailed article here on "toilettage", or the art of making a text compliant with Brussels regulation:

https://mlexmarketinsight.com/insights-center/editors-picks/brexit/europe/long-march-to-brexit-passes-a-milestone,-but-faces-many-more?source=mlextwitter0 -

Capt'n Midnight wrote: »Posting larger version for clarity.

Nothing new here, but some people still have trouble grasping the concept.

Also because of the most favoured nation thing the EU can't just bump the UK to a higher step without offering the same terms to all the other countries too. And I can't see what the UK can trade for that.

Good evening!

Again - this is merely indicative of a bias on the thread, everything that falls from the European Commission is taken as sweet nectar when it is just their position at this point in time. I'm quite relaxed to let this play out and to see what happens. Why? I don't think the outcome is going to be anywhere near as terrible as some on this thread are making it out to be.

But look - a CETA style trading relationship with MiFID II equivalence isn't a terrible option (even the FT think this is an option even if the FTA doesn't include financial services). Sure, it is a worse option than a more comprehensive FTA (which I still don't think is impossible), but it is certainly much better than WTO terms.

Much thanks,

solodeogloria0 -

So long as the phase 1 commitments are implemented in full, and customs barriers in any direction are thereby avoided, I would imagine most posters here would be perfectly happy to leave the UK to its own devices.0

-

Moderators, Recreation & Hobbies Moderators, Science, Health & Environment Moderators, Technology & Internet Moderators Posts: 92,704 Mod ✭✭✭✭

Join Date:Posts: 90942

Join Date:Posts: 90942

In addition to Gibraltar there are 13 other British Overseas Territories being thrown under that big red bus.

Many of them benefit from the EU. Some have got reconstruction grants from the recent hurricanes and I doubt the UK will match that level in future. Others make a living as Tax Havens and the EU is starting to move against that sort of thing.

https://www.politicshome.com/news/uk/foreign-affairs/brexit/news/88475/excl-caribbean-island-anguilla-warns-brexit-could-spellThe island, which has a population of 15,000, receives financial support from the EU, including €14m from the European Development Fund.

...

With no international airport, Anguilla depends on St Martin, a neighbouring island which is half-Dutch and half-French, for supplies and services.

Having your cake and eating it ?One short-term alternative floated in the Anguillan white paper is for British Overseas Territories to obtain “associate membership” of the EU on a “pay-as-you-go” basis, enabling it to continue to receive development funds from Brussels.0 -

Advertisement

-

Tell me how wrote: »Impossible. There is no deal yet, no one knows what the framework which needs to be assessed legally is.

The banks will say that they are planning rigorously for every eventuality which translates as waiting and seeing.

Banks talk a good game more than play it. Crash of 08 was evidence of that.

They have actually. Not to say that they have any clairvoyance on this, but if your Risk people and Strategists haven't looked at the implications of Brexit you would be a very concerned Director (or indeed, Regulator). The London City law firms have been churning out access maps for their banking clients to show them where their passporting rights or authorisations will be lost, or indeed where their presence in general will be affected from a legal perspective.

We cannot tell what the outcome of Brexit will be, but regulatory authorities (including the Central Bank of Ireland) are now looking to see evidence of Brexit planning and if you are a smart business who wants to appease the Regulator, you react to the utter uncertainty by planning for the worst case scenario -- a hard Brexit. If you fail to appease regulators, they are going to block you from adopting the business approach to Brexit you want to adopt. So it is now in the best interests of banks based in the UK to be ready to show (in particular) the Irish, French, German, Belgian, Luxembourgish and Dutch regulators that they are planning and stress-testing appropriately to cope with a cliff-edge outcome.

Let's be realistic -- the Banks do not want to leave London. They are well-established there, their staff happily living in one of the world's greatest cities.

London is a formidable beast and its financial sector will not collapse overnight. But, as I have said before way back -- the longer the uncertainty of this Schrodingers Brexit goes on, the more stress-tests are going to test the patience of the Banks.0 -

solodeogloria wrote: »Good evening!

Again - this is merely indicative of a bias on the thread, everything that falls from the European Commission is taken as sweet nectar when it is just their position at this point in time. I'm quite relaxed to let this play out and to see what happens. Why? I don't think the outcome is going to be anywhere near as terrible as some on this thread are making it out to be.

But look - a CETA style trading relationship with MiFID II equivalence isn't a terrible option (even the FT think this is an option even if the FTA doesn't include financial services). Sure, it is a worse option than a more comprehensive FTA (which I still don't think is impossible), but it is certainly much better than WTO terms.

Much thanks,

solodeogloria

Except it is not just their position at this point in time - it is the fixed position that they have in relation to all non-members. Change an option for one, you change it for all.

The UK are like a guest in a restaurant, there is a menu, you can pick from it. If you want something different, you need goodwill from the waiter, the chef, the owner etc. and you need to persuade them it is worth their while. If you insult the waiter, rubbish the food the chef cooks and tell the owner you wish you had never came to the restaurant, you are unlikely to get the option you are looking for.0 -

Join Date:Posts: 19594

Except it is not just their position at this point in time - it is the fixed position that they have in relation to all non-members. Change an option for one, you change it for all.

The UK are like a guest in a restaurant, there is a menu, you can pick from it. If you want something different, you need goodwill from the waiter, the chef, the owner etc. and you need to persuade them it is worth their while. If you insult the waiter, rubbish the food the chef cooks and tell the owner you wish you had never came to the restaurant, you are unlikely to get the option you are looking for.

You also need to be prepared to pay the bill.0 -

ArthurDayne wrote: »They have actually. Not to say that they have any clairvoyance on this, but if your Risk people and Strategists haven't looked at the implications of Brexit you would be a very concerned Director (or indeed, Regulator). The London City law firms have been churning out access maps for their banking clients to show them where their passporting rights or authorisations will be lost, or indeed where their presence in general will be affected from a legal perspective.

We cannot tell what the outcome of Brexit will be, but regulatory authorities (including the Central Bank of Ireland) are now looking to see evidence of Brexit planning and if you are a smart business who wants to appease the Regulator, you react to the utter uncertainty by planning for the worst case scenario -- a hard Brexit. If you fail to appease regulators, they are going to block you from adopting the business approach to Brexit you want to adopt. So it is now in the best interests of banks based in the UK to be ready to show (in particular) the Irish, French, German, Belgian, Luxembourgish and Dutch regulators that they are planning and stress-testing appropriately to cope with a cliff-edge outcome.

Let's be realistic -- the Banks do not want to leave London. They are well-established there, their staff happily living in one of the world's greatest cities.

London is a formidable beast and its financial sector will not collapse overnight. But, as I have said before way back -- the longer the uncertainty of this Schrodingers Brexit goes on, the more stress-tests are going to test the patience of the Banks.

Let's be more realistic. The banks don't want to move, but they're loosing passporting rights equal to over 20 billion a year. The banks are long established, but they were established under the single market. They were happy before Brexit, but the immigration controls will make life considerably harder and England less attractive. You're effectively saying that things were great before Brexit so will continue to be fine.0 -

Join Date:Posts: 13695

solodeogloria wrote: »Again - this is merely indicative of a bias on the thread

Mod note:

This thread has been very polite and rule abiding over the last few days after a bad couple of weeks so kudos to all involved.

In the spirit of keeping the standards high, please refrain from comments like this. If other posters have an opinion different to yours and express it on the thread, that isnt bias it is just discussion.

So it would be helpful to stick to the points rather than making generalised comments like this. I appreciate that you take what is undoubtedly a minority view on Brexit, and it hasnt been a good few weeks for the UK Govt/ pro brexit position, but it would be helpful to stick to specific responses to specific issues.0 -

Advertisement

-

steddyeddy wrote: »Let's be more realistic. The banks don't want to move, but they're loosing passporting rights equal to over 20 billion a year. The banks are long established, but they were established under the single market. They were happy before Brexit, but the immigration controls will make life considerably harder and England less attractive. You're effectively saying that things were great before Brexit so will continue to be fine.

The other issue is that the UK has long been a haven of regulatory and political stability. All of that has changed in the past year. If you’re a business, you’ve no longer any idea if you’ll have market access, the immigration / employment policies are in a state of flux and have become very irrational and you can't be sure if you can get access to talent or if they staff will stay, the regulatory environment is potentially going to become politicised and is in flux and to top it off, the currency is behaving like one in from an emerging market country.

Even without Brexit completing, the UK business environment has changed and its reputation has been irreparably damaged and could take years if not a decade or more to repair.

They're also congratulating themselves on things like currency weakness! The recent good manufacturing figurss in the UK are being driven by a weak pound caused by Brexit while the UK still hasn't felt the effects of loss of market access.

They also keep looking at the growth of the FTSE 100, a group of companies that earn their money in hard currencies and will increase in value I'm £ because it's weak. It's simply not a reflection of the UK economy.

This stuff has changed the UK and how it is perceived in an extremely dramatic and profound way.

I don’t think businesses will necessarily put up with this chaos for much longer.0 -

steddyeddy wrote: »Let's be more realistic. The banks don't want to move, but they're loosing passporting rights equal to over 20 billion a year. The banks are long established, but they were established under the single market. They were happy before Brexit, but the immigration controls will make life considerably harder and England less attractive. You're effectively saying that things were great before Brexit so will continue to be fine.

I think you have misunderstood my stance, or rather perhaps I did not convey it clearly. I think Brexit is a travesty, and will damage London -- the essence of my previous post being that the lack of certainty being put forward by the British government will gradually sap commercial patience. I am also saying that the lack of certainty is compelling banks to risk-assess Brexit on a worst-case scenario basis (i.e. Hard Brexit). What I should have added is my expectation that this uncertainty, in itself, will to my mind herald a leaking away of certain areas of businesses to areas where access to the single market is safe.

Nevertheless, in my view, a huge mistake is being made by commentators who have foretold the swift demise of London -- because the true effect of such commentary is to make anything less than obvious and immediate disaster some sort of triumph for the Brexiteers, who will spin it as such to the voters they swindled back in June 2016. But the fact remains that London financial institutions will do all they can to maintain their existing business models, and as such we will not likely see any mass exodus which we can point to and say 'here you go, here is the disaster'.

What is ironic of course though is how the rally for Brexit was seen as a statement against the big banks of London and a blow struck in the name of the 'little people' of England outside the metropolis. Now . . London and its banks have arguably never been as important to the UK as they are now --- and the areas of England outside London never more irrelevant.0 -

Moderators, Recreation & Hobbies Moderators, Science, Health & Environment Moderators, Technology & Internet Moderators Posts: 92,704 Mod ✭✭✭✭

Join Date:Posts: 90942

Join Date:Posts: 90942

Reality Check on that one.Peregrinus wrote: »So what's the thousand pounds for?

The UK currently charge £1,282 for naturalisation. and £1163 to regain your passport if you've had to renounce citizenship for example to stay in Holland where you can't have dual-citizenship. A reminder that the current deal means that a UK citizen living in Belgium won't be able to get a job in Holland as they won't have the rights to live there.

Note it's cheaper to apply for British Overseas Territory citizenship, but as lots of Hong Kong residents found out in the past it isn't the same as a real UK passport. But I suspect that many in the UK, in places like Scotland, Northern Ireland, Wales , Cornwall and 'up north' may be second class citizens when it comes to how the current administration views them.

Currently to apply for UK residency there's an 85 page form to fill in, though this is promised to drop to something a lot simpler for EU citizens. But the proof of the pudding...

Re the Northies and the ECJ , any rights they would have are by virtue of the pre-existing arrangement that Ireland kept when joining the EU, Irish citizenship is automatic and grandfathered in. (literally in the case where you have Irish grandparents) We've had referendums on this one too.

http://www.citizensinformation.ie/en/moving_country/irish_citizenship/irish_citizenship_through_birth_or_descent.html0 -

Moderators, Recreation & Hobbies Moderators, Science, Health & Environment Moderators, Technology & Internet Moderators Posts: 92,704 Mod ✭✭✭✭

Join Date:Posts: 90942

Join Date:Posts: 90942

No it's not a terrible option.solodeogloria wrote: »But look - a CETA style trading relationship with MiFID II equivalence isn't a terrible option (even the FT think this is an option even if the FTA doesn't include financial services). Sure, it is a worse option than a more comprehensive FTA (which I still don't think is impossible), but it is certainly much better than WTO terms.

But this is cake and eat it talk,

no EU politician is going to get re-elected by taking potential jobs from Frankfurt or the IFSC or Paris.

You have to realise that MiFID II equivalence is an absolute requirement for trading with or providing certain services to European counterparts. If you don't have it's Do Not Pass Go , Do Not Collect €200.

It's like the CE mark. You can't sell most consumer goods into the EU without it. But having a CE mark doesn't give you the automatic right to sell into the EU, because of barriers and tariffs and quotas etc , however much you might wish it to be so.0 -

Well, that depends on your definition of "terrible", I suppose.solodeogloria wrote: ».. . .everything that falls from the European Commission is taken as sweet nectar when it is just their position at this point in time. I'm quite relaxed to let this play out and to see what happens. Why? I don't think the outcome is going to be anywhere near as terrible as some on this thread are making it out to be.

You're quite right to say that what the EU is laying out publicly at the moment is "just their position at this point in time". The same, of course, is true in relation to what HMG is saying. But the relative strategic positions of the two parties and the history of these discussions to date both suggest that, if an agreement is to be reached, the UK will have to move a lot further from "their position at this point in time" than the EU will. The EU's "position at this point in time" therefore repays close study.

The other point to be borne in mind in connection with the Barnier chart. . .

. . . is that what it shows is not so much the EU's position at this point in time as the EU's analysis of the UK's position at this point in time. Movement from this position is possible if the EU changes its analysis, or if the UK changes its position, or if in reality the UK's position is not as shown here.

And, of course, in one important respect the UK's position is not as shown in Barnier's chart. Barnier's chart shows only some of the UK's red lines. The the modified version of the chart gussied up by the blogger Jon Worth . . .

. . . includes also the UK's no-hard-border guarantee and suggests that, yeah, the UK is highly likely to move away from its current position, because its current position seems to be irreconcilably conflicted with itself. This is not a problem that the EU can fix for the UK.0 -

UBS have no more of an idea of the end state than any of us.

No but they, like all the major banks they have the operational facilities (usually tested twice a year from what I remember) to very quickly switch away from London should the need arise. Which means they can better afford to play the waiting game at the moment.0 -

That I can believe and it reiterates why UBS hasn't moved its entire operation out of London. Solo takes great solace in this as if it's a sign that all is well. It isn't. We all know the very last thing the banks want is to is spend any of their lucre moving operations, so they'll hold off until it's absolutely inevitable.No but they, like all the major banks they have the operational facilities (usually tested twice a year from what I remember) to very quickly switch away from London should the need arise. Which means they can better afford to play the waiting game at the moment.

The real picture, as painted by most posters here, is that London will suffer a death by a thousand blows (of lost future investment) and over the next couple of decades reduce in importance.

It's only Solo who is talking about an overnight collapse and mass exodus.0 -

That's a common argument of the Brexiters.

The absolute worst thing hasn't happened yet therefore Remainers are all wrong and it's all good.

(We'll just ignore the thousand small bad things that have happened and the fact that Brexit hasn't happened).

I think it can be compared to the frog sitting in the pot of boiling water. If the water starts cold and then increases he'll sit there till he dies. If the water starts hot he'll jump out.

If we had known all of the negatives that the UK would have by this stage and were informed of this before the referendum I am sure they'd have voted to remain. But now that they're taking the death by a thousand cuts each new cut is just another issue to ignore when talking about talking back control.0 -

This Barnier guy is becoming a joke. does he understand it is not him, Junker or Tusk who is charge of anything. It is the people, businesses, security and trade that call the final shots.

The EU have been negotiating for some time on a free trade deal alongside the WTO on services. This will open up all of the EU to the rest of the world, which will benefit lots of economies. In that case the UK has to be be part of that anyway.

If the EU drop out of it out of spite, can you imagine what an inward looking bunch they will look to the rest of the World. Probably the ROTW will just say sod them, we will do it without them.

Do you really believe that will happen, all the WTO trading in services freely and the EU in isolation.

Seems a fair idea.

http://www.bbc.co.uk/news/business-42420829"if you get on the wrong train, get off at the nearest station, the longer it takes you to get off, the more expensive the return trip will be."

0 -

The last completed round of WTO talks was in......

Líon na bearnaí0 -

Advertisement

-

People go on like as of the WTO arrangemebrs are a neat set if rules and open market access like the EU and EEA arrangements. They are anything but !

There's a nice synopsis of how messy this could be here:

https://tradebetablog.wordpress.com/2017/04/12/eu-uk-wto-services/

There is also a very strong possibility that the WTO members may get involved in this too as many of the balances would be upset by what the UK government is proposing. This could kick off not only a messy trade negotiation with the EU members but also the broader WTO.

They’re really not being honest with anyone, probably including themselves, about how complex this really is!0 -

flaneur wrote:The other issue is that the UK has long been a haven of regulatory and political stability. All of that has changed in the past year. If you’re a business, you’ve no longer any idea if you’ll have market access, the immigration / employment policies are in a state of flux and have become very irrational and you can't be sure if you can get access to talent or if they staff will stay, the regulatory environment is potentially going to become politicised and is in flux and to top it off, the currency is behaving like one in from an emerging market country.flaneur wrote:Even without Brexit completing, the UK business environment has changed and its reputation has been irreparably damaged and could take years if not a decade or more to repair.

Presumably that's why Forbes just named post Brexit UK the best place in the world (out of 153) to do business.

It's interesting that it ranked 28th for political stability.

But the new Facebook investment, the apple campus, the fact that city of London jobs have actually grown since the referendum.... apparently these things won out.0 -

Capt'n Midnight wrote: »No it's not a terrible option.

But this is cake and eat it talk,

no EU politician is going to get re-elected by taking potential jobs from Frankfurt or the IFSC or Paris.

You have to realise that MiFID II equivalence is an absolute requirement for trading with or providing certain services to European counterparts. If you don't have it's Do Not Pass Go , Do Not Collect €200.

It's like the CE mark. You can't sell most consumer goods into the EU without it. But having a CE mark doesn't give you the automatic right to sell into the EU, because of barriers and tariffs and quotas etc , however much you might wish it to be so.

Good morning!

Can you please provide information about tariffs on financial services? From what I've read financial services are only subject to non-tariff barriers to the EU. I'd be interested to find out more about the tariffs financial services outside the EU are subjected to.

MiFID II equivalence is intended to deal with non-tariff barriers.

Your post ignores the fact that it is EU clients that require financial services in London and EU member states at a Governmental level need access to London's markets for debt markets.

Banking at present seems to be one of the safer sectors post-Brexit.

I do wish this thread would put the fear mongering aside and support arriving at a reasonable free trade deal. It seems like some are more interested in schadenfreude than actually negotiating a good exit.

Edit:Peregrinus wrote: »The other point to be borne in mind in connection with the Barnier chart is that what it shows is not so much the EU's position at this point in time as the EU's analysis of the UK's position at this point in time. Movement from this position is possible if the EU changes its analysis, or if the UK changes its position, or if in reality the UK's position is not as shown here.

This is just your spin. The chart simply shows the options the EU is willing to offer the UK at the time of writing.

Much thanks,

solodeogloria0 -

Jim2007 wrote:No but they, like all the major banks they have the operational facilities (usually tested twice a year from what I remember) to very quickly switch away from London should the need arise. Which means they can better afford to play the waiting game at the moment.

Those are DR facilities not actual offices.

If you tried to move a trader to DR permanently - he would deck you.

One of the primary reasons the banks are staying in London is the risk of losing their top players. Nobody wants to work in Frankfurt or Paris let alone Dublin. It's the equivalent of trying to move players from man Utd to Sligo Rovers.

The big hitters will stay in London or go to New York. The talent at all levels will follow them and the capital will find them. It's not really a matter for either the banks, or the regulators, to decide.0 -

Presumably that's why Forbes just named post Brexit UK the best place in the world (out of 153) to do business.

Here's the article.

https://www.forbes.com/sites/kurtbadenhausen/2017/12/19/the-u-k-tops-forbes-best-countries-for-business-2018/#12bda05a26de

https://www.forbes.com/best-countries-for-business/list/#tab:overall

Do you have the metrics that they measure? I can't find them.

Nothing substantially changed in the UK the day after the referendum. So if the metrics they measure were good then they may not have changed much and it would be interesting to see how they were last year and how they'll measure next year and after Brexit / transition period has happened.0 -

It really isn't. The UK isn't looking to conclude an exit agreement with "people, businesses, security and trade"; they're looking to conclude an exit agreement with the EU. Barnier's views matter a lot.brickster69 wrote: »This Barnier guy is becoming a joke. does he understand it is not him, Junker or Tusk who is charge of anything. It is the people, businesses, security and trade that call the final shots.

I don't think your view of what's going on here is very realistic. There's already a WTO Treaty on trade in services - the General Agreement on Trade in Services (GATS), which entered into force in 1995. The EU is a party to it, and therefore the UK is too (but it will drop out when it leaves the EU, and won't become a party again unless and until it applies to be be admitted to the WTO, and is accepted).brickster69 wrote: »The EU have been negotiating for some time on a free trade deal alongside the WTO on services. This will open up all of the EU to the rest of the world, which will benefit lots of economies. In that case the UK has to be be part of that anyway.

If the EU drop out of it out of spite, can you imagine what an inward looking bunch they will look to the rest of the World. Probably the ROTW will just say sod them, we will do it without them.

Do you really believe that will happen, all the WTO trading in services freely and the EU in isolation.

A review of the GATS, with a view to amending, extending and updating it, has been trundling along for about 15 years. It hasn't made great progress, to be honest. Nobody is expecting a revised treaty any time soon. If and when a revised treaty ever appears, it will certainly include measures designed to make Brexiters foam at the mouth. There's not much point in brexitting to escape the jurisdiction of the Court of Justice of the European Communities, only to subject yourself to the jurisdiction of the GATS Disputes Panel, a much murkier body which makes its decisions in closed hearings.0 -

solodeogloria wrote: »It seems like some are more interested in schadenfreude than actually negotiating a good exit.

Who? I don't think many people are taking pleasure out of this. Most of us are being negatively affected or can see ways that we'll be affected after Brexit.0 -

In my case, I am just really annoyed that having just ridden out the credit crunch and thinking that everything was stabilising and looking like we might be returning to normally, along came Brexit.

I've already lost income due to sliding Sterling, so this is very real!

What I don't want to see is a "good deal" meaning that Ireland's completely undermined by a UK operating with one foot in and one foot out. That would be totally unfair all 27 actual EU members. That's where I see the UK wanting to take this - towards a situation where they're effectively non EU members still with full access to the EU.

If we've a situation where Ireland and everyone else is competing with a large country that has full EU market access without any regulatory burden, it's not going to be a very fair situation.

That's a recipe for rendering the EU pointless as everyone wouldn't be economically foced to friends the same deal.

That's what I don't see happening and, despite all the whaling in the tabloids, is not likely to ever happen.0 -

The last couple of dozen or more of your posts have been this sort of stuff. You're not bringing any new arguments to the thread yourself Solo, just endlessly repeating that you hope for a trade deal that allows for services...but the EU has been crystal clear on this: ain't gonna happen.solodeogloria wrote: »Good morning!

Can you please provide information about tariffs on financial services? From what I've read financial services are only subject to non-tariff barriers to the EU. I'd be interested to find out more about the tariffs financial services outside the EU are subjected to.

MiFID II equivalence is intended to deal with non-tariff barriers.

Your post ignores the fact that it is EU clients that require financial services in London and EU member states at a Governmental level need access to London's markets for debt markets.

Banking at present seems to be one of the safer sectors post-Brexit.

I do wish this thread would put the fear mongering aside and support arriving at a reasonable free trade deal. It seems like some are more interested in schadenfreude than actually negotiating a good exit.

Much thanks,

solodeogloria0 -

Advertisement

-

The last couple of dozen or more of your posts have been this sort of stuff. You're not bringing any new arguments to the thread yourself Solo, just endlessly repeating that you hope for a trade deal that allows for services...but the EU has been crystal clear on this: ain't gonna happen.

Good morning!

I'm challenging the idea that the UK is apparently going to go to hell in a handcart after Brexit.

The banking sector at present doesn't agree with you. The conclusion they've come to is that it will play out as normal. The regulatory advice that UBS has received suggests back to back trading into the EU will be able to happen on March 30th 2019. What evidence do you have to the contrary?

We should simply let phase 2 play out before coming up with grand conjecture about how the UK is going to fall apart and it needs the nanny EU to pick it up. The reality is that it doesn't. The UK will be successful after Brexit.

I wish people like you wouldn't see Brexit as something so personal, but rather as a decision by a state to chart a different course. I don't really get why Euro-federalist types in particular get so emotional about the European Union.

Much thanks,

solodeogloria0 -

No, we very much want to encourage the negotiation of a good exit. We just disagree with you about what “a good exit” would look like.solodeogloria wrote: »It seems like some are more interested in schadenfreude than actually negotiating a good exit.

No. It shows the options that the UK is willing to accept. It’s the UK, remember, that’s ruling out the single market, the customs union, ECJ jurisdiction, etc, etc. If the UK maintains those red lines, then the options shown on the chart, which variously involve participation in the single market, the customs union, ECJ jurisdiction, etc, etc. are all options which the UK is rejecting.solodeogloria wrote: »This is just your spin. The chart simply shows the options the EU is willing to offer the UK at the time of writing.

No offence, but your take on this chart pretty much sums up one of the central flaws at the heart of brexitry, which is the insistence that others are responsible for the consequences of the choices that Brexiters make. They really aren’t.0 -

Presumably that's why Forbes just named post Brexit UK the best place in the world (out of 153) to do business.

It's interesting that it ranked 28th for political stability.

But the new Facebook investment, the apple campus, the fact that city of London jobs have actually grown since the referendum.... apparently these things won out.

I would like to remind you that UK is a full EU member. We are going to see how "post-Brexit" UK is doing in 2020 - 2021 the earliest.0 -

solodeogloria wrote: »

This is just your spin. The chart simply shows the options the EU is willing to offer the UK at the time of writing.

Are you suggesting there is an other option not listed on the Chart? If so what is it?0 -

If they don't start getting realistic, they'll be hitting a brick wall fairly soon. Whether the UK economy is deeply impacted or not is really a matter for the UK. So far, very little they're doing should be inspiring much confidence. You've a government and political system putting a fight about notions of emotional ideas about sovereignty ahead of all practical and pragmatic economic necessities.

I don't think you'll see the UK turn into a complete mess, but I do think there's an unpleasant contraction coming.

What's also worrying me is that there's a growing consensus that there's an international correction likely to arrive sometime in 2018-19. There's a huge bubble inflating in the US and that may come crashing down depending on a number of factors over there.

If we've a hard Brexit scenario feeding into big market correction - we could have something akin to 2008 all over again.

Fundamentally what the UK is doing is feeding into serious instability and removing predictability. That's bad for the UK, all of its trade partners and the global economy.

Also what they're doing is unprecedented. So the outcome is unpredictable and hard to model.0 -

Peregrinus wrote: »No, we very much want to encourage the negotiation of a good exit. We just disagree with you about what “a good exit” would look like.

No. It shows the options that the UK is willing to accept. It’s the UK, remember, that’s ruling out the single market, the customs union, ECJ jurisdiction, etc, etc. If the UK maintains those red lines, then the options shown on the chart, which variously involve participation in the single market, the customs union, ECJ jurisdiction, etc, etc. are all options which the UK is rejecting.

No offence, but your take on this chart pretty much sums up one of the central flaws at the heart of brexitry, which is the insistence that others are responsible for the consequences of the choices that Brexiters make. They really aren’t.

Good morning!

We disagree about what the chart conveys. The logical approach from what I can see is that it shows the options that the EU are willing to entertain at present given Britain's red lines.

All I'm saying is that we need to see how phase 2 plays out before we come to a definitive conclusion on this matter.

My take is simply based on a willingness to see what happens in phase 2 as opposed to insisting that every word that falls from Barnier's mouth is gospel. It certainly isn't. I don't take his words any more seriously than what I hear from the British negotiators.

Much thanks,

solodeogloria0 -

Advertisement

-

The EU has very few options solo, unless you expect the EU to contravene its legal obligations to third countries that it has agreements with.

Do you?

Layout a position outside of the chart that has no impact on those legal agreements. Any position.0 -

Presumably that's why Forbes just named post Brexit UK the best place in the world (out of 153) to do business.

It's interesting that it ranked 28th for political stability.

But the new Facebook investment, the apple campus, the fact that city of London jobs have actually grown since the referendum.... apparently these things won out.

Did I miss Brexit? As far as I'm aware the UK is still in the EU.

Either way... London will ultimately be grand. It's a global financial center.0 -

This is what I’m not seeing being discussed : this goes beyond just the UK and EU. If you start to create new structures or new ageements, you’ll reopen issues in the WTO too as countries may seek to enforce agreements against either party to what could be an illegal bilateral arrangement.

By leaving the EU and becoming a third party rather than a member, the EU-UK deal immediately falls into the realms of WTO complications and the EU relationship with the WTO is actually painfully complex.

There’s a whole other can of worms (and particularly nasty ones) that is being completely ignored by the discussion in Britain at the moment.0 -

This is not 'simply' a political problem. It is a legal problem too.

Solutions which are politically good but illegal won't be accepted. Solutions that are legal but politically rubbish may have to be.0 -

solodeogloria wrote:My take is simply based on a willingness to see what happens in phase 2 as opposed to insisting that every word that falls from Barnier's mouth is gospel. It certainly isn't. I don't take his words any more seriously than what I hear from the British negotiators.

What you have to look at is how phase 1 went. The UK basically capitulated to every major EU demand. The time table of negotiations was supposed to be the row of the summer. It was sorted in a day. The UK agreed to pay the Brexit bill, gave way on citizens rights and the Irish border.

Why should phase 2 be any different when the UKs negotiating position is even weaker than its already weak position in phase 1. The closer Brexit gets and the more likely there is to be no deal(i.e. UK does not give the EU what it wants) companies will activate Brexit contingencies and move jobs out of the UK. Time is the UKs biggest enemy. So given the negotiating positions I would put for some emphasis on what any EU official says compared to any equivalent UK official.0 -

Advertisement

-

Deleted User wrote: »This is not 'simply' a political problem. It is a legal problem too.

Solutions which are politically good but illegal won't be accepted. Solutions that are legal but politically rubbish may have to be.

This is again another crock of bluster / misinformation being pushed in the UK. There’s been a discussion that hasn’t even begun to look at the complications around global trade. It’s not the wonderful international free-for-all that is being portrayed and you could end up absolutely mired in messy and protected disputes.

That woman who was interviewed on the C4 vox pop is absolutely right, “you can’t always have everything you want in life”. She May just also need to apply the saying to her own country too.

The reality is that the Brexit vote has politically offered undefined things to the electorate, many of which are legally extremely difficult and in some cases impossible to deliver.

It’s unfair on the UK electorate to continue to mislead them into what could be economic mayhem and I really do think they’re being horribly mislead both by politicians and aspects of media who seem to want to deliver a hard Brexit at quite literally any cost.

If they’re not being given real facts and analysis of the risks and the difficulties, how can they embe expected to make any kind of decisions?

I just see a country sailing off into mayhem based on what are still looking more like the pontificating arguments of people debating something in a pub without any more a superficial grasp of the facts.0 -

-

solodeogloria wrote: »Good morning!

I'm challenging the idea that the UK is apparently going to go to hell in a handcart after Brexit.

The banking sector at present doesn't agree with you. The conclusion they've come to is that it will play out as normal. The regulatory advice that UBS has received suggests back to back trading into the EU will be able to happen on March 30th 2019. What evidence do you have to the contrary?

We should simply let phase 2 play out before coming up with grand conjecture about how the UK is going to fall apart and it needs the nanny EU to pick it up. The reality is that it doesn't. The UK will be successful after Brexit.

I wish people like you wouldn't see Brexit as something so personal, but rather as a decision by a state to chart a different course. I don't really get why Euro-federalist types in particular get so emotional about the European Union.

Much thanks,

solodeogloria

Why do you keep bringing this up. WHo is claiming this, other than yourself?

You are creating a strawman and then winning the argument against yourself.

You continue to bring up the 'project fear' reports prior to the campaign being wrong, yet seem totally non-plussed with pretty much everything on the Leave side being wrong. At least be consistent and try to curb your bias.

IN regards to the effect on the UK, I have asked a number of times yet I have still to see any evidence that Brexit will actually have a positive effect on the UK, outside of the nebulous "control" and "sovereignty".

Both of those are great but not much use to the people who may lose their jobs or face wage stagnation and inflation over the next few years. Do you think it is the EU that has led to increasing number of people needing foodbanks? Was it the EU that led to the failures in oversight to allow Grenfeld to happen? Has it been the fault of the EU that the UK has moved to a service economy but that the spread is largely London centric?

What plans are in place to change these once the dreaded EU is gone?

Already UK has suffered a large drop in GDP growth, from fastest growing to slowest. Dropped from 5th to 6th largest economy. Faces 5+ years of cumulative .4% drop on the projected GDP growth.

Now you have said before that it is still growth, and thats true, but there is a cost to all this and yet Brexit is still sold as this great win for the UK.

Even this latest posts about the City of London, at best it appears that things may stay the same. That is quite a risk to take.

And real people will be affected by all this. Lack of funds to fund the NHS, schools, extra taxes. What is the plan if companies do start to pull out or start to move production elsewhere? Are the UK taxpayers willing to pay extra taxes to ensure that no one is left behind?

And thats even before we get to the effects on Ireland and other countries.0 -

I think the point of the chart is not to say "there's no point to phase 2; we might as well all sign a Canada deal and go home". It's to illustrate the challenge of phase 2 by expressing it as a puzzle.solodeogloria wrote: »We disagree about what the chart conveys. The logical approach from what I can see is that it shows the options that the EU are willing to entertain at present given Britain's red lines.

All I'm saying is that we need to see how phase 2 plays out before we come to a definitive conclusion on this matter.

My take is simply based on a willingness to see what happens in phase 2 as opposed to insisting that every word that falls from Barnier's mouth is gospel. It certainly isn't. I don't take his words any more seriously than what I hear from the British negotiators.

- The UK has adopted a set of red lines which involves rejecting all the existing models, except Canada/South Korea.

- But the UK also doesn't want Canada/South Korea.

- It's possible, but not inevitable, that there's a model (which doesn't yet exist in the real world but which is feasible) which would respect all the UK's red lines, differ significantly from Canada/South Korea, be coherent and consistent, and be more attractive to the EU than a "no-deal" Brexit. Such a model would be a solution to the puzzle.

- Nobody has yet been able to point to one.

- It's not primarily the responsibility of the EU to produce a solution to the puzzle; they didn't set the puzzle and they are not asserting that any solution exists.

- The UK has far and away the most compelling interest in finding a solution to the puzzle. Plus, the UK set the puzzle through its Brexit decision and through its free and unfettered choice of red lines. Presumably, they set a puzzle which they believed had a solution.

- So the diagram basically seeks to set out the puzzle, and invite the UK either to suggest a solution or to reframe the puzzle (by adjusting one or more of its red lines).

- Most commentators point out that the UK's red lines are inconsistent and, if so, then there is no solution to the puzzle and the only way forward is to reframe the puzzle.

- The EU is in principle open to either solving the puzzle or reframing it but in practice suspects that reframing it is the only feasible approach.

As you say, we need to see how phase 2 will play out. But unless the UK can offer a solution that meets the criteria I have identified, phase 2 will crash and burn unless the UK modifies one or more of its red lines.0 -

I would add that a lot of the major projects cited, for example Apple HQ are not as significant as being spun.

Apple is simply taking up to 6 floors of Battersea Power Station to consolidate into a single campus. They had numerous offices scattered around London. Also those decisions to spend money were taken in 2014/15 not after the Brexit referendum.

They’re at big risk of being unable to attract EU design and development talent, if they end up with a convoluted visa arrangement, in which case they might as well just do it in California. One of the advantages of being in the EU is access to a huge array of employees. That’s very relevant to tech, engineering, academica/education, fashion, media etc etc etc and all and has been very much part of what made London a thriving EU hub of creativity.

A lot of people aren’t going to be willing to go through convoluted visa processes. It means things are complicated for moving with your partner, gf, bf, having to apply for settlement rights, having issues with losing your welfare contributions if you decide to move home or elsewhere in Europe etc etc etc Even take something like being an Irish person moving to the non EU UK. You’ll end up with no rights to subsidised university access for your kids in the EU if you spend more than 3 years there as you’ll be deemed to have been non resident in Ireland / EU to establish those rights. This has happened to kids of people I know who’ve worked for US multinationals in the US. They moved back to Ireland and discovered they had to pay full economic fees for 3rd level!

That’s just one of a ton of practical issues that aren’t even being considered.

It removes all the advantages or London as a European base vs just inviting talent back to your real HQ in Cupertino. The visa burden is likely to be similar anyway. London just become any other non EU or non US city. It’s probablu going to do ok but it will not be able to access that huge pool of people so easily.

You really need to look at where the UK is in general now and it is showing very slow GDP growth relative to the rest of the EU and other nations you’d expect to benchmark it against. It’s taking businesses a while to react and adapt to the changed environment.0 -

solodeogloria wrote: »I'm challenging the idea that the UK is apparently going to go to hell in a handcart after Brexit.

The banking sector at present doesn't agree with you. The conclusion they've come to is that it will play out as normal. The regulatory advice that UBS has received suggests back to back trading into the EU will be able to happen on March 30th 2019. What evidence do you have to the contrary?

We should simply let phase 2 play out before coming up with grand conjecture about how the UK is going to fall apart and it needs the nanny EU to pick it up. The reality is that it doesn't. The UK will be successful after Brexit.

I wish people like you wouldn't see Brexit as something so personal, but rather as a decision by a state to chart a different course. I don't really get why Euro-federalist types in particular get so emotional about the European Union.

Firstly, please stop the nonsense that people are saying that the UK will fail after Brexit. Yes there are some people that have posted this, but to say this is the perception on this thread is insulting to those that contribute to it. You will always have posters that will profess that this will happen. At the same time you have posters that will say the UK will flourish and will outgrow the EU as soon as they leave. We don't hold you to that view, I ask you not to hold the view that the UK will explode after March 2019 against everyone else here.

On this point, while there may be consensus that Brexit is a stupid idea, I would bet if you ask those that agree with this view their opinion on anything else you will get opposing opinions. If we were in a echo chamber surely we would all sing from the same hymn sheet and would agree with the same position.

Secondly, don't take it personally? Having just come through the recession and no wage growth for 10 years its a bit rich to say not to take a decision that will hurt both the UK and Ireland personally. Any chance of trying to get ahead a little while costs are increasing has been put in danger because some English people are scared of brown skins and people that speak other languages.

What I hope for is a sensible deal, one that the UK realises what can be given and what cannot. At the moment it seems to me that this isn't possible because the UK wants control. There is no control that will lead to prosperity. If you take control from the EU you will give it to the US or another country who wants to do a deal.0 -

Firstly, please stop the nonsense that people are saying that the UK will fail after Brexit. Yes there are some people that have posted this, but to say this is the perception on this thread is insulting to those that contribute to it. You will always have posters that will profess that this will happen. At the same time you have posters that will say the UK will flourish and will outgrow the EU as soon as they leave. We don't hold you to that view, I ask you not to hold the view that the UK will explode after March 2019 against everyone else here.

On this point, while there may be consensus that Brexit is a stupid idea, I would bet if you ask those that agree with this view their opinion on anything else you will get opposing opinions. If we were in a echo chamber surely we would all sing from the same hymn sheet and would agree with the same position.

Secondly, don't take it personally? Having just come through the recession and no wage growth for 10 years its a bit rich to say not to take a decision that will hurt both the UK and Ireland personally. Any chance of trying to get ahead a little while costs are increasing has been put in danger because some English people are scared of brown skins and people that speak other languages.

What I hope for is a sensible deal, one that the UK realises what can be given and what cannot. At the moment it seems to me that this isn't possible because the UK wants control. There is no control that will lead to prosperity. If you take control from the EU you will give it to the US or another country who wants to do a deal.

Good morning!

I think people are heavily implying that Britain is not going to be successful after Brexit. The vast majority of posts on this thread are in that light. That's the impression you get from scrolling through post after post after post of speculative prophecies about Britain many of which haven't come to light or never will come to light. That's why I broadly think this thread is an echo chamber, or at least it would be if there weren't a handful of dissenting voices on the thread.

I've given plenty of reasons as to why I don't believe that is true, and reasons as to why I think membership of the European Union doesn't suit the UK given its political philosophy. I've been through both at length on the other thread.

And yes, I don't think people should take Brexit personally. It is a decision made by the UK about its own future. Although I think there is going to be a short term cost to Brexit, I think this cost is going to be worth it long term for the additional control that will be regained and new opportunities that will open up. I've been specific about a number of these on the previous thread. Ultimately - I'm convinced that Brexit will be good for Britain.

Now, if Ireland and other EU member states are worried about the impact of Brexit, the right response isn't to cajole Britain into somehow staying against its will. The right response is to put pressure on the EU to ensure that a good deal is reached that is beneficial to all parties.

I don't view Brexit in very emotional terms. It is a logical process that follows from the referendum. It needs to be implemented, step by step until it is completed.

There is nothing wrong, or indeed stupid about a country wanting to regain the same level of control over its own affairs that most countries (outside of the EU) have the great privilege of having.

The point about brown people is silly and it says more about you than it does about anyone else. Most countries on the face of the earth control immigration. Most Western countries outside of the EU manage to do this fairly. Unless you're saying that Australia, Canada, New Zealand and America only have border controls because they are racist. Heck, if immigration controls are racist why doesn't the EU simply just let anyone in? Isn't it racist that they have controls on those coming outside of the EU?

Surely, you know that this is a poor argument.

Much thanks,

solodeogloria0 -

Moderators, Recreation & Hobbies Moderators, Science, Health & Environment Moderators, Technology & Internet Moderators Posts: 92,704 Mod ✭✭✭✭

Join Date:Posts: 90942

Join Date:Posts: 90942

You well know that was an analogy for CE products, which can attract tariffs.solodeogloria wrote: »Can you please provide information about tariffs on financial services?

MiFID II equivalence is a duty not a right.

If you don't have it then for certain services, as Mr Wonka would say, "You Get Nothing"

Especially when you can get the gumberment to roll over.Banking at present seems to be one of the safer sectors post-Brexit.

This is either hoping the EU will reciprocate , or just doing it for the money. For UK citizens abroad this means one less thing to trade for their freedoms.

#takingbackcontrol

http://www.bbc.com/news/business-42420829The Bank of England is to unveil plans allowing European banks to operate in the UK as normal post-Brexit.

The BBC has learned that banks offering wholesale finance - money and services provided to businesses and each other - would operate under existing rules.

...

But on the other hand, London acts as the wholesale bank to the EU and access to its expertise and capital is highly prized. Some may see this decision as surrendering a trump card that should have been held back for the tough negotiations ahead.

...

a senior banker told me six months ago - "if the regulators were in charge, and not the politicians, this would all be sorted out in a fortnight."

They are not in charge. But I understand the bank has the blessing of the government in offering this "no new post-Brexit strings attached" access to the world's largest financial centre.0 -

Capt'n Midnight wrote: »You well know that was an analogy for CE products, which can attract tariffs.

MiFID II equivalence is a duty not a right.

Good morning!

I've cut the silly nonsense from the end of this post.

If you had read the rest of my post - you would have seen that I've mentioned many times on this thread and its predecessor about the EU27 need to access specific financial markets in London. Both clients and governments.

I've also mentioned that this infrastructure isn't easily movable. And even if it was movable, there is little desire amongst regulators in member states to take on clearing.

Also - the Bank of England is independent from the Government. It's been independent since 1997.

EDIT: From reading the article this is a good move. It's a good will gesture and it isn't good for Britain to stop European firms trading in London. It's a reasonable use of what control Britain has. It allows for easier access to London for other European banks. That's exactly the type of move London needs as a financial centre. As for MiFID II equivalence. The idea that the European Commission couldn't see British financial regulation as being equivalent in 2019 when it is actually exactly the same is something to question. It also looks like a number of American banks will get this status subject to Donald Trump not removing Dodd Frank.

Much thanks,

solodeogloria0 -

This is nonsense. The EU is built on decades of complex treaty law. There is no scope to alter the fundamentals to accommodate the UK and even that is not an option as other countries like Canada would have grounds to complain should they be treated less favourably than other third countries like the UK. The reality is obviously that the UK must pick an off the shelf option which it can live with and which maintains the open Irish border.solodeogloria wrote: »Good morning!

We disagree about what the chart conveys. The logical approach from what I can see is that it shows the options that the EU are willing to entertain at present given Britain's red lines.

All I'm saying is that we need to see how phase 2 plays out before we come to a definitive conclusion on this matter.

My take is simply based on a willingness to see what happens in phase 2 as opposed to insisting that every word that falls from Barnier's mouth is gospel. It certainly isn't. I don't take his words any more seriously than what I hear from the British negotiators.

Much thanks,

solodeogloria0 -

Advertisement

This discussion has been closed.

Advertisement