Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

FG to just do nothing for the next 5 years.

Options

Comments

-

Jinglejangle69 wrote: »According to the Irish Tax Institute, the top quartile of earners in Ireland pays more than 80% of the total income tax and USC; the top 1% (incomes over €200,000) pay over a quarter of income tax and USC. A person earning €100,000 already pays twelve times more personal tax than someone earning €25,000.

Successive budgets in recent years have removed an increasing number of income earners from the USC net. In 2015, 23% of the personal tax take came from the USC; by 2018, that number had fallen to 18%. In 2011, just 12% were exempted from paying the charge. Eight years later, that number has more than doubled to 28%.

I keep hearing that. the very few at the top pay for everyone else.

Yet when you go to the CSO figures (which I would presume to be accurate) they tell a completely different story.

Do I believe the extremely wealthy in the country pay very significant amounts of tax? Yes, I believe that to be true.

What I dont believe is this nonsense that a tiny minority pay, the vast majority of the tax. Whenever I challenge someone on it they always fail to provide the evidence.

Look at the figure I cut and paste from the CSO in my above post and tell me how it is at all possible for your claim to be true. If you cant do that provide me with a equally reliable source. Its possible that the CSO have feck'd up I suppose.

But if no one can provide the evidence, (and I'm not talking about some newspaper hack's opinion) then to me its just an urban myth that has been repeated so many times that people actually start believing it.0 -

FrancieBrady wrote: »Because she wasn't prepared to buy power...quite simple.

FF and FG are about to do it...vague bull**** programme for government... constituency bonanzas for those willing to prop them up.

It's how it works and how it always worked from Tony Gregory to Shane Ross.

Well what use is she then. She only got 25% of the vote. She has no divine right to implement her party’s policies as they see fit. She needs to compromise and work with people operating in the real world who want to get things done. That’s if she and SF actually want to do anything, or maybe they’d rather just give out from the opposition benches and in the media and achieve nothing.0 -

Well what use is she then. She only got 25% of the vote. She has no divine right to implement her party’s policies as they see fit. She needs to compromise and work with people operating in the real world who want to get things done. That’s if she and SF actually want to do anything, or maybe they’d rather just give out from the opposition benches and in the media and achieve nothing.

But to compromise you have to talk first.

FG and FF refuse to talk so why would she ever compromise unless there was a potential deal on the table.

Also, and I do not think for one minute anyone disagrees, the disparity in wages in this country is absolutely shocking. I would have no problem with her giving way on the top tax band if a half decent minimum wage was guaranteed, and zero hours contracts were outlawed.0 -

I would have no problem with her giving way on the top tax band if a half decent minimum wage was guaranteed, and zero hours contracts were outlawed.

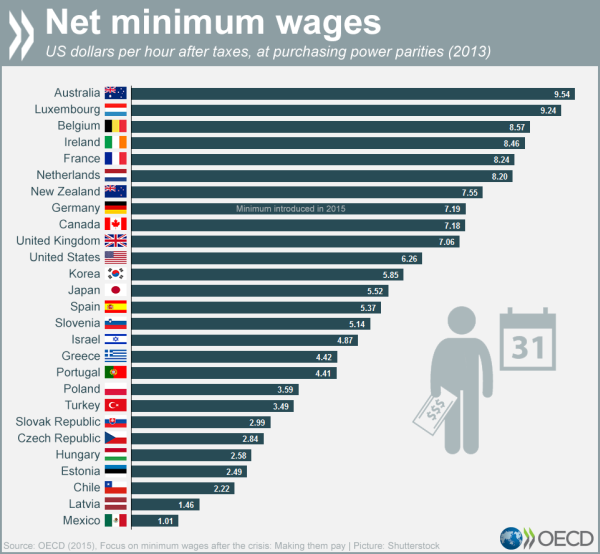

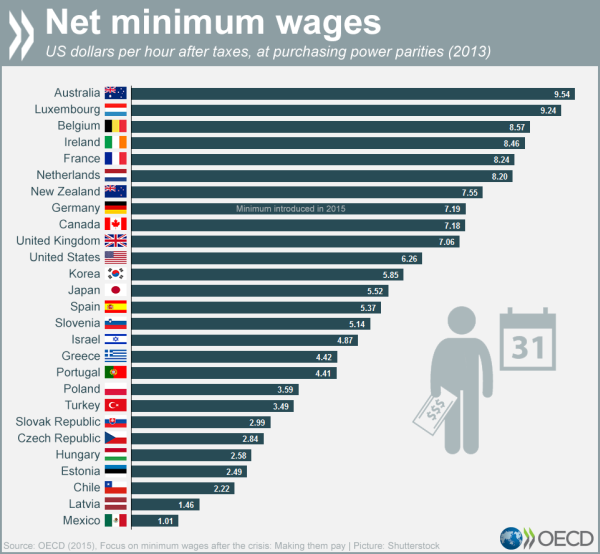

Ireland already has one of the highest minimum wages in the OECD and EU. How much more should it go to, keeping in mind that large scale automation of jobs is coming?

You have a bot above giving out about the high costs of things in Ireland, well you do know that the cost of labour is often the primary cause of this??

Also, those on the minimum wage in Ireland pay no income tax, which we in Ireland are an outlier on.

By all means, advocate European or Scandanavian public services but that means those bottom 25% wage earns will start paying a hell of a lot more taxes.

Good luck to any party advocating that.

No, in Ireland we get the 'Irish solution to the Irish problem'. Advocate Scandanavian public services but get someone else somewhere to pay for it all.

Kind of like how SF are against property taxes in the Republic, but for them in the North.... 0

0 -

Actually not true

Taxation is not just income tax.

The lower paid pay proportionately more in all the other taxes and levies when you compare take home pay to what these taxes take.

Would that mean that the top 5% pay significantly more tax in total? yes but I doubt it is close to the 60% you claim. In fat the CSO would agree with me

Total income tax collected 2017 €84,138.85 Million after deductions

Those earning 100k or more account for 6.7% of all cases in 2017 paying €19,217.94 million after deductions

2017

All Persons

Gross income

100,000 to 150,000

Number of Income Cases (Number) 95,613

Percentage of the Total Number of Income Cases (%) 3.88

Gross Income Charged (Million) 11,394.24

Percentage of the Total Gross Income Charged (%) 11.45

Tax Deducted (Million) 2,690.34

Percentage of the Total Tax Deducted (%) 17.49

150,000 to 200,000

Number of Income Cases (Number) 26,402

Percentage of the Total Number of Income Cases (%) 1.07

Gross Income Charged (Million) 4,506.20

Percentage of the Total Gross Income Charged (%) 4.53

Tax Deducted (Million) 1,241.81

Percentage of the Total Tax Deducted (%) 8.07

200,000 to 275,000

Number of Income Cases (Number) 14,196

Percentage of the Total Number of Income Cases (%) 0.58

Gross Income Charged (Million) 3,280.16

Percentage of the Total Gross Income Charged (%) 3.30

Tax Deducted (Million) 984.83

Percentage of the Total Tax Deducted (%) 6.40

275,000 and over

Number of Income Cases (Number) 14,060

Percentage of the Total Number of Income Cases (%) 0.57

Gross Income Charged (Million) 7,412.22

Percentage of the Total Gross Income Charged (%) 7.45

Tax Deducted (Million) 2,457.90

Percentage of the Total Tax Deducted (%) 15.98

Link to CSO stats if you want to check it out for yourself.

https://statbank.cso.ie/px/pxeirestat/Statire/SelectVarVal/Define.asp?maintable=RVA01&PLanguage=0

Stop posting verifiable facts that contradict Gaelers' worldview. It hurts them and makes them think of Venezuela.0 -

Advertisement

-

Actually not true

Taxation is not just income tax.

The lower paid pay proportionately more in all the other taxes and levies when you compare take home pay to what these taxes take.

Would that mean that the top 5% pay significantly more tax in total? yes but I doubt it is close to the 60% you claim. In fat the CSO would agree with me

Total income tax collected 2017 €84,138.85 Million after deductions

Those earning 100k or more account for 6.7% of all cases in 2017 paying €19,217.94 million after deductions

2017

All Persons

Gross income

100,000 to 150,000

Number of Income Cases (Number) 95,613

Percentage of the Total Number of Income Cases (%) 3.88

Gross Income Charged (Million) 11,394.24

Percentage of the Total Gross Income Charged (%) 11.45

Tax Deducted (Million) 2,690.34

Percentage of the Total Tax Deducted (%) 17.49

150,000 to 200,000

Number of Income Cases (Number) 26,402

Percentage of the Total Number of Income Cases (%) 1.07

Gross Income Charged (Million) 4,506.20

Percentage of the Total Gross Income Charged (%) 4.53

Tax Deducted (Million) 1,241.81

Percentage of the Total Tax Deducted (%) 8.07

200,000 to 275,000

Number of Income Cases (Number) 14,196

Percentage of the Total Number of Income Cases (%) 0.58

Gross Income Charged (Million) 3,280.16

Percentage of the Total Gross Income Charged (%) 3.30

Tax Deducted (Million) 984.83

Percentage of the Total Tax Deducted (%) 6.40

275,000 and over

Number of Income Cases (Number) 14,060

Percentage of the Total Number of Income Cases (%) 0.57

Gross Income Charged (Million) 7,412.22

Percentage of the Total Gross Income Charged (%) 7.45

Tax Deducted (Million) 2,457.90

Percentage of the Total Tax Deducted (%) 15.98

Link to CSO stats if you want to check it out for yourself.

"

Total income tax collected 2017 €84,138.85 Million"

The link says that total tax collected was 15.4bn

It also says that 7.4bn of the 15.4bn is paid by those on over 100k.

So 48% of income tax paid by about 150,000, or about 6.1% of the total of 2.46 million.

Or, 150,000 in this country with a population of about 5 million are paying half of all the income tax.

You're not very good at this.0 -

"

Total income tax collected 2017 €84,138.85 Million"

The link says that total tax collected was 15.4bn

It also says that 7.4bn of the 15.4bn is paid by those on over 100k.

So 48% of income tax paid by about 150,000, or about 6.1% of the total of 2.46 million.

Or, 150,000 in this country with a population of about 5 million are paying half of all the income tax.

You're not very good at this.

Its just a random copy paste job and passed off as 'facts' to try an bolster an argument.

So, lets get to brass tax here.

https://www.irishtimes.com/business/personal-finance/what-is-the-truth-about-paying-tax-in-ireland-1.4101097The Organisation for Economic Co-operation and Development agrees. It cites the State as the second most progressive for income tax among its 36 member countries, and the most progressive among its EU members.

2nd most progressive country for income tax in the OECD.For many years, the ITI has been comparing how much tax average workers pay here compared with seven other countries: the UK, the US, Germany, France, Sweden, Singapore and Switzerland.

It has picked these countries for comparison because they, too, are exporting open economies and compete with the State for inward investment.

In its latest analysis, it found that the State has the second-lowest effective personal tax rate among all eight countries for workers on lower salaries. But as salary levels rise, the State quickly moves up the international income tax league table.

2nd lowest effective tax rates for those on lower incomes.

https://www.datawrapper.de/_/V55bv/

In terms of the overall tax take.For example, in 2015, the top 1% of income earners paid 19% of all personal taxes while just twelve months later this is estimated to be 22%.

https://taxinstitute.ie/wp-content/uploads/2018/03/The-Budget-Book-2017.pdfIn 2017, it is estimated that the bottom 50% of income earners will pay 3.6% of the income tax take0 -

The lower paid pay proportionately more in all the other taxes and levies when you compare take home pay to what these taxes take.

I would like to see a source for this claimWould that mean that the top 5% pay significantly more tax in total? yes but I doubt it is close to the 60% you claim. In fat the CSO would agree with me

The top 1% of earners, earned over €203,389 in income and paid 19% of personal tax.

The top 10% of earners, earned over €77,530 in income and paid 61% of personal tax.

So, perhaps not 5% of the top earners but certainly the top 10% pay 61% of all personal tax.

https://igees.gov.ie/wp-content/uploads/2018/04/Income-Dynamics-Mobility-in-Ireland-Evidence-from-Tax-Records-Microdata.pdf0 -

I would like to see a source for this claim

Nevin Economic Institute:

"Specifically, the bottom 10 per cent of the population forked out 30.5 per cent of their income in total tax, while the top 10 per cent paid 29.6 per cent."

https://www.irishtimes.com/business/economy/poorer-people-in-ireland-pay-out-more-of-their-income-in-tax-1.1910725

The exchequer gets more total tax proportionally out of poorer individuals than they do out of the richest strata in society.

Fairly obvious, and particularly true of countries with high levels of indirect taxation as Ireland does. I'm not sure what squeezing the bottom for more taxes would do for society but to drive more into poverty to satisfy people pushing taxation myths.0 -

Ireland already has one of the highest minimum wages in the OECD and EU. How much more should it go to, keeping in mind that large scale automation of jobs is coming?

You have a bot above giving out about the high costs of things in Ireland, well you do know that the cost of labour is often the primary cause of this??

Also, those on the minimum wage in Ireland pay no income tax, which we in Ireland are an outlier on.

By all means, advocate European or Scandanavian public services but that means those bottom 25% wage earns will start paying a hell of a lot more taxes.

Good luck to any party advocating that.

No, in Ireland we get the 'Irish solution to the Irish problem'. Advocate Scandanavian public services but get someone else somewhere to pay for it all.

Kind of like how SF are against property taxes in the Republic, but for them in the North....

Cum hoc ergo propter hoc - total lack of understanding displayed here. Embarrassing.

We've some of the lowest disposable income in the OECD. And another thing :

"there is a considerable gap between the richest and poorest – the top 20% of the population earn almost five times as much as the bottom 20%."

http://www.oecdbetterlifeindex.org/countries/ireland/0 -

Advertisement

-

Nevin Economic Institute:

"Specifically, the bottom 10 per cent of the population forked out 30.5 per cent of their income in total tax, while the top 10 per cent paid 29.6 per cent."

https://www.irishtimes.com/business/economy/poorer-people-in-ireland-pay-out-more-of-their-income-in-tax-1.1910725

The exchequer gets more total tax proportionally out of poorer individuals than they do out of the richest strata in society.

Fairly obvious, and particularly true of countries with high levels of indirect taxation as Ireland does. I'm not sure what squeezing the bottom for more taxes would do for society but to drive more into poverty to satisfy people pushing taxation myths.

Your link is from 2014.

6 years old.0 -

Jinglejangle69 wrote: »Your link is from 2014.

6 years old.

So has taxation has radically changed in the last 6 years?0 -

Can't wait for the first FG - FF cabinet meeting,, just wait till FF see the type of things FG want to push to the top of the list.

A number of TDs have raised the question of new allowances to allow them to purchase office equipment while they work from home during the Covid-19 outbreak.

https://www.irishexaminer.com/breakingnews/ireland/tds-seek-allowance-for-working-from-home-994059.html

I give it 3 months before it falls apart, and we have to have a GE.0 -

Can't wait for the first FG - FF cabinet meeting,, just wait till FF see the type of things FG want to push to the top of the list.

A number of TDs have raised the question of new allowances to allow them to purchase office equipment while they work from home during the Covid-19 outbreak.

https://www.irishexaminer.com/breakingnews/ireland/tds-seek-allowance-for-working-from-home-994059.html

I give it 3 months before it falls apart, and we have to have a GE.

https://twitter.com/EOBroin/status/1250309582884229120?s=190 -

https://kfmradio.com/news/15042020-1018/listen-social-democrats-not-ruling-outjoining-coalition

SDs now surprisingly looking like the best bet to be the third wheel on this contraption. Although I guess Shortall and Murphy are probably thinming this is their last shot at a big job...0 -

Loafing Oaf wrote: »https://kfmradio.com/news/15042020-1018/listen-social-democrats-not-ruling-outjoining-coalition

SDs now surprisingly looking like the best bet to be the third wheel on this contraption. Although I guess Shortall and Murphy are probably thinming this is their last shot at a big job...

I thought Roisin Shorthall said the opposite only yesterday (or maybe I was reading an old tweet) I will try and dig it out.0 -

Its just a random copy paste job and passed off as 'facts' to try an bolster an argument.

So, lets get to brass tax here.

https://www.irishtimes.com/business/personal-finance/what-is-the-truth-about-paying-tax-in-ireland-1.4101097

2nd most progressive country for income tax in the OECD.

2nd lowest effective tax rates for those on lower incomes.

https://www.datawrapper.de/_/V55bv/

In terms of the overall tax take.

https://taxinstitute.ie/wp-content/uploads/2018/03/The-Budget-Book-2017.pdf

You really need to read what you are posting and digest it before using it as evidence.

The top 0.1 percent are earning over €745,580, ten times more than the €76,296 of the lowest paid in this top 10%.According to the analysis, in 2015 the top 10% earn one-third of all income (36 per cent).

Now what does that tell you? Well it tells me that we have some horrendously rich people in this country. Would you hazard a guess as to the total earnings of this 10%?

Clearly shows the wage disparity in this country.The median gross income is €27,898 in 2015. The income threshold for the top 0.1% is €618,296 in the same year

You do understand what the difference is between Average (mean) and median is?

The "mean" is the "average" you're used to, where you add up all the numbers and then divide by the total number of people. The "median" is the "middle" value in the list of numbers.

The report you use as evidence suggests that the lower half of that table earned €27,898 or less.

I geustimate they will be paying some where close to €5k to €5,5k in tax depending on circumstances.

Given that so many people are earning significantly less than the average industrial wage do you expect them to be paying more tax?

In fact it is highly likely that many of these do not even reach the threshold to start paying income tax (about €16k)

If your argument is that the lower half of income earners should be paying more tax, I totally agree with you.

In order for that to happen they would have to earn significantly more.

The wage disparity in this country is atrocious. Its why average figures, or using percentages, simply does not give a clear picture of what is happening in this country.0 -

Nevin Economic Institute:

"Specifically, the bottom 10 per cent of the population forked out 30.5 per cent of their income in total tax, while the top 10 per cent paid 29.6 per cent."

https://www.irishtimes.com/business/economy/poorer-people-in-ireland-pay-out-more-of-their-income-in-tax-1.1910725

The exchequer gets more total tax proportionally out of poorer individuals than they do out of the richest strata in society.

Fairly obvious, and particularly true of countries with high levels of indirect taxation as Ireland does. I'm not sure what squeezing the bottom for more taxes would do for society but to drive more into poverty to satisfy people pushing taxation myths.

I remember that report doing the rounds, and it was widely discussed and also questioned widely.The research flies in the face of many other findings.

Earlier this month, the ESRI reversed previous findings to conclude in a report by John FitzGerald on income distribution that the brunt of the budgetary adjustments have been borne by middle-income earners.

Dr FitzGerald's findings note that welfare payments have been protected and high earners have been wiped out, leaving the tax burden to be shifted to Middle Ireland.

"This means that somebody else has got to pay and in this case it was those in the middle-income range," Prof FitzGerald concludes.

But this is the most pertinent point in all this.

.This hits the poor harder because they pay the same tax for a bottle of wine or packet of cigarettes as their middle class counterparts, the Nevin Institute says

So, the poorer people spend more of their income on drinks and fags then the rest. Is that is what they are telling us?The Nevin Institute does not question the contribution from the richest people in the country but believes that the middle class is not paying its fair share.

So, its the middle class that need to pay more, that is circa 80% of the population. Will SF adopt that position? :pac:

And this is to take the research done by NERI at face value.

There is an interesting thread here about it, where its claimed the Nevin Institute cooked the books to come out with these findings.

https://www.askaboutmoney.com/threads/nevin-institute-low-paid-pay-more-tax.188862/0 -

We've some of the lowest disposable income in the OECD.

When you say some, you mean we are ranked 19th of out 40? As in right in the middle? You can also say 'We have some of the highest disposable income in the OECD'. It would more correct than your statement."there is a considerable gap between the richest and poorest – the top 20% of the population earn almost five times as much as the bottom 20%."

http://www.oecdbetterlifeindex.org/countries/ireland/

Again, by your very own link, we are 15 out of 39. We are a more equal nation that Germany, Australia, Italy, Greece, Luxemberg, Canada, New Zealand, just to name a few, if measuring on Social Inequality.

.

.

.

I know some want to paint Ireland as this dystopian unequal uber neo-liberal capitalist hell-hole... but the facts don't bear it out at all. Are there some things we can do better at, sure, buts lets lose the plot either and go full retard when discussing this stuff.

From the very same link.In general, Irish people are more satisfied with their lives than the OECD average. When asked to rate their general satisfaction with life on a scale from 0 to 10, Irish people gave it a 7.0 grade on average, higher than the OECD average of 6.5.0 -

I know it makes great news, in times like this, but has there been any indication that any FG TD's were asking for this?0 -

Advertisement

-

-

The top 0.1 percent are earning over €745,580, ten times more than the €76,296 of the lowest paid in this top 10%.

Now what does that tell you? Well it tells me that we have some horrendously rich people in this country. Would you hazard a guess as to the total earnings of this 10%?

I am not sure what your point is. In any country, go out and see what the top 0.1% earn and it will be a nice number. The top 0.1% will be rich enough in places like Norway and Sweden too. So, unless you are advocating some sort of national wage cap, the top 0.1% will always earn well.

Oh, and they pay lots of tax too! More income tax than the bottom 20-30% of workers.Clearly shows the wage disparity in this country.

It doesn't if you look at the OECD figures. You do know what a laffer curve is, do you?You do understand what the difference is between Average (mean) and median is?

The "mean" is the "average" you're used to, where you add up all the numbers and then divide by the total number of people. The "median" is the "middle" value in the list of numbers.

Oh great, a lecture on statistics from a bot.The report you use as evidence suggests that the lower half of that table earned €27,898 or less.

Does that include part time workers as well?Given that so many people are earning significantly less than the average industrial wage do you expect them to be paying more tax?

In fact it is highly likely that many of these do not even reach the threshold to start paying income tax (about €16k)

Dont guess, tell us. How many workers as a % do not reach that threashold.

A worker, working full time hours on the min wage, will earn €19,852 a year.

Those that earn less, are part time workers, normally students and the like, mostly because they choose to work less hours.If your argument is that the lower half of income earners should be paying more tax, I totally agree with you.

In order for that to happen they would have to earn significantly more.

The wage disparity in this country is atrocious. Its why average figures, or using percentages, simply does not give a clear picture of what is happening in this country.

Again, that means raising the minimum wage. How fast and far do we raise it?

Do you think in the middle of a pandemic and soon to be global depression, we should rise the cost of labour?0 -

I know it makes great news, in times like this, but has there been any indication that any FG TD's were asking for this?

Who else might do this,, lets see.

The SD's ..Róisín Shortall and Catherine Murphy ,, Not in a million years.

SF.. Defo Not ,, are ya mad ?

Richard Boyd Barrett and the PBP gang, again, are ya mad,,Not in a million years.

Gene Pool FF IND,, accidental landlords and shop owners,, No way

FF,, so long in opposition, they just want to be at the table,, so no way its them.

LP,, licking wounds and keeping their head down.

So here we are.

FG and the Gene Pool FG IND,, sure who else would it be ???0 -

Don't see any indication in the article from the tweet Mark, which played a huge part in me not suggesting that they had.

OK, so why post it in this thread so, which has to do with FG?

Is it the case of everything that is now wrong in Ireland gets posted here, like a honeypot for cranks and malcontents?0 -

OK, so why post it in this thread so, which has to do with FG?

Is it the case of everything that is now wrong in Ireland gets posted here, like a honeypot for cranks and malcontents?

A poster posted about apparently some TDs requesting extra moolah for working from home, I posted a tweet that was related to that post.

Rocket science it is not.0 -

Who else might do this,, lets see.

The SD's ..Róisín Shortall and Catherine Murphy ,, Not in a million years.

SF.. Defo Not ,, are ya mad ?

Richard Boyd Barrett and the PBP gang, again, are ya mad,,Not in a million years.

Gene Pool FF IND,, accidental landlords and shop owners,, No way

FF,, so long in opposition, they just want to be at the table,, so no way its them.

LP,, licking wounds and keeping their head down.

So here we are.

FG and the Gene Pool IND,, sure who else would it be ???

You should get a job with the Washington Post, with that cutting edge journalistic investigation Vigor of yours. The world needs another Carl Bernstein.... :D:D:):)

:D:D:):)

Or maybe the National Enquirer is more your level... or maybe the comment section of journal.ie....:D:D:D

Just off the top of my head.

SF... printer cartridges..

They also claim millions from Westminister, without ever stepping foot in the place.

RBB... car expenses...

https://www.independent.ie/irish-news/richard-boyd-barrett-claims-12000-for-car-repairs-and-travelling-12km-to-dail-28820971.html

FF and expenses....

Remember this?He spent €250,000 in his time as Ceann Comhairle and €550,000 in his time as Minister for Arts, Sport and Tourism.[1] His wife Kate-Ann also enjoyed many of the expenses.[1] Tabloid newspapers referred to the politician with titles such as "Johnny Cash

Labour?

https://www.irishexaminer.com/breakingnews/ireland/higgins-spent-17m-on-hospitality-during-first-term-892017.htmlPresident Michael D Higgins spent more than €1.7m on food, beverages, hospitality, and entertainment during his first term in office, newly published figures reveal.

Áras an Uachtaráin has published a report which details, for the first time, how an annual €317,000 discretionary allowance was spent during President Higgins’ first term in office.

Mr Higgins came under pressure during the recent presidential campaign to make his expenses public and the allowance was dubbed a “slush fund” by Fianna Fáil TD Marc McSharry when the Public Accounts Committee examined presidential spending earlier this year.

..

.

.

Stones, glass houses and all that.0 -

-

You should get a job with the Washington Post, with that cutting edge journalistic investigation Vigor of yours.

Stones, glass houses and all that.

Small change, and individual lapses in judgement.

With FG it their government policy, and billions of euros are involved.

When Dinny sold esat for 350 Million, he never paid a penny in tax

100's of millions to Dinny to put in water meters

Nearly 2 billion of NAMA properties sold back to developers for a penny on the pound.

I would rather have the odd ink cartridge go missing than see another SiteServ,, or see over 2 billion paid to BAM to build a hospital that will have less beds than the one it will replace.0 -

https://gript.ie/how-the-irish-government-risked-the-lives-of-people-in-nursing-homes-and-lost/

Incredible, negligence of the highest order here. It's dumbfounding that these decisions were made and allowed to happen. Dozens of parents, grandparents, great grandparents lives lost unnecessarily by our governments ineptitude.

May they all rest in peace.0 -

Advertisement

-

Grand, this is the honeypot thread for cranks and malcontents...

Glad we cleared it up.

2 questions please mark.

Have you taken it upon yourself to police the thread, and set the tone as to what can and cannot be posted, ie I was unaware other posters could now not post stuff in the thread if it was not specifically FG related.

Second question, do you think if I bothered my barney searching your posts in this thread, I might perhaps find a few posts non fg related, in actual fact, they might be SF related, and if you did post such things would that then make you a malcontent crank encircling a honeypot?

Think before you post.0

This discussion has been closed.

Advertisement