Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi there,

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

So a Memestock was my first Stock. What Now?

Comments

-

Right so I made some purchases this morning, here is what it cost me:

First I changed (sold Euro) €980.00 and got £839.91. This was a great rate. I paid a commission of €1.68 (i.e. the $2.00).

I then made 9 UK Investment Trust buys in 7 UK trusts. I messed up a little here and basically bought £100.00 (roughly) of each, then spent another £150.00 (roughly) topping up two stocks. This means I made two unnecessary trades and wasted money. Ah well.

I spent a total of £821.94 on the stocks themselves (i.e before commission/fees).

I am a little confused about what currency commissions and fees are displayed in, I am pretty sure they are in GBP (as that is the currency they are traded in) but don't take that as gospel. I paid a total commission on the stocks of £9.35, with total fees (Stamp Duty Reserve Tax? Fee works out at 0.5%) of £3.62 for a total cost of £12.97, giving me a total cost basis for these stocks of around £836.00.

I have paid total commissions of €1.68(about £1.44) + £9.35 = £10.79 which is around $15.00 This comfortably covers the $10.00 a month charge (which is not charged for the first 3 months anyway).

So to conclude, between commissions and fees, for 9 stock purchases and 1 fx trade, it cost me around €17.00 (around 4 of that being what I think is tax).

Or another way to look at it, is that I spent around €975.00 today (have a remaining cash balance of €25) and €17.00 of that €975.00 were "costs" which works out at 1.74% of what I spent (I think I have that right?).0 -

Just to add, on the reporting front you can generate tax documents, and it has a facility to factor in FIFO which means I have probably wasted my time making a complicated spreadsheet, ah well!!0

-

No, I'm afraid not you have to pay tax, and should have, by the sounds of it, paid it years ago.shtpEdthePlum wrote: »I got in to crypto six years ago. I made substantative profits off initial investment. I took profits out for car insurance and maybe some other things I needed at the time but reinvested the rest.

It is only now occurring to me that I need to pay taxes on the profits. Is there any way I can just give all the money to charity or something and not have to figure out how much I owe. I don't actually need the money any more, it was just a hobby. I currently have around 25k in various coins and some fiat.

I would actually forfeit the money rather than going back through the hundreds and possibly thousands of individual transactions and figuring out if it was a profit or loss and how much, because that is absolutely sh!t craic. Stupid prick government ruling every action we ever take.

I would talk to an accountant about how to get you back to compliance.0 -

shtpEdthePlum wrote: »Can I just assume it's all a profit and hand the relevant amount to the revenue.

I really could not be bothered dealing with this, I don't want it.

The laws around this were very unclear at the time and I was young so I didn't even realise there were laws around it.

I'm willing to give the government the whole thing just to be able to forget about it.

Our CGT laws are abusive and overly complicated, but even if it was all a profit with an initial acquisition cost of 0, you would not have to pay everything as tax. “Only” 33% minus your yearly allowance.

IMO if you go to Revenue and hand them money telling them it is all profits and they can have it, it will actually cause trouble for you. I.e. they will likely ask you to clarify where this profit comes from before accepting your money.

Do you still have access to you transactions history on the exchange(s) on which you were trading? If yes you can import the whole history on a service like Koinly and it will calculate your tax liabilities automatically (for a fee) and produce a nice PDF report which you can provide to Revenue if they ask. This is pretty easy and works well if you still have all your transactions history as CSV files (it will work across multiple exchanges as well). If you don’t have the documentation anymore, you should probably talk to a tax professional.

Note that if you haven’t made any large disposals over the years* and have just been holding, you actually aren’t behind with your tax obligations as it is only at disposal time that CGT is due. If you have made large disposals though, you might have outstanding CGT liabilities for previous years (and to be clear, trading one cryptocurrency for another one is a disposal as far as CGT calculation is concerned).

* I.e. if your gains didn’t go above your yearly CGT exemption for any of the past years0 -

You won't end up in jail. How many years ago are we talking?shtpEdthePlum wrote: »That is phenomenal advice. Thanks a million. So 33% minus allowance. Dark cloud lifted, I can actually enjoy investing again! Lesson learned.

Probably have to pay a fine actually though for the profits from years ago, will I? Could I end up going to jail? Balls0 -

shtpEdthePlum wrote: »That is phenomenal advice. Thanks a million. So 33% minus allowance. Dark cloud lifted, I can actually enjoy investing again! Lesson learned.

Probably have to pay a fine actually though for the profits from years ago, will I? Could I end up going to jail? Balls

Oh actually I just had a look and I think they might be under the allowance. I will speak to an accountant.

No worries.

I was actually adding a note at the end of my original post at the same time as you replied. I think it adresses this.

Basically as long as your total profit across all assets disposals (not just cryptocurrency) for a given year is below €1,270, you don’t owe any tax (but see my comment on trading between cryptos).

And no you’re not going to jail :-) Even if you had a few thousands euros of CGT in arrears, for Revenue this is a small amount in the grand scheme of things and if you come to them explaining you didn’t know and want to clear your balance, they’ll probably just apply a small fine for delayed payment. But yeah maybe talk to a professional and go into the details of your situation with them.0 -

Had a go at trying to send "pre converted" currency (USD) to IBKR. It very much seems possible, just a case of putting in the right bank details. However, I am always nervous of messing this type of thing up, and transferring to an American account is a bit different than just putting in a BIC and IBAN. It seems straightforward enough, but I didn't chance it, especially seen as I will have to pay $10 a month either way, it seemed too much fuss to avoid the fee on exchange, only to have to pay it anyway! However, if you plan on making lots of trades each month, transferring directly with your currency of choice from Revolut is possible, and would save you money.

Just on the point of commissions, it is a little sad that because of them , you will start off in the red :-(. Hopefully it won't take long to go green! IBKR is a little awkward to use, to log in you get a text and have to put a code in each time. This makes sense and is secure, but is a little annoying if you just want to see how your portfolio is doing (although that said it has great tools that breakdown in detail your holdings, even on an individual basis, it breaks down ITs like funds so you can see what sectors, countries etc.) I have a spreadsheet with live prices which tracks things for me, but I also put my portfolio and transactions into WallMine which is very good with charts and stuff just to see how you are getting on at a glance.0 -

Right, so I have established a holding in each of my eight holdings, with a total cost of around €1,120. Its not split exactly evenly, in Euro terms each has a minimum of €108.00 with PCT, BRKB and AGT being the largest holdings I have.

I will have around €300 a month to invest, so I plan to make 3 €100.00 investments a month in a strict order, regardless of market price (within reason).

There is a good argument that the best way may have been to invest the money differently, perhaps to invest in a single stock at €1,000 a time. I decided against this for a few reasons: I want to have the money in the market ASAP, by regularly investing I can get the merits of averaging, I don't want to save up a larger sum then start second guessing about what stock to buy (this is the main reason, if I just think "I am spending x on a, b and c this month" I think I will be more inclined to regularly invest and stick to it over the long term, mentally I will just find this easier). I think this way of regular, small monthly investments may work best for me, but others may find other ways better.

In the longer term I may add some more holdings (trusts focused on real estate or debt perhaps) but for now I am just going to stick with my 300 or so a month and see how it goes. (The 300 is not an arbitrary number, but rather a small percentage of disposable income I have. This will rise over time)

I am thinking of posting here now and again about how I get on, in the hope that it may be interesting/helpful for people here (even if it is just to see how not to do things!). However, I don't want to go ahead posting self indulgently, so please let me know if you think occasional updates on progress, if I change the portfolio etc. would be helpful/of interest.0 -

Lamar Thoughtless Napkin wrote: »Right, so I have established a holding in each of my eight holdings, with a total cost of around €1,120. Its not split exactly evenly, in Euro terms each has a minimum of €108.00 with PCT, BRKB and AGT being the largest holdings I have.

I will have around €300 a month to invest, so I plan to make 3 €100.00 investments a month in a strict order, regardless of market price (within reason).

There is a good argument that the best way may have been to invest the money differently, perhaps to invest in a single stock at €1,000 a time. I decided against this for a few reasons: I want to have the money in the market ASAP, by regularly investing I can get the merits of averaging, I don't want to save up a larger sum then start second guessing about what stock to buy (this is the main reason, if I just think "I am spending x on a, b and c this month" I think I will be more inclined to regularly invest and stick to it over the long term, mentally I will just find this easier). I think this way of regular, small monthly investments may work best for me, but others may find other ways better.

In the longer term I may add some more holdings (trusts focused on real estate or debt perhaps) but for now I am just going to stick with my 300 or so a month and see how it goes. (The 300 is not an arbitrary number, but rather a small percentage of disposable income I have. This will rise over time)

I am thinking of posting here now and again about how I get on, in the hope that it may be interesting/helpful for people here (even if it is just to see how not to do things!). However, I don't want to go ahead posting self indulgently, so please let me know if you think occasional updates on progress, if I change the portfolio etc. would be helpful/of interest.

I think its good of you to disclose what you are doing so regular updates would be interesting to see. You currently explain your thought process around what you are doing which makes it even more interesting.

This being the internet, someone saying you're doing it wrong, you should have done A, B, C months ago etc or that there's no need for another thread like this probably are never too far away but so what. You'll definitely learn something in this process and even if it's only a defacto diary of your movements and thoughts around them which you will look back as time passes, then that might not be a bad thing either.

Good luck with it.0 -

Advertisement

-

Thanks all. Just to comment again on lodging funds with IB, today I converted EUR to GBP in Revolut and transferred the GBP to IB directly. This worked much better, not only did I save the commission fee, but it transferred within ten minutes rather than the 12 hours the EUR transfers took. The only snag was that IB give you a BIC and IBAN and Revolut asked for Account and Sort Code - easily solved of course as these are in the IBAN.0

-

Some further thoughts on Investment Trusts and Trust Managers.

Recently it was announced that the investment manager of Scottish Mortgage, James Anderson, is retiring next year. With ITs it is vital to keep an eye on the manager, and who managed it in the past. IT managers can have their own style (and luck!) that can massively affect the performance of the trust. When you are looking at past performance of an IT, you have to account for the manager - if a new one was appointed last year, the IT performance 3 years ago is of limited use. But if the manager has been in charge, and successful, for a long time then past performance is useful. Of course, past performance does not guarantee anything, but if a manager consistently beats his index it does mean something.

That said, a change in manager might not result in a significant change in philosophy and performance, particularly if an assistant from the same firm is taking over. This is the case with SMT, Baille Gifford remain in charge, and an experienced deputy is taking over. The same is happening with Monks. This is the ideal form of transfer, if the manager has been successful. A change in manager can also be a massive shot in the arm for an under-performing trust, case in point is Temple Bar.

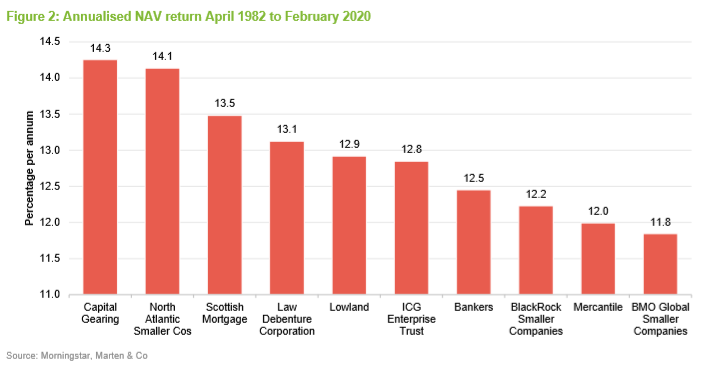

Trust investment managers differ wildly: James Anderson is a dedicated (and wildly successful) Growth style investor. Peter Spiller, manager of CGT for coming up on 40 years is a far more conservative, Value style investor (also extremely successful). Some managers are also "active" managers. Take Christopher Mills of North Atlantic Smaller Companies, he specializes in getting positions in companies, then actually going in and forcing changes, forcing out and replacing company managers etc. He has been fantastically successful for decades and has a "value" style philosophy.

North Atlantic Smaller Companies (NAS)

This trust, ran by the aforementioned Mills, has been extremely successful for a long time, consistently beating the GBP adjusted S&P500. It is focused on small caps around the north Atlantic - basically the UK and some in America. It holds shares in other companies and investment vehicles, but it also takes some companies private. This trust can be hard to get data on (hence me not mentioning it earlier until I did my research) as it is not registered with trustnet or the AIC. This initially made me a bit wary of it, but having read up a lot on it I think it is a good buy, so it is my 9th stock.

Another useful indicator regarding managers and trusts, is the amount of shares in the trust they own, or "skin in the game". The theory is that if they own a substantial amount of it they will be careful and prudent with the trust. Mills owns about 25%. Mills is in his late sixties, so what will happen when he retires? Well, all indications are that he will go on for a while yet. It is suspected that when he does call it a day the trust will be liquidated in an orderly fashion with investors getting paid out, all going to plan, something approaching the NAV. It is worth noting that it currently trades at a discount of around 28%. The largest institutional holder of shares in NAS is the aforementioned CGT who are big fans of it.

Anyway I could go on, but the annual reports and such are all there to read... Tl:dr NAS is a buy because of the managers great record, the attractive discount, because I think there is lots of value in the UK in general.

Finally, I would say again that I could be wrong on everything, and I would be sympathetic with any suggestion that splitting such a small initial sum over 9 stocks is not the best idea, especially with the commissions, but I have explained why previously, and as the sums grow (hopefully ), both the size of the portfolio and the amount invested regularly, over time it will balance out. We will see! 0

), both the size of the portfolio and the amount invested regularly, over time it will balance out. We will see! 0 -

Great report e.l.r.

Did you do any investigation I to the Real Estate trusts ?0 -

I have done a little, I've decided I won't go near them for a while yet because I am not sure how everything will play out post covid, but mainly because 9 trusts is probably too many at this stage given the small sums I'm investing. As time goes on and I might take "one off" investments of a grand or so in specialist trusts and just leave it, and keep regularly adding to my "main" ones, but I will wait and see. I'm buying a new house within the next year (hopefully) so that's enough real estate to keep me going!Great report e.l.r.

Did you do any investigation I to the Real Estate trusts ?

Regarding real estate, the first thing to decide is what type you want to invest in, or do you just want to invest in real estate in general? My feeling is to pick a sector of real estate and back it, decide whether retail, commercial (offices), residential or industrial will do better.

Commercial is a bit of an unknown, many people are saying that wfh will cause a big change in office practice, and reduce the demand for office space. I am not convinced. I work in a large organization and this is something I know a bit about, and while people want to stay working from home, the general consensus is to have at least one day a week in the office, in practice probably two to three. For there to be any net reduction in required office space there will have to be "hot-desking". Once you get above entry to lower mid level employees this will not work. Giving up your office to share one with god knows who? Squabbling over desk space when too many come in on the one day? No chance. So I am not convinced the bearish projections on prime office space are at all warranted. I can see the appeal for places like call centers, if they can supervise properly with people wfh, but I'm not convinced, because younger and poorer people who are housesharing do not have the space to effectively work from home. I think, in the long term, offices are to stay. But I don't know really, too many unknowns.

Retail, rents from shops, you would think will decline as more people move online, but again I'm not too sure.

Residential, again I am not sure. We will have to see how it plays out. Some are saying wfh will see a big exodus from city apartments, I'm not too sure. You would think that people have fallen behind on rent due to job losses from Covid. In Ireland people will be screwed when PUP runs out and they have no job to go back to.

If I were to pick one type, it would be industrial/warehousing. In theory, warehouse leasing is good, as tenants spend loads of money kitting them out (so they won't move at the drop of a hat) and they have decade plus long leases, usually linked to inflation. Online shopping will presumably increase, so demand for warehouse space is going nowhere. Even if everyone is at home working in their living room, warehouse workers are not. The trust that is head of my list if I ever invest in a real estate trust is Tritax Big Box (I have some small exposure to this through CGT, it is 2% of CGTs assets) who specialize in this area, I can see this sector increasing, perhaps substantially. I can't see it totally collapsing, so this is why I think it is the best.0 -

Thanks ex loco for your very detailed posts regarding IT.

what is annoying for me is the £ in all of them. Somehow i see the £ as a weak link. Would love to invest in € IT.

What's your view on this?0 -

Thanks ex loco for your very detailed posts regarding IT.

what is annoying for me is the £ in all of them. Somehow i see the £ as a weak link. Would love to invest in € IT.

What's your view on this?

Whether it is quoted in GBP, USD, EUR, or whatever currency makes no difference in terms of how they are performing for you. What matters is the performance of the underlying equities they are invested in.0 -

Advertisement

-

Whether it is quoted in GBP, USD, EUR, or whatever currency makes no difference in terms of how they are performing for you. What matters is the performance of the underlying equities they are invested in.

How is that right? If i strongly believe that GBP will go south if my investment is in GBP am I not affected?0 -

How is that right? If i strongly believe that GBP will go south if my investment is in GBP am I not affected?

Let’s say an IT is 100% invested in US equity, and one share is worth 10 GBP at today’s price.

If next week the US stock market is perfectly stable and the GPB loses half of its value against the dollar, the outcome is that each share of your IT will be worth 20 GBP (the IT is listed in GBP but none of the underlying assets are GBP assets, so if the value of the GBP drops the share price of the IT increases accordingly because the GBP value of those assets is increasing).

So at the end of the day, yes the pound has lost 50% of its value, but it makes no difference to you as your shares are also worth twice as much in pounds (I.e. they have been flat in dollars).

So what should matter to you if you don’t want GBP exposure isn’t the currency in what an IT/ETF/fund is listen, but you should look at the details of their holdings and see if they own many GBP assets or even are holding cash in GBP.

And it is a different discussion, but I personally wouldn’t be so bearish on the pound vs the euro. It looks like the UK are starting to tighten their fiscal and monetary policies while the rest of Europe is going the opposite direction. I won’t be making any strong directional bet and I will just diversify my cash holdings, but this could actually be headwind for the euro.0 -

Let’s say an IT is 100% invested in US equity, and one share is worth 10 GBP at today’s price.

If next week the US stock market is perfectly stable and the GPB loses half of its value against the dollar, the outcome is that each share of your IT will be worth 20 GBP (the IT is listed in GBP but none of the underlying assets are GBP assets, so if the value of the GBP drops the share price of the IT increases accordingly because the GBP value of those assets is increasing).

So at the end of the day, yes the pound has lost 50% of its value, but it makes no difference to you as your shares are also worth twice as much in pounds (I.e. they have been flat in dollars).

And it is a different argument, but I personally wouldn’t be so bearish in the pound vs the euro. It looks like the UK are starting to tighten their fiscal and monetary policies while the rest of Europe is going the opposite direction. I won’t be making any string directional bet and I will just diversify my cash holdings, but this could actually be headwind for the euro.

Do you live in the UK. I dont. So my currency is EUR. Yes what you say is right for the investment's NAV. But not right for my pocket0 -

Do you live in the UK. I dont. So my currency is EUR. Yes what you say is right for the investment's NAV. But not right for my pocket

Why is it bad for your pocket?

What I am saying is that*, if the GBP loses half its value your share prices goes from 10 to 20 GBP (the share price eventually has to follow the NAV).

So the disposal value in euros of each of your share is unaffected (each pound is worth half to as much in euros, but your shares are also worth twice as many pounds so in the end the euro value is the exact same).

* assuming the IT is not invested in GBP assets0 -

-

Advertisement

-

This is a great question, and something I thought about quite a bit.Thanks ex loco for your very detailed posts regarding IT.

what is annoying for me is the £ in all of them. Somehow i see the £ as a weak link. Would love to invest in € IT.

What's your view on this?

As Bob24 has outlined, this only really matters if the trust has invested solely in UK equities. If it owns a load of US equities, the price in pounds would increase if the value of the pound against the dollar decreased (materially).

With the trusts that are focused on the UK (like Temple Bar) currency changes can be an issue. However, I would be inclined to think that the GBP will actually do quite well - I have experienced an increase in the Euro value of my portfolio in the last two weeks solely due to currency gain. Even if it goes the other way at times, in the long run I do not think it will be an issue.

In fact, if the GBP suffers a devaluation/large depreciation, it would be a prime time to hoover up quality UK stocks which will be artificially repressed - when the devaluation crisis resolved itself you could get souped up returns - not only a return via the growth of the stocks from undervalued levels, but this would be turbocharged by an appreciation in the value of the GBP!

But in the long term (10, 15, 20 years) I expect it will all even itself out to be not much of a factor.0 -

I am still undecided on whether to go with ETFs, Investment Trusts, or even just Berkshire Hathaway for decent exposure.

Has anyone come cross any Investment Trusts that are non-dividend paying? I can't seem to find any, yet. Would prefer not to have to deal with the tax implications of dividends at all0 -

Polar Capital Technology Trust if you want tech.I am still undecided on whether to go with ETFs, Investment Trusts, or even just Berkshire Hathaway for decent exposure.

Has anyone come cross any Investment Trusts that are non-dividend paying? I can't seem to find any, yet. Would prefer not to have to deal with the tax implications of dividends at all

Look here for others with zero dividend yield: https://www.theaic.co.uk/aic/find-compare-investment-companies?sortid=NetDivYld&desc=false0 -

-

Hi, im trying to buy into a few investment trusts on IB and its saying no trading permissions, any idea what I'm doing wrong?0

-

-

Lamar Thoughtless Napkin wrote: »Go to Manage Account and Trading Experience & Permissions and see what is listed. May have to fill in a few details and apply there.

That’s what I was thinking, silly question but which one applies to investment trusts? I though I had that covered.0 -

-

Lamar Thoughtless Napkin wrote: »Stocks, you need to have UK enabled.

That’s what I thought, it’s enabled! I’ll have to do some more digging.0 -

-

Advertisement

-

Lamar Thoughtless Napkin wrote: »Have you been asked to send in ID and such?

Yes, all sorted, allowed me to do some trades after posting. Thanks0 -

An interesting monthly update from Ruffer:Ruffer Investment Company Limited

An alternative to alternative asset management

During March, the net asset value of the Company rose by 3.0% after allowing for the dividend

paid during the month. This compares with a rise of 4.0% in the FTSE All-Share index. Index-linked

gilts and cyclical equities were the main contributors to performance while options, gold and US indexlinked

bonds were a small drag on returns.

Closing the books on the first quarter, we are pleased to be up 7.3%. Global equities also had a good

start – the FTSE All-World was up 4.0% as investors started to visualise what a recovery will feel like.

Meanwhile, most multi-asset strategies and conventional portfolios were either side of breakeven.

Conventional portfolios have become, by design and by default (via benchmarking), wired to the

assets which performed well in the last market regime. That was a period of low economic growth and

falling inflation. In a nutshell, this equated to prioritising conventional bonds over inflation-linked

bonds, a preference for growth over value and for technology over everything. The problem is that in

the new regime these might all be the wrong trades.

Today, we expect an economic boom in the latter half of the year and hopefully into 2022. What is

the recipe? Take one part pent up animal spirits, mix with accumulated lockdown savings, pour on

lashings of stimulus – serve in a supply constrained glass. Even central bankers are in party mood –

they have said they will not take away the punchbowl until we have overshot policy objectives.

In this world, there will be ample opportunity for businesses that have survived covid to grow sales

and earnings – so the premium put on growth stocks will no longer be valid. Expect cyclical and value

stocks to perform best. In the bond market, the US ten year yield has more than tripled from the

August lows and sits at 1.7%, but it is still lower than where it ended 2019. This is where the real

conundrum lies. The Barclays Long Treasury Index is down over 20% since August, its worst fall in 40

years, reminding everyone there is still risk in this supposedly risk-free asset. Rising yields are also

starting to cause stresses elsewhere. The tide going out revealed Archegos and Greensill to be

swimming naked and gold is down 15% from the autumn peak where we were taking profits.

Our Chief Investment Officer, Henry Maxey, expands upon the idea that traditional portfolios are

going to get chomped by ‘Jurassic risk’ in our latest Ruffer Review. Of course, it is possible this is just a

cyclical upswing before disinflationary forces reassert themselves, but we think the game has changed.

For the new regime, investors need to be more creative in their diversification and protections.

Government and corporate bonds are a mathematically bounded asset class offering low returns and

limited protective qualities. We continue to see a competitive advantage in the expertise we have

accumulated in unconventional protections and also think index-linked bonds will become a key asset

class in the future.

As for inflation, as George Soros said “I’m not predicting it, I’m observing it.” Houses, used cars,

microchips, the cost of shipping – it’s happening right now. We have our protections and a game plan

in place.

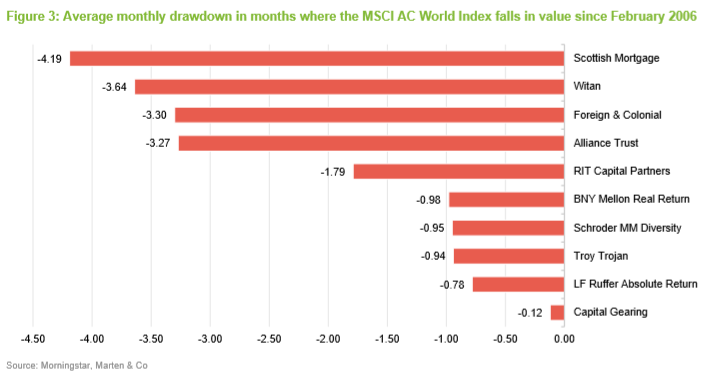

I believe that CGT and RICA will play an important role in my portfolio. The hope would be that, should there be a crash, they will decline a lot less than my other trusts, or indeed the market in general. This was certainly the case last March. As I have previously stated the money I am investing is "not needed" you might wonder why not put the cash in 'riskier' trusts seen as I aim to ride out the market long term, and only switch into this type of defensive trust when it gets to the stage when I start wanting to extract profits. This is a fair question, and a good point. However, you never know what may happen and I wanted the facility to extract some funds at pretty much any-time, where they would not have to be sold at a low ebb.

So for example, if there is another downturn and my other trusts are very much under-preforming or at the bottom of a downturn and I suddenly need cash for whatever reason, I have the option of selling RICA or CGT which would (hopefully) only be down a little, rather than selling the likes of PCT or Monks which may be way down, and could rebound strongly. All going to plan though I won't be selling anything for a long time, so it may ultimately turn out I could have made more by investing in other trusts instead of RICA or CGT, but that is a price I am willing to pay.0 -

Lamar Thoughtless Napkin wrote: »

I believe that CGT and RICA will play an important role in my portfolio.

For sure in the current situation with regards to currency debasement and market volatility, it makes sense to have a couple of defensive trusts as a core position (and I would add gold or gold related equity).

My 2 choices are Ruffer and Personal Asset Trusts though. I like Ruffer because they are doing rather sophisticated stuff to edge the portfolio and are not afraid to go off the beaten tracks (with strict risk control) when they have strong conviction (for exemple their small Bitcoin exposure). And I like Personal Assets Trust because they have a very clear and tidy traditional defensive portfolio which is easy for anyone to understand and has proven to work fairly well. The reason I left out Capital Gearing is that their portfolio seems untidy to me and I didn't find it performed better than the other 2 so I go for what I understand.

Any reason you picked it over Personal Assets Trust?0 -

I think Personal Assets is like 500 pound a share? Or have I got that wrong? When looking at it compared to CGT I remember share price being a major factor, pretty much ruling it out, considering the modest amounts I am dealing with.For sure in the current situation with regards to currency debasement and market volatility, it makes sense to have a couple of defensive trusts as a core position (and I would add gold or gold related equity).

My 2 choices are Ruffer and Personal Asset Trusts though. I like Ruffer because they are doing rather sophisticated stuff to edge the portfolio and are not afraid to go off the beaten tracks (with strict risk control) when they have strong conviction (for example their small Bitcoin exposure). And I like Personal Assets Trust because they have a very clear and tidy traditional defensive portfolio which is easy for anyone to understand and has proven to work fairly well. The reason I left out Capital Gearing is that their portfolio seems untidy to me and I didn't find it performed better than the other 2 so I go for what I understand.

Any reason you picked it over Personal Assets Trust?

I think the performance of PNL and CGT has been pretty similar over the long term, and CGT's manager has been at it for a very long time. CGTs portfolio is also a bit more diversified - untidy is one way to put it - but to be honest I do not think there is a huge amount to chose between them, particularly as both operate a firm discount/premium control mechanism. I agree on Ruffer, but there is the risk that it could plunge to a significant discount in a crisis (although if you have cash this would be a significant opportunity!)0 -

I suppose these two charts (notwithstanding the legitimate problems with charts like these) sum up CGT strengths:

But as I said PNL is great too, don't get me wrong, CGT just suited me better.0 -

Lamar Thoughtless Napkin wrote: »I agree on Ruffer, but there is the risk that it could plunge to a significant discount in a crisis (although if you have cash this would be a significant opportunity!)

Yeah for me this is a trust for which I trust (no pun intended :-)) the managers to go with tactical and possibly complex techniques to edge against market movement (and I know I am not necessarily fully aware of these as they might be complex and/or be applied at short notice).

There is some level of risk if they get it wrong, but actually in March last year they got their timing/edging perfectly right. The share price remained mostly flat while the market was tanking (while even though to some extend they did their job in the sense that they dampened the move, CGT and PNL did see a price drop at that time).

And yes Personal Asset Trust is around 500 euros a share. But I guess this is only relevant if someone is investing modest amounts and doesn't have access to fractional shares.0 -

I agree, ruffer were and are very impressive. What I was getting at is not that they would do anything wrong, but rather that as they are not as strict as CGT or PNL on controlling the premium or discount to NAV. The NAV could remain stable but the share price reduced. During the worst of the crisis last year it hit nearly a 10% discount to NAV, whereas CGT and PNL especially did not trade at anywhere near that discount. Like I said if during a crisis it approached that sort of discount it would certainly be a tasty opportunity to load up!Yeah for me this is a trust for which I trust (no pun intended :-)) the managers to go with tactical and possibly complex techniques to edge against market movement (and I know I am not necessarily fully aware of these as they might be complex and/or be applied at short notice).

There is some level of risk if they get it wrong, but actually in March last year they got their timing/edging perfectly right. The share price remained mostly flat while the market was tanking (while even though to some extend they did their job in the sense that they dampened the move, CGT and PNL did see a price drop at that time).

And yes Personal Asset Trust is around 500 euros a share. But I guess this is only relevant if someone is investing modest amounts and doesn't have access to fractional shares.

I don't have fractional shares on IBKR for UK shares I don't think there is any way to enable it either. If I did I may well have gone for PNL, as I said I do not view them as massively different but the share price ruled PNL out for me and CGT are certainly, if not as good as, the next best thing. 0

I don't think there is any way to enable it either. If I did I may well have gone for PNL, as I said I do not view them as massively different but the share price ruled PNL out for me and CGT are certainly, if not as good as, the next best thing. 0 -

Speaking of Capital Gearing Trust, interesting interview this week on the Moneyweek Podcast with the manager Peter Spiller.

Podcast (and transcript) is here: https://moneyweek.com/investments/investment-strategy/603110/peter-spiller-how-to-not-lose-money-to-inflation-and

I thought his comments on gold were interesting, he has some in the portfolio but isn't a massive fan:MSW: OK, and we protect ourselves with, as discussed earlier, index-linked bonds, preferably US I think you said. And then should we also be holding large piles of gold?

PS: Not in our view. So we do have 2% in gold, short of 2% in gold, and it’s just worth discussing why that's the case. Why so little, given our views? The reason is that gold is supposed to trade at the same real price over time, it holds its real value over time. So, famously, I always recall being told earlier on in my career, the price of dinner at the Savoy had always cost the same amount of gold.

MSW: How much gold is that?

PS: I feel I don't have it in grammes. Because I'm afraid it's been disproved ever since because gold peaked at $850 in 1981, and then fell continuously, until what's generally known as the Gordon Brown low.

MSW: Poor Gordon Brown.

PS: Yes, it was bad luck wasn't it? It was $250 when he sold a lot of our gold. And it's rebounded enormously since. So whatever, whatever else it is, is not constant.

But more importantly than that, I think, is that the real price which is supposed to hold is calculable. We looked at what the price was in 1973, two years after Nixon closed the gold window. It was a pretty free market then, there was plenty of inflation around. I'm pretty sure that gold was not depressed at that time. And it was actually almost exactly $100 then, in 1973, and we applied the CPI in the United States to that, and you get a number, which is just under $600 per ounce. So it trades a very big premium to that.

Now, the circumstances where paying that premium might seem sensible are essentially where people think they might lose everything. So my favourite example would be something like instability in China, which might cause a lot of Chinese people to put maybe just 5% of their money into gold. And that would induce a very big price reaction indeed.

MSW: Interesting. So while, right now, in the past, you might have held gold as a hedge against inflation right now, you should probably be holding at least a small bet as a hedge against political crisis.

PS: Well, yes, because we're pretty convinced that TIPS [Treasury inflation-protected securities, ie, US index-linked bonds] are a much, much better protection against all moderate levels of inflation. So hyperinflation, gold has a role clearly. But against all foreseeable levels of inflation, we think Tips are much better protection.0 -

Lamar Thoughtless Napkin wrote: »Speaking of Capital Gearing Trust, interesting interview this week on the Moneyweek Podcast with the manager Peter Spiller.

Podcast (and transcript) is here: https://moneyweek.com/investments/investment-strategy/603110/peter-spiller-how-to-not-lose-money-to-inflation-and

I thought his comments on gold were interesting, he has some in the portfolio but isn't a massive fan:

I think he's suggesting that Gold etc is a good hedge for people in certain situations:

- Dodgy governments (Venezuela, China, Turkey etc)

- Countries with negative interest rates (Europe, Japan, US)

- Billionaires hedging against inflation.

It's not suitable.neccessary for everyone0 -

Advertisement

-

Well he is saying that it is not the best hedge against inflation, he must think there is some worth in it for the reasons you say, hence nearly 2% of the portfolio is in it (2% is the usual max of any position). PNL for example would hold a lot more gold.I think he's suggesting that Gold etc is a good hedge for people in certain situations:

- Dodgy governments (Venezuela, China, Turkey etc)

- Countries with negative interest rates (Europe, Japan, US)

- Billionaires hedging against inflation.

It's not suitable.neccessary for everyone

His comments on Bitcoin were interesting, I have heard most of the arguments before (Bitcoin scares me, seems a gamble - I'm not averse to a flutter, but as an investment over 20 years it is far too risky for me) but the ESG one is new to me, and raises a very good point.

The link to the report references is in the Podcast hosts tweet below, it's interesting!

https://twitter.com/MerrynSW/status/13833437723862917200 -

I think gold is a bit misunderstood as an hedge against inflation. More accurately it is rather an hedge against currency debasement and negative real rates (inflation is strongly related to those two things but not the same thing).

A more pure play hedge against inflation would rather be commodities as an asset class.

TIPS are of course designed for this as well, but the problem with them is that TIPS price calculation relies on inflation figures (CPI and the likes) which are produced by governments which are regularly changing the calculation rules of those metrics to understate inflation. There is a bit of a conflict of interests here as governments which have an interest in TIPS valuations remaining low are also the entity providing the data which is influencing that valuation.0 -

Interesting article. One thing to be aware of tho is that he's a fund manager managing other people's money, as they say on the last page "At the heart of our investment principle is preserving client capital". That's a little different to my approach of taking calculated risks to grow my capital.Lamar Thoughtless Napkin wrote: »Well he is saying that it is not the best hedge against inflation, he must think there is some worth in it for the reasons you say, hence nearly 2% of the portfolio is in it (2% is the usual max of any position). PNL for example would hold a lot more gold.

His comments on Bitcoin were interesting, I have heard most of the arguments before (Bitcoin scares me, seems a gamble - I'm not averse to a flutter, but as an investment over 20 years it is far too risky for me) but the ESG one is new to me, and raises a very good point.

The link to the report references is in the Podcast hosts tweet below, it's interesting!

https://twitter.com/MerrynSW/status/1383343772386291720

I do a bit of portfolio management at work (or rather I watch others do it), the most any serious people are doing is 2/3% of their portfolios into Bitcoin. If it goes tits up, so be it, if it doubles, they're delighted.

I've heard the ESG argument before alright. its definitely an issue, but every currency/resource/equity has their issues on that front.0 -

That kind of exposure, and mentality, to bitcoin is basically speculation. Which is fair enough (I'm half thinking of tossing spare change into bitcoin on Revolut) but it is not investing. How do you calculate the risk with Bitcoin?Interesting article. One thing to be aware of tho is that he's a fund manager managing other people's money, as they say on the last page "At the heart of our investment principle is preserving client capital". That's a little different to my approach of taking calculated risks to grow my capital.

I do a bit of portfolio management at work (or rather I watch others do it), the most any serious people are doing is 2/3% of their portfolios into Bitcoin. If it goes tits up, so be it, if it doubles, they're delighted.

I've heard the ESG argument before alright. its definitely an issue, but every currency/resource/equity has their issues on that front.

That said, I do have a small exposure to bitcoin through Ruffer (which certainly helped them over the past year).

On the ESG, it would seem to me to be fair severe with Bitcoin. Server farms employ (virtually) no one, and Bitcoin has no practical application or inherent value. Gold for example, has loads of practical uses, and employs tons of people.

That said, I am not a slave to ESG considerations. I think it is a very bad idea to divest from fossil fuels, for example. Coal mines are not going to close overnight, they are still needed. Surely we want the most environmentally conscious people running these, rather than essentially forcing them to be sold off to people who are actively seeking out these things because they do not care, or deny climate realities?0 -

Bitcoin is undoubtedly the riskiest asset (definitely could go to zero), but the returns are potentially huge too. There's lots of models for how this goes higher, based on institutional money, and how much bitcoin is available (of the 21m, i'd say half is lost and another 1/4 never moves). People need to balance what they can afford to lose, with what they can potentially win. 2% is the most I'd do with other peoples money.Lamar Thoughtless Napkin wrote: »That kind of exposure, and mentality, to bitcoin is basically speculation. Which is fair enough (I'm half thinking of tossing spare change into bitcoin on Revolut) but it is not investing. How do you calculate the risk with Bitcoin?

That said, I do have a small exposure to bitcoin through Ruffer (which certainly helped them over the past year).

On the ESG, it would seem to me to be fair severe with Bitcoin. Server farms employ (virtually) no one, and Bitcoin has no practical application or inherent value. Gold for example, has loads of practical uses, and employs tons of people.

That said, I am not a slave to ESG considerations. I think it is a very bad idea to divest from fossil fuels, for example. Coal mines are not going to close overnight, they are still needed. Surely we want the most environmentally conscious people running these, rather than essentially forcing them to be sold off to people who are actively seeking out these things because they do not care, or deny climate realities?

Gold doesn't do much really, we put it in rings because people says it looks nice, but that could change overnight. it's a nightmare to store and move, does a little bit in engines, but not much else. I'm sure those gold mines aren't very environmentally friendly either. And then there's the whole "blood diamond" issue".

There's no right and wrong answer to any of this, but pros and cons to all of them.0 -

Gold is also used in loads of electronics... I dunno at least it can be made into something that looks nice !Bitcoin is undoubtedly the riskiest asset (definitely could go to zero), but the returns are potentially huge too. There's lots of models for how this goes higher, based on institutional money, and how much bitcoin is available (of the 21m, i'd say half is lost and another 1/4 never moves). People need to balance what they can afford to lose, with what they can potentially win. 2% is the most I'd do with other peoples money.

Gold doesn't do much really, we put it in rings because people says it looks nice, but that could change overnight. it's a nightmare to store and move, does a little bit in engines, but not much else. I'm sure those gold mines aren't very environmentally friendly either. And then there's the whole "blood diamond" issue".

There's no right and wrong answer to any of this, but pros and cons to all of them.

How do you buy your bitcoin, any opinion on Revolut? I have one of those spare change vaults on the go, might do no harm to throw 20 quid every now and again into bitcoin, with the mentality of it being a bet, rather than an investment.0 -

Advertisement

-

Interesting research note on Temple Bar: https://quoteddata.com/research/temple-bar-investment-trust-started-qd/0

-

Some more on temple bar, and why they believe in M&S https://citywire.co.uk/investment-trust-insider/news/temple-bar-managers-jumped-on-mands-in-tilt-back-to-value/a1497993?section=investment-trust-insider0

-

Right, so today marks the end of the first full month of my portfolio. In the hope that it might be of interest/help to some I'll give an update below, with some lessons learned etc. Just to recap, I made my first purchase of stocks on 17 March, and two further purchases before the end of March to set up my initial nine holdings, which are to be topped up as time goes by. During April I made three stock purchases on the 19th of Temple Bar, Ruffer and Monks (which almost immediately declined ha!). It will be a different three exactly 4 weeks later, and so on, so basically each stock will get topped up once a quarter (or thereabouts) by the same amount.

The breakdown of my holdings at the end of April is as follows:

The first lesson I learned is that it was probably a bad (expensive) idea to buy all 9 stocks with such low sums straight straight away. Basically, the commission for a UK stock is £1 plus the stamp duty which set me back straight off the bat by over 1% on each stock. The last two weeks in March were also not amazing for my stocks, but basically I was down because of the commission and tax. The following chart covers the 15th to the end of March:

It was not so bad at all for April because some of my stocks did ok and as I only made three individual stock purchases (rather than 11 as in March) the fees were not bad and did not cripple me as much as before. The following chart covers April, as of COB today:

So the performance for half of March and all of April works out at as below, giving an overall portfolio performance for the entire period of -1.17% (This and all % figures are True Time Weighted Rates of Return).

My takeaway from this is that April was a good month which I am very happy with, but that the commission off the bat was fairly hefty because my sums were so low. As time goes on the impact of the commission each month (minimum of $9.99, which with only 3 purchases is also the effective maximum) should get further diluted as the sums involved grow. Still a pain though, it would have been much better if T212 were set up and allowing new customers, and they also allowed you to transfer to another broker. The ideal would have been to trade "commission free" up to about 20k and then transfer to a "proper" broker like IBKR at that stage. But not much I can do about that, IBKR were the only show in town really. If I were doing it again it may have been a better idea not to buy all 9 stocks at once, but to have bought a smaller number of stocks but a greater amount of each, so percentage wise the commission would have been less.

In terms of stock performance, Berkshire and PCT have done really well, as has AGT. Temple Bar has lagged a bit. But 6 weeks is nothing so no judgements on anything can be made. The only thing I would add, is that there is a possibility that Berkshire could become significantly overvalued. For example, if Buffet turns around at the shareholders meeting and says that he will stop doing buybacks because the stock is overvalued (unlikely) or it seems that Berkshire is just trading away beyond what it is worth, I will stop buying it at that level, and instead invest in JP Morgan American Investment Trust until such time as thinking around the valuation of Berkshire changes. However, I don't see this happening anytime soon.

Someone had asked about the impact of currency. Each of the charts, and the figures etc. above are adjusted to Euro. However, if looked at in GBP (which all my stocks except Berkshire trade in) my portfolio is actually up, in the black, by 0.24%. However, I will stick with using Euro as my base currency even if performance looks better in other currencies But for interests sake, GBP monthly performance figures are below:

But for interests sake, GBP monthly performance figures are below: 0

0 -

The work undertaken on GME and AMC by the lunatics on Reddit is very interesting.

With GME in particular, not only is much of the research over on r/Superstonk very compelling, the research is being externally reviewed and confirmed by well known experts who are also engaging with the community on Reddit and Twitter.

I threw money at both AMC and GME in late Jan and early Feb and on GME in particular I bought more at multiple times to average down my GME bep from 360 to well below half of that.

Similar with AMC, my plan is to let it ride to whatever the peak is and sell on the way down.

The naked shorts and the apparent wash trading to allow retail pressure on pricing to be mitigated has become quite apparent in the price action on limiting of certain fibre feeds since Monday has been very, very apparent.

The price moves this week, well they may be coincidental and my own trust in the current market condition could be driven by confirmation bias and coincidence.

So don't trust my assessment, that said.

If we do have any "apes" in here?

Well fúcking done lads!

There seems to be quite a few Irish lads on the Reddit sub, and the Bloomberg terminal info shows a surprisingly high number of shares owned here.0 -

I still have half a GME share, will sell once it is in profit which it nearly isThe work undertaken on GME and AMC by the lunatics on Reddit is very interesting.

With GME in particular, not only is much of the research over on r/Superstonk very compelling, the research is being externally reviewed and confirmed by well known experts who are also engaging with the community on Reddit and Twitter.

I threw money at both AMC and GME in late Jan and early Feb and on GME in particular I bought more at multiple times to average down my GME bep from 360 to well below half of that.

Similar with AMC, my plan is to let it ride to whatever the peak is and sell on the way down.

The naked shorts and the apparent wash trading to allow retail pressure on pricing to be mitigated has become quite apparent in the price action on limiting of certain fibre feeds since Monday has been very, very apparent.

The price moves this week, well they may be coincidental and my own trust in the current market condition could be driven by confirmation bias and coincidence.

So don't trust my assessment, that said.

If we do have any "apes" in here?

Well fúcking done lads!

There seems to be quite a few Irish lads on the Reddit sub, and the Bloomberg terminal info shows a surprisingly high number of shares owned here. Can't wait for the book on GME 0

Can't wait for the book on GME 0 -

Advertisement

Advertisement